[This is a short note because its purpose is to flag an ongoing headache rather than dwell on causes, symptoms or possible cures. I may return to those in due course.]

Avoidable Calamity

The title of this note should have been the headline for the story that was run by the Financial Times on January 19th. Instead the FT ran a story with the following headline “China-focused equity funds suffer worst year in a decade”. Most of these losses were avoidable.The ‘why’ of this calamity was explained as follows; “A slowdown in Chinese economic growth, weak corporate earnings and big falls for technology stocks created a wall of challenges that managers failed to break down.”

Partly true, but this explanation avoids the elephant in the room. The biggest ‘wall of challenges’ that ‘managers failed to break down’ last year was, in fact, a wall of their own making i.e. the practice of following a benchmark. More particularly the benchmark of choice for most in the space, the MSCI China Index.

What’s Wrong With This Picture?

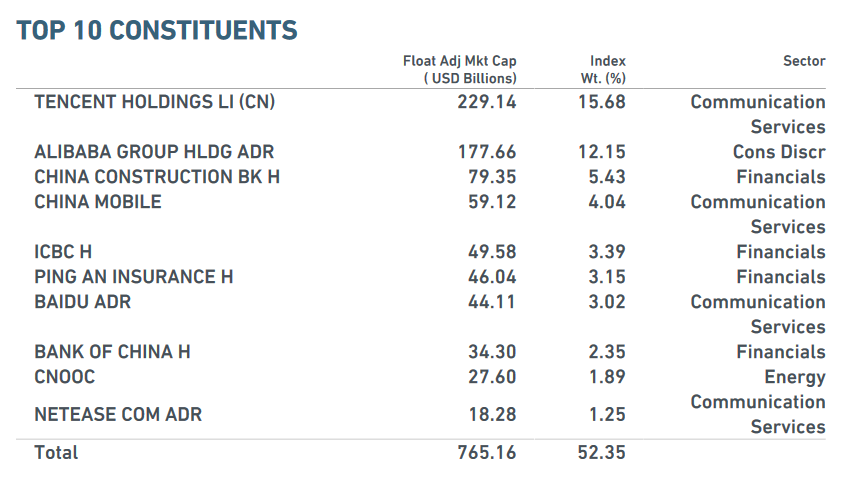

From the MSCI China Index fact sheet for December 2018 I’ve extracted the following table:

You see the problem? Not only is index following a bad idea for so many reasons following this index is a terrible idea because of its crazy lopsided weighting in favor of just two stocks!

Index Tracking Isn’t The Problem;..

Wazza Buffett has advised the average investor in the U.S. if they want to invest in stocks to adopt a dollar cost averaging strategy into a no-load S+P-500 tracking ETF such as those offered by Vanguard; and that makes eminently good sense, for those investors.

What he’s in fact recommending is investment into an actively managed and diverse portfolio of the best managed companies in the world. Nearly all the constituents of the S+P 500 are run by professional managers that are held to robust account by minorities.

..But Tracking The MSCI China Index Is

The MSCI China Index however clearly doesn’t represent a diverse portfolio and it’s constituents are not the best managed companies in the world.

Moreover, of the top five three are run by the Chinese government with little regard for minorities. Of the top two one has a shareholding structure that vests power in a controlling minority and the other is closely identified with just one individual.

Enough For Now

[I promised a short note!] It’s not an absence of smarts that led to the serial poor performance of China fund managers last year. It’s the manner in which the companies they work for have structured businesses around a manifestly flawed index that’s mostly to blame.

Easier to finger that nebulous ‘wall of challenges’ above than the shabby business models many managers find themselves having to operate; and a pity to find the Financial Times complicit in perpetrating such a misleading and incomplete analysis.