Over the weekend of July 4th and 5th this year the Chinese government panicked. A raft of measures were announced to try and halt the slide in the domestic stock markets and in the following week over half of the stocks traded in the Shenzhen and Shanghai markets were suspended. The Shanghai stock market, at that point down around 30% from its high earlier in the year, appeared to stabilize. It then crept up to a post intervention high of just under 4,000 on August 13th before plunging again, this time by a further 25%, to its August 26th low of just under 3,000.

At this time, having emptied their quiver the authorities appeared to be out of interventionist arrows. Their actions were judged then desperate.

Ten Weeks On – Victory

As I write the Shanghai market appears to have returned to the orderly and dull place it was for much of the post GFC period. From the August lows it’s recovered around 25% and the question now is will this state of affairs persist?

As much as a thrashabout as the Chinese government’s actions over the summer were they have been effective and, more importantly I believe, will continue to be so.

..But At What Cost?

A full-scale crisis may have been prevented; but there’s little else to cheer.

For a number of global institutional investors the halt-to-caprice nature of stock trading suspension makes the A-share markets now a no go area, at any price. The use of Hong Kong stocks as an ATM to fund redemptions (or the fear thereof) won’t be forgotten and will add an uncertainty discount to valuations raising the cost of capital for all Hong Kong listed firms. Finally, the ranks of skeptics who believe China will never be able to adopt market based solutions will have swelled making a revaluation, of what remain very cheap assets (in Hong Kong at least), that much harder in the future.

How Do We Know We’re Done?

Why am I so confident in predicting the ongoing efficacy of the intervention?

What made the fall so bad and worrisome that the government felt they had no choice but to get involved? Three things, none of which will be permitted to reoccur; at least not on this administration’s watch. Videlicet?

Not Happening Again #1 – CCP Ownership

I can’t tell when it started, who was most involved or how it got to be this way; but by the end of last year and certainly well into this somehow the notion took hold that the government were talking up the market. Grassy-Knollists produced all manner of reasons why this was being allowed to happen but I think it was nothing more than one or two reformers wanting either ammunition for or proof to justify their efforts. They naively confused a rising stock market with a voting machine on government policy. As the market wilted therefore punters were coming to the conclusion that it was because government were somehow pulling the rug. China abhors little more than an angry mob and by early July pitchforks were being sharpened. The Chinese government will not allow itself again to be perceived as being responsible for stock market levels (or at least we sincerely hope not!).

Not Happening Again #2 – Margin Finance Blow Out

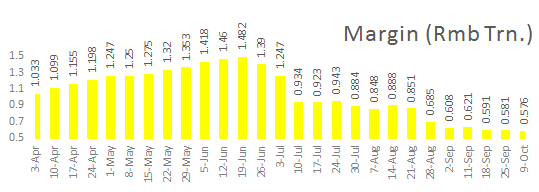

I can’t tell when it started, who was most involved or how it got to be this way; but as you can see from the chart margin finance was surging in the first half. Being able to buy stocks on margin is a very new game in China which has only permitted this since 2010. As the market did nothing but go sideways for a number of years after its introduction my guess is somebody’s eye came off this ball.

As you can see from the chart though many eyes are now on it and it’s been wound in very convincingly since July. I would guess brokers and others have been given a serious wigging and it was no surprise (to me at least) that these agents were used as a front line in initially trying to hold the market together. It was after all they who were a major part of the problem providing much of this finance.

Not Happening Again #3 – Short Selling [And All That]

On August 3rd single day short selling was banned. At the same time several local brokers said they would stop facilitating the practice with immediate effect. The China Securities Regulatory Commission (CSRC) has declared war against ‘malicious’ short sellers and, looking for a chicken to frighten monkeys, decided to suspend an onshore trading account operated by Citadel. Journalists have since been detained (notably among them Mr. Wang Xiaolu of Caixing, accused of “fabricating and spreading false information about securities and futures trading.”), traders from CITIC securities have been investigated for ‘performing illegal trades’ and most recently Mr. Xu Xiang, one of China’s most high profile hedge fund managers, has been arrested on charges of insider trading and stock market manipulation. Guilty or innocent the CSRC and their friends want a clear message out; if we even suspect you of mucking about with markets you’ll be presumed guilty unless or until you can prove your innocence.

What Now?

So, the government has won. Cadres will in future refrain from puffing stocks, margin finance remains in the mix but as a useful servant rather than poor master and some of the wilder trading antics and speculation has been tamped down. What’s not to like?

As I’ve already mentioned above there are costs to all this. China’s stock markets, especially since the GFC, were poor performers both relative to the underlying economy and global peers [See my last Sunday Paper which elaborates on why at Explaining The Underperformance of the Chinese Stock Market] and if all that’s been achieved is a return to that status quo the market ahead looks like a dull one.

More dreadful IPOs via a politically operated queuing system from hardly commercial SOEs, more tin-eared corporate governance from self-absorbed listcos and more price action driven by innuendo, gossip and small time insider rings; and all this wrapped up in mid to high teen (or above) earnings multiples. Xie-xie.

In Conclusion

The jury may no longer be out on whether or not China has saved its stock markets from a melt-down; it has, and the actions of early July onward should no longer be referred to as desperate. They have been decisive.

From an investors’ point of view though what’s left after all this is the same old unappealing diet of, as Charlie Munger likes to put it, turds and raisins we’ve been offered all along in A-share land.

The Chinese government and its agent the CSRC talk about financial market reform and the need for a greater role for market forces. However, at least as far as stock markets are concerned, their actions over the last few months seem clearly to point to this process being, decisively, retarded.