Here’s the problem, in a nutshell.

The paper highlighted this week is from a team of 13 contributors and was released last October as an ‘IMF Working Paper’.

It’s worth a close read for a couple of reasons. First, if you’re new to the subject it gives good perspective on how and why we’ve got to where we are; but second, and more important, is (I suspect) it’s a stealth-action-plan for reformers.

China and the IMF have enjoyed a collaborative relationship with regard to economic policy in the past and this paper reads like a branch of the broader dialogue. It speaks with particular authority and provides a detailed road map for what needs to be done and how best to go about it.

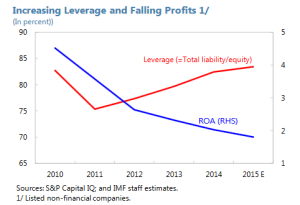

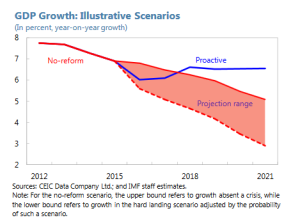

Jump in at page-23 for compelling analysis of what happens if China continues to fumble on this. I’ve no doubt the chart below, and a few others from this report, have already been across President Xi’s desk.

So what’s the fix? China needs a six point action plan.

- Name and shame the hopeless

- Take the hit in the financial system; it’ll be painful but not life threatening

- Make sure the burden is shared. Bank shareholders may be tapped in the process

- Corporate restructuring and governance reform must be proactively addressed

- Budget constraints must be hardened; both at the corporate and regional level

- Facilitate market entry. Cosseting certain SOEs cannot continue

The issue is urgent; the researchers point out that of 43 countries that allowed the kind of credit growth China has allowed since the GFC, 38 subsequently either had banking crises, sharply slower growth, or worse, both.

They acknowledge the reality of the current system and rather than swallow a box of bitter pills they recommend ‘triage’. Start with the worst excesses. What’s important is that both creditors and debtors be involved in the process. Merging hopeless enterprises with stronger industry peers isn’t a solution.

I’d add couple of points here that may calm those of a nervous disposition.

China differs from scary examples like Japan, Thailand and Spain the paper cites in that it directly controls the bulk of its corporate sector. It can therefore mandate better-behavior change (difficult politically but not impossible). Moreover, it’s up to speed on these problems and I’ve no doubt policy wonks at the highest level are working out practical solutions.

Always bear in mind, China’s planners unlike Western peers in recent years, are rarely if ever found dozing at the wheel.

The paper in full can be accessed via this link Resolving China’s Corporate Debt Problem.

Happy Sunday.