Censorship in China is normally associated with political issues; but Jonathan Hassid, an Assistant Professor at the Iowa State University, has taken a look at censorship from an economic perspective.

In the process he takes the lid off a major contributory factor to domestic Chinese investors’ antipathy to the A-share stock markets. The high degree of censorship, particularly as it relates to large State Owned Enterprises controlled by the SASAC, may be creating what he describes as “An unreliable equities market for “lemons,”..”

The last time Mr. and Ms. Wang were persuaded to participate more actively in stocks was in 2014~15 egged on by a shameless-booster government . We all know what happened next. From their June 2015 peaks the Shanghai and Shenzhen stock markets, as of Friday night, remained both around 35% lower. As if we need to add, this in the context of the biggest rally over the same period in global stock markets for a generation.

For the second time in ten years then domestic investors have been punished severely for listening to advice about broadening savings away from property and bank deposits. Fool me once and all that..

Perhaps the government care; perhaps they don’t, about fostering more transparency in financial markets? What’s for sure though is the development of these markets is being retarded if some of the very biggest listed companies are being consistently economical with the truth regarding their businesses. The point about whether or not you can progress economic gains with a repressive political regime remains, to me at least, moot. Not moot in the least though is the question of whether you can develop financial markets without greater transparency than is the norm presently in China; that, you cannot, period.

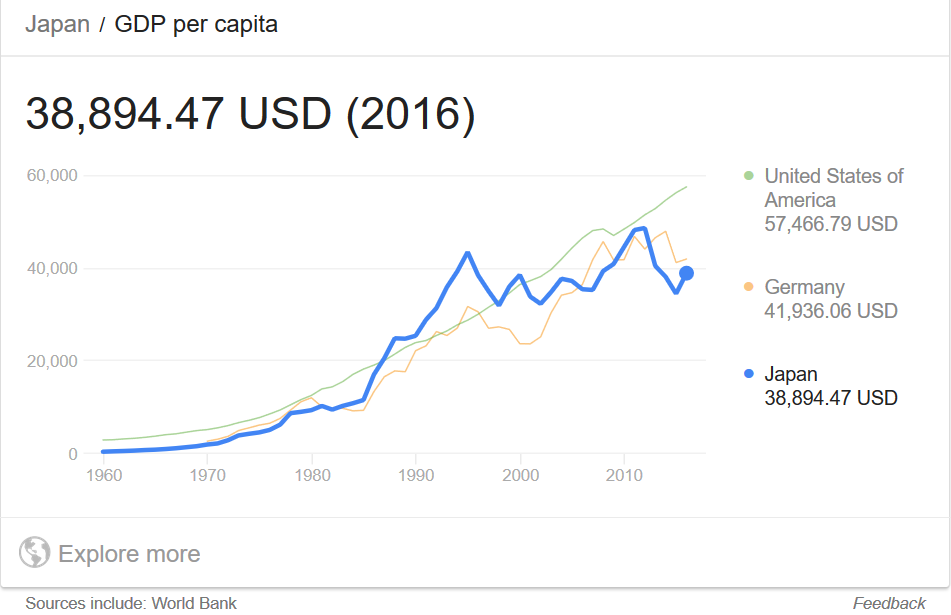

As a parting aside. We have a useful simulation of how an economy progresses when there’s an absence of financial reform and poor corporate governance standards are allowed to persist.

On a per capita basis the Japanese were worse off in 2016 than 20-years prior. Just saying.

This link will take you to the paper in full Media and the Market.

Happy Sunday.