The world, economically at least, is in the best shape it’s been since before the GFC. Whether it was the quantitative easing or just the passing of time not only have the world’s major economies been spared a great-depression they’re now in synchronous recovery. Perhaps this is as good as it gets? Or perhaps gains to date are a springboard into an economic condition few in this generation have seen?

Summary Conclusion

The global economy in two years time will be in one of three states. Worse, the same, or better than today. Today, most seers come down on the side of a combination of the same/worse outcome and so we must assume that’s reflected in current asset prices?

It may be prudent then to explore the third possibility i.e. that things could be better than today, perhaps a lot better. In happier times this condition would be referred to as a ‘boom’.

What A Wonderful World

Before we think about tomorrow it’ll help if we take a tour of just how well our world is doing presently. There are four areas where trends are encouraging and where, if they were to improve further, a boom would be acknowledged.

GDP Growth Expectations. A notable feature of this year is how analysts have been scrambling to adjust forecasts to account for better out-turns just about everywhere. If you doubt this you can follow these links for the U.S. U.S., Germany Germany and China China.

For an omnibus report follow this link to a report from the World Bank Global Economic Prospects from June. Analysts have been surprised at the strength in the global economy and individual economies now for some time; given past form they’ll most likely continue to be ‘surprised’.

Exports. The medium term picture here has been mixed but what’s clear is the world’s leading exporters, China, Germany and the U.S. are a long way from the brutal collapses that occurred just after the GFC.

The very latest data, from China in particular where exports in the first six months of 2017 were up 15%, indicate an acceleration of trend. Numbers for Germany and the U.S. for the first five months of the year weren’t too shabby either with the former posting a 7.2% gain and the latter a rise of 6%.

Consumer Sentiment. Scribblers may find few takers for good-news stories but the men and women on the Brooklyn, London and Paris, Tokyo and Beijing omnibuses are feeling better about life. At least that’s what their telling pollsters.

In the U.S. consumer sentiment averaged 96.8 in the first half, the last time it was that high was H2 2000. Euro Area consumer confidence in June was a multi year high and in Japan June consumer confidence dipped slightly to 43.3 but compare that with the low of 27.4 in Jan. 2009. China also dipped in June but by a whisker and from a near ten-year high the previous month.

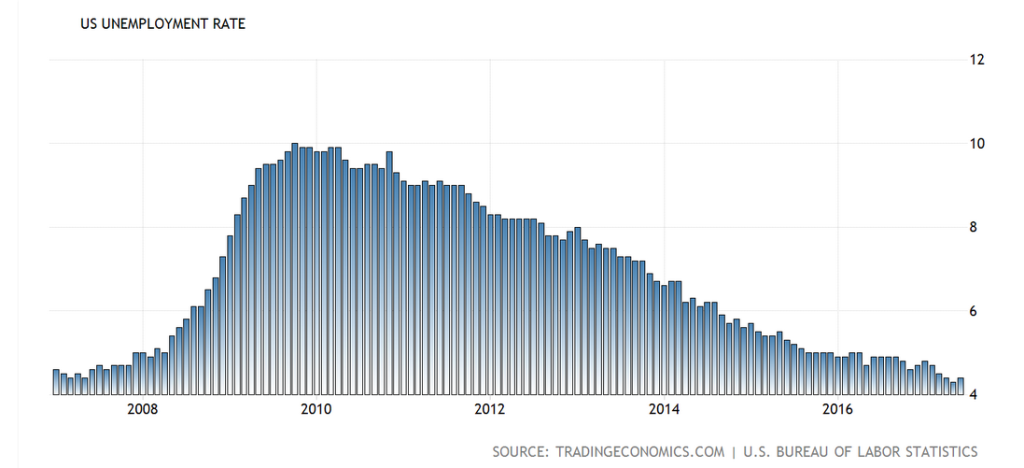

Employment. This is where central banks can probably take their deepest post-GFC bows. This picture tells the story most eloquently about the U.S.

Cudos Mr. Bernanke and Madame Yellen. There’s also another way of looking at the U.S. labor market and one I prefer when considering economic impact. Let’s consider the absolute number of working stiffs i.e. the absolute number of pay-checks going out each week/month.

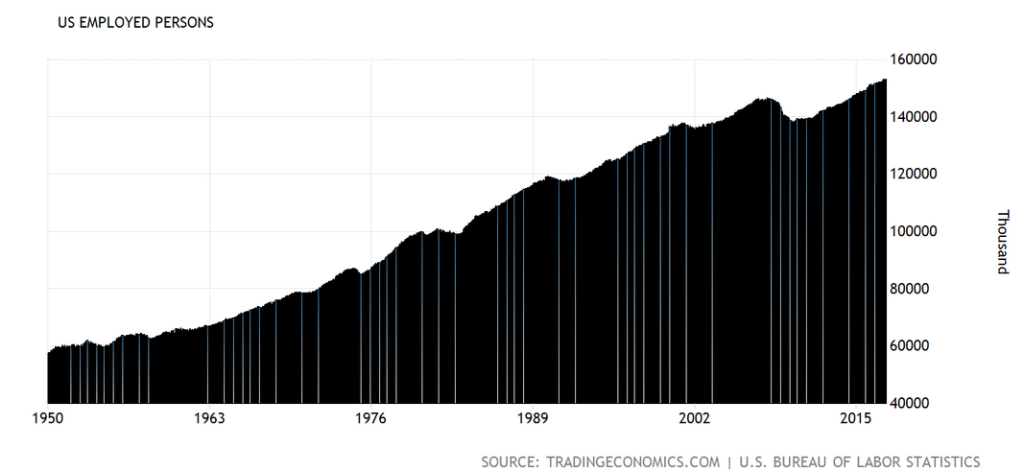

I’ve gone back as far as I could to highlight how big the current number is and so you can see it in it’s historical context.

I’ve gone back as far as I could to highlight how big the current number is and so you can see it in it’s historical context.

Currently the U.S. has just over 153m people in full-time employment. The highest number in it’s entire history; and this situation is almost certain to improve further in the next couple of years. Elsewhere?

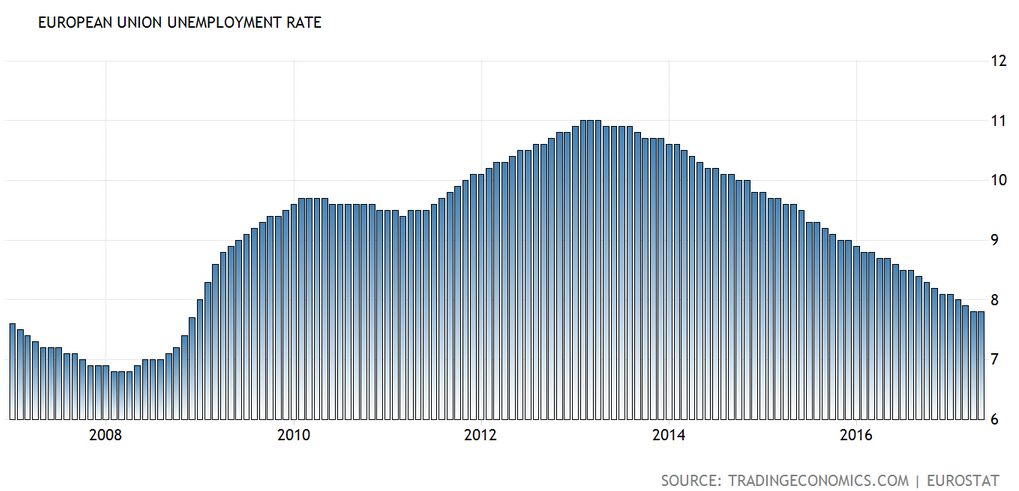

Not bad Sig. Draghi (and friends). The rate is still high but the trend is clear.

Not bad Sig. Draghi (and friends). The rate is still high but the trend is clear.

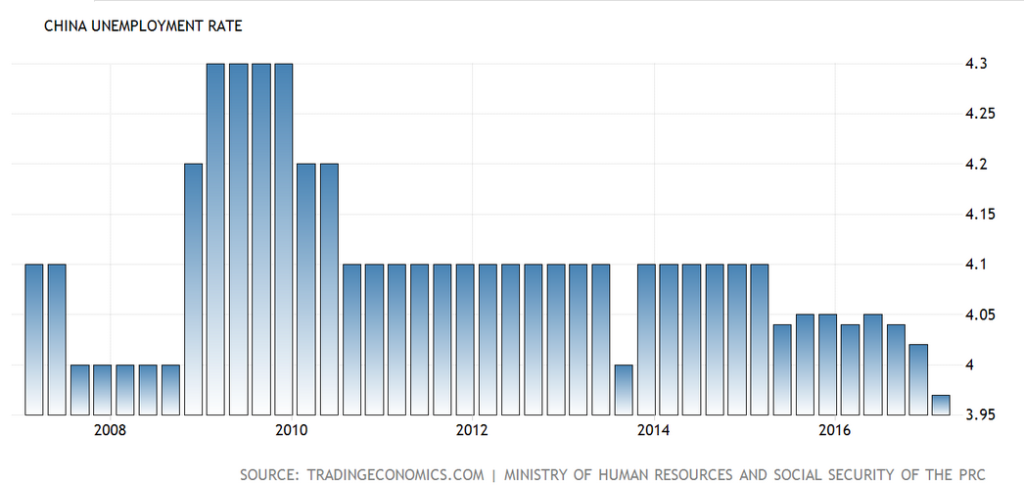

This series looks sketchy but the trend is probably correct.

This series looks sketchy but the trend is probably correct.

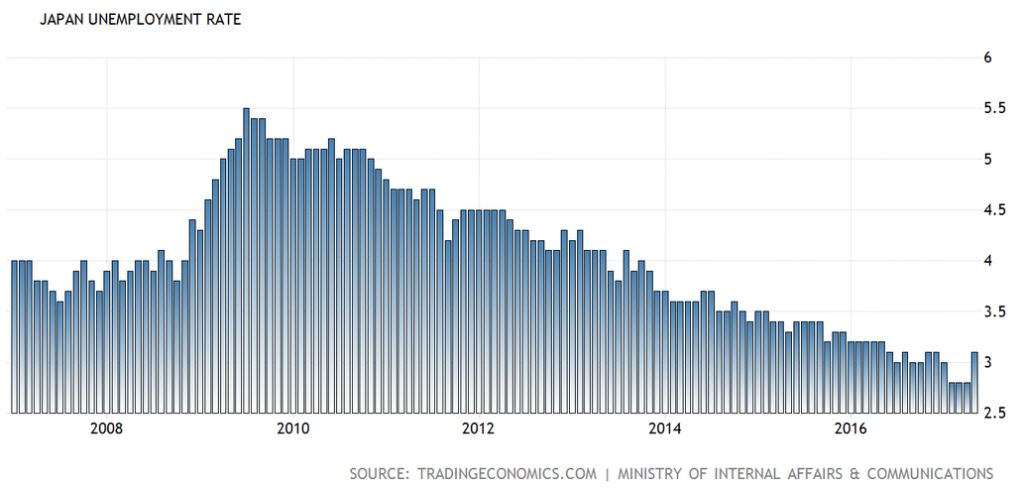

Finally, few in Japan should have much to complain about?

So, having considered broad economic growth, how people feel, the consumption proxy of exports and finally labor markets it’s clear; there’s a lot to like about the global economy, today.

So, having considered broad economic growth, how people feel, the consumption proxy of exports and finally labor markets it’s clear; there’s a lot to like about the global economy, today.

So why does the tone tend toward glum when the future is currently discussed?

It depends whom you talk to.

Of Haves; And Have-Nots

If you’re reading this you’re probably a ‘Have’. Since 2008 you’ve been a winner if you started out with some assets. For most that’s been property and we don’t need another raft of charts to tell us what’s been the trend there, almost everywhere, for the last ten years.

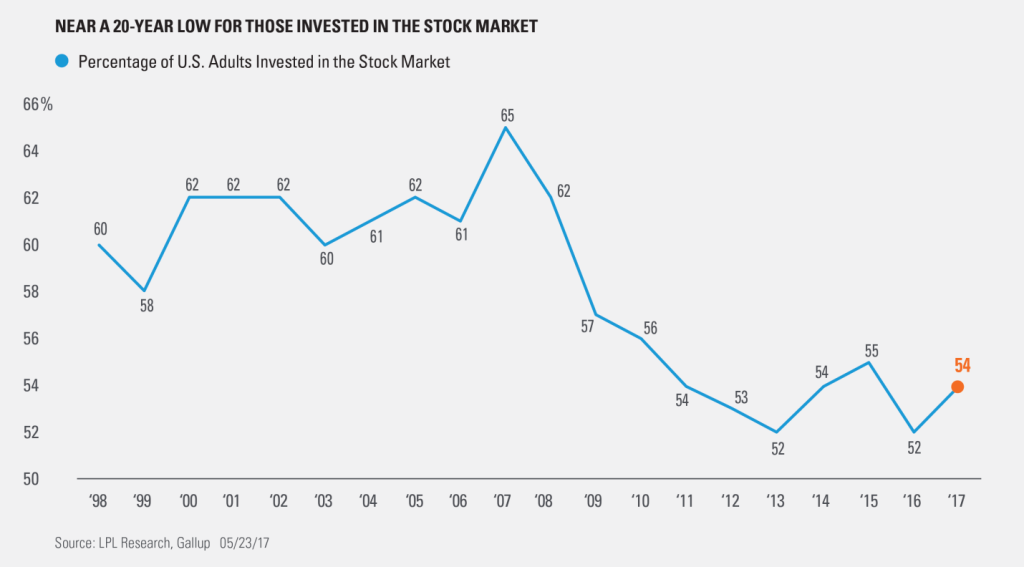

Where Haves have missed out though is stock markets. Sure they may have had some participation via a pension plan but did they/you load up at the lows of 2009? Nah. How do I know this? Here a chart does help.

Haves have missed the biggest bull-run in stocks in a generation; and they know it.

Haves have missed the biggest bull-run in stocks in a generation; and they know it.

Sour-grapes is thus the default now for many. The idea that markets have been great but from here on will be pants is the response of sore losers not the well thought out prediction of non-partisans.

Have-Nots?

We know they’re unhappy. Trump supporters in the U.S. and middle-digit-rampant Brexit voters, for different but sort of the same reasons, have made views quite clear. They felt the system wasn’t delivering; and, they have a point.

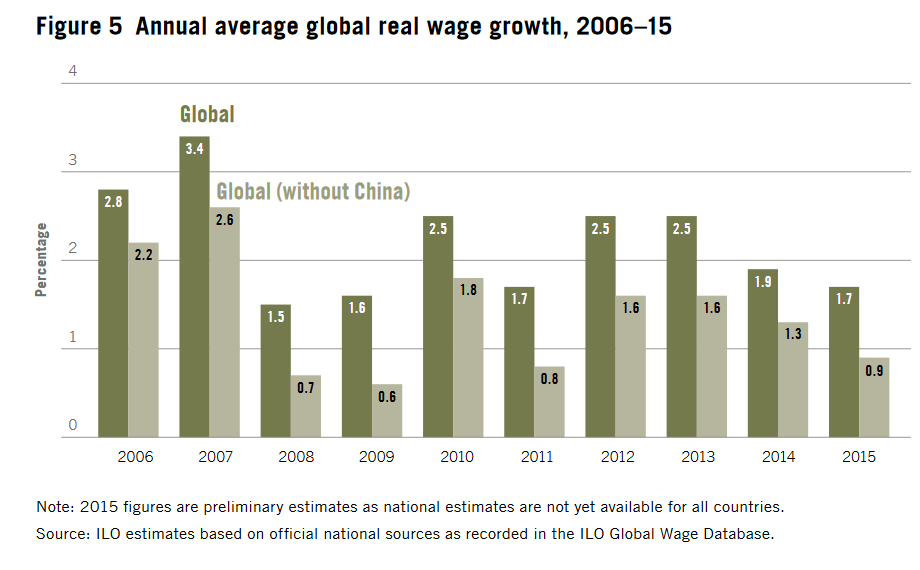

Yes, they have jobs; but the jobs are often sucky and pay hasn’t gone anywhere for a long time. Blame globalization, NAFTA, TPP, Estonian waiters, East-Coast Brahmans, a rootless global elite, beastly bankers (of whom more later) and etcetera, and etcetera.

Yes, they have jobs; but the jobs are often sucky and pay hasn’t gone anywhere for a long time. Blame globalization, NAFTA, TPP, Estonian waiters, East-Coast Brahmans, a rootless global elite, beastly bankers (of whom more later) and etcetera, and etcetera.

For Have-Nots to feel better some form of fillip to wage growth has to occur. Without that glum will remain the default view for them as well.

How then might we get from glum, to boom?

Turn That Frown Upside Down

[Here come the second most dangerous four words in investing (the first being ‘This time it’s different’); ‘If present trends continue’.]

If present trends continue the world, already an agreeable place as discussed, becomes more agreeable.

For Haves this means no pull-back in stocks and most likely further earnings-based advances. They can participate or they can enjoy the positive zeitgeist this is likely to promote. Go on, rent the house in Sicily for your 50th. Buy the Harley. Build the hobby-room. The feeling the future is going to be better than the past would make a big difference to and accelerate trends noted above.

For Have-Nots, if present employment trends continue, higher wages are just around the corner. A little (but please let it only be a little) bit of protectionism will help, so too will a little (but please let it only be a little!) bit of inflation; the latter being helpful in terms of greasing tricky wage negotiations, especially with the public sector.

The Accelerator That Dare Not Speak It’s Name

In a note to Friends, sent August 20th 2007, I predicted the Financial Crisis (I’ll send it again on its tenth anniversary). My analysis then was based on a what was likely to happen to asset prices if the world’s largest banks had to shrink balance sheets in response to the permanent depletion of capital losses were then leading to.

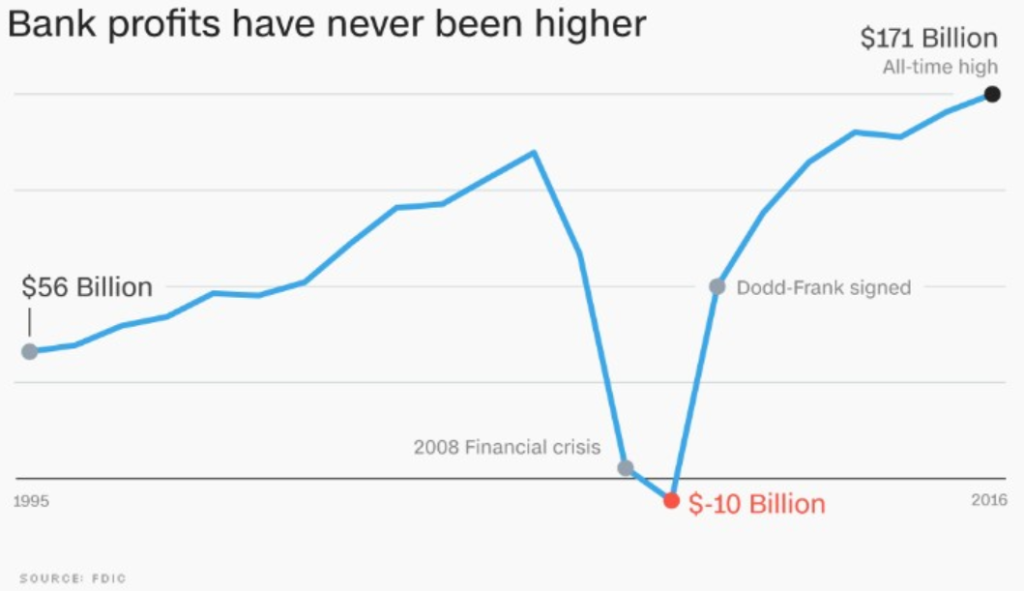

What happens in a world though when the banking system enters what is most likely a multi-year recovery cycle? Bashing beastly bankers for taking the world to the edge of financial Armageddon has been such a persistent leitmotiv in recent years I’m not sure many have considered how powerfully their return to profitability may impact economies from this point?

And, BTW, are they ever returning to profitability!

For all the bleating from the beastlys you can see whatever pain they took during the crisis they’ve made losses back, and a lot, lot more.

For all the bleating from the beastlys you can see whatever pain they took during the crisis they’ve made losses back, and a lot, lot more.

The picture here is for U.S. banks but around the world versions of the same pattern repeat.

There’s an obvious ah-but here. As banks increase their balance sheets won’t they be met by QE-winding-down governments going the other way? Yes, but as Madame Yellen was kind enough to explain in detail last week, central banks will be intentionally behind the curve (a major potential source of inflation in itself). As the beastlys prime already warm economies the world’s central banks will stand back until the tempo accelerates to a convincingly faster pace.

In Conclusion

Of course, I could be wrong, and none of the above may come to pass. The purpose of this note though, unlike my 2007 warning, is not prediction. Instead, what I wanted to do is consider one of many future scenarios so that, in the event, we shan’t be surprised by it. From a markets and investing perspective asset prices are not asking a big premium for this anyhow; so, if it fails to materialize, where’s the harm?

If, on the other hand, economies continue to expand, consumption continues to rise, sentiment gains further ground and wage/inflation trends turn up? That scenario has a shorthand not used for a long time.It’s called a boom, babies.