The best time to repair a roof is on a sunny day.

The paper highlighted today is another in the ‘Working Paper’ series from the IMF and was published in April this year. In it Richard Koss and Xinrui Shi go beyond the tired ohmyGodChinazbuildingtoomuchstuff narrative and take a look at the underlying mechanics of China’s housing market to suggest changes that would be beneficial in the event of real distress developing.

Along the way they pause to note how ineffective policy measures have been in stemming the rising tide of prices and affordability. In fact, as they note, policy intervention is now almost taken as a signal that more price rises are on the way as after every attempt to retard upward price movement they go higher anyway.

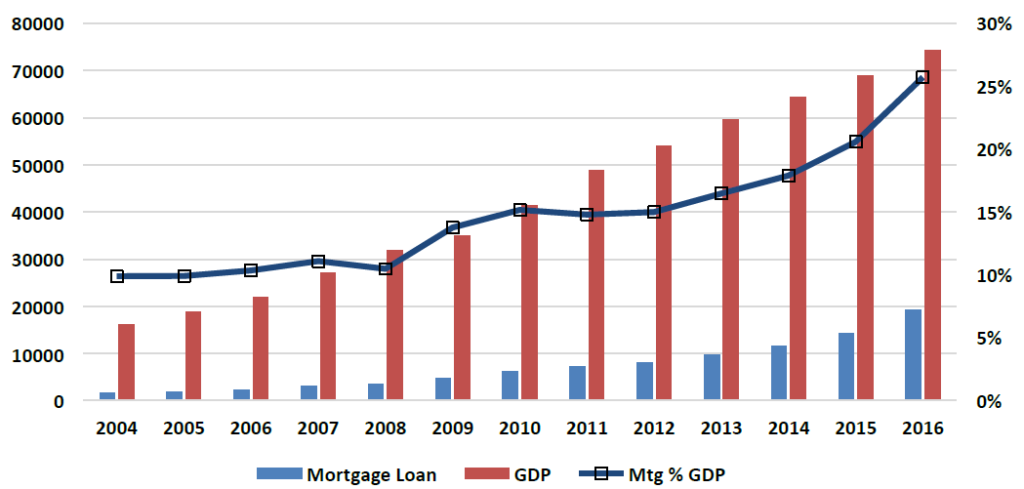

What makes this discussion more urgent is just how big property has become in China’s fiscal equation. A look here makes the point nicely.

There are five broad headings under which the analysts make suggestions.

There are five broad headings under which the analysts make suggestions.

1) Mortgage underwriting procedures. Credit scoring, debt burden assessment and appraisal processes are a patchwork of standards presently. These need to be harmonized.

2) Mortgage requirements. Documentation, title and search procedures all need simplifying and clarifying.

3) Consumer protection. Terms and costs need to be clearly spelt out in agreements. Both sides must also agree foreclosure procedures at the outset.

4) Mortgage guarantee corporations. China has these but not at the national level. They presently operate locally and all march to different drums. There should be a nationwide standard.

5) Secondary market liquidity. In theory the process for selling off property acquired in a delinquency is straightforward but in practice is complicated. This can lead to dilapidation while the process is progressed leading to unnecessary further losses on the part of creditors.

If the above sounds like a tall order the authors of the paper agree, it is. However, China has time to work on this while the property sun continues to shine. China’s property market has some unique characteristics (highlighted in the paper) that make a crash in the short to medium term unlikely. The chance of these factors saving the market from adjustment in perpetuity though is probably slim.

Time now then to get up the ladder and start getting some tar paper down.

You can access the paper in full via the following link Stabilizing China’s Housing Market.

Happy Sunday.