I have a problem with the work, that I’ll come back to, in the paper highlighted this week.

In it Yuyan Tan, Yiping Huang and Wing Thye Woo, the first two researchers from the University of Peking and the latter from the University of California, try to quantify the effect on the economy of propping up so-called ‘Zombie’ firms.

In a nutshell they conclude; “Overall, after the exit of the zombie firms, annual output growth could be lifted by 2.12 percentage points. Capital growth would increase by 1.4 percent. Growth of employment would rise by 0.84 percentage point a year, which means the short-term stress in the labor market can actually lead to lower unemployment rate in long run. And, finally, TFP growth may be lifted by 1.06 percentage point a year.” Who wouldn’t want all that?

The problem is their work is based on data drilled out from the period 2004~2007. Their conclusions may be correct about the economy at that time, but times have changed.

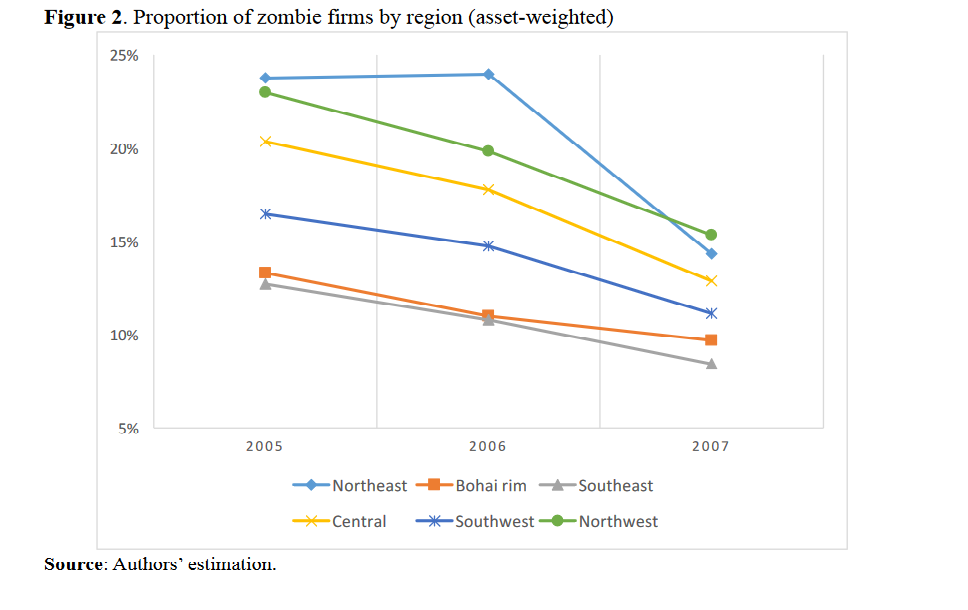

Look at the chart here extracted from the paper. The geographic location of the zombies should be no surprise but observe the trend of their numbers; I’m prepared to wager that trend continued. Hard-wired investor views therefore on this subject are, for many, now very out of date.

The geographic location of the zombies should be no surprise but observe the trend of their numbers; I’m prepared to wager that trend continued. Hard-wired investor views therefore on this subject are, for many, now very out of date.

An analysis of financial reporting (mine) from the biggest banks shows how lending has been restricted to these problem companies for many years and although still an issue it’s a much smaller one than it used to be.

The researchers usefully pause along the way in their work to note not all state sponsored investment leads to crowding out. Especially in areas where the private sector is reluctant or unable to place big bets i.e. infrastructure and education.

So, yes, there was a problem; but it’s nothing like it used to be. The same could be said about many other areas of China’s economy where past problems are being overly vexed about by poorly informed investors today.

You can access the paper in full via this link Zombie Firms and Crowding Out.

Happy Sunday.