We all know e-commerce is big in China; but the paper* highlighted today contains this useful reminder “.., China’s worldwide e-commerce transaction value grew from less than 1 percent [Of the global total] a decade ago to over 40 percent now [2017], exceeding that of France, Germany, Japan, the United Kingdom, and the United States combined..” [My italics and bold] .

[* Luo, Xubei and Wang, Yue and Zhang, Xiaobo, E-Commerce Development and Household Consumption Growth in China (April 10, 2019). World Bank Policy Research Working Paper No. 8810.]

E-commerce in China is now starting to show signs of maturity (more from me on that below) and as it does social scientists are starting to take a more granular interest. Not only is more data available, it’s comes now with a longer tail.

The main findings from work looked over today are as follows:

- E-commerce development is associated with higher consumption

- The effect is particularly pronounced in rural areas

- Consumption of consumer durable and ‘fashion’ items has risen faster than the growth in consumption of local services

The mechanism for increased consumption seems to be cost reduction. Lower cost goods leave a surplus in household budgets which can be spent on higher consumption producing a virtuous circle. This effect is especially pronounced in the countryside.

In summary, e-commerce is a good thing. Especially if you live in the sticks.

An Aside From Me On China’s E-commerce Growth Trajectory And The ‘Correct’ Valuation Of Related Companies

Reading the paper I was reminded of the hoopla that characterizes prediction and valuation in this sector. Investors are still paying fancy prices for e-commerce growth in China but they’re making the mistake of assuming past rates of growth will persist. This is to imagine the impossible.

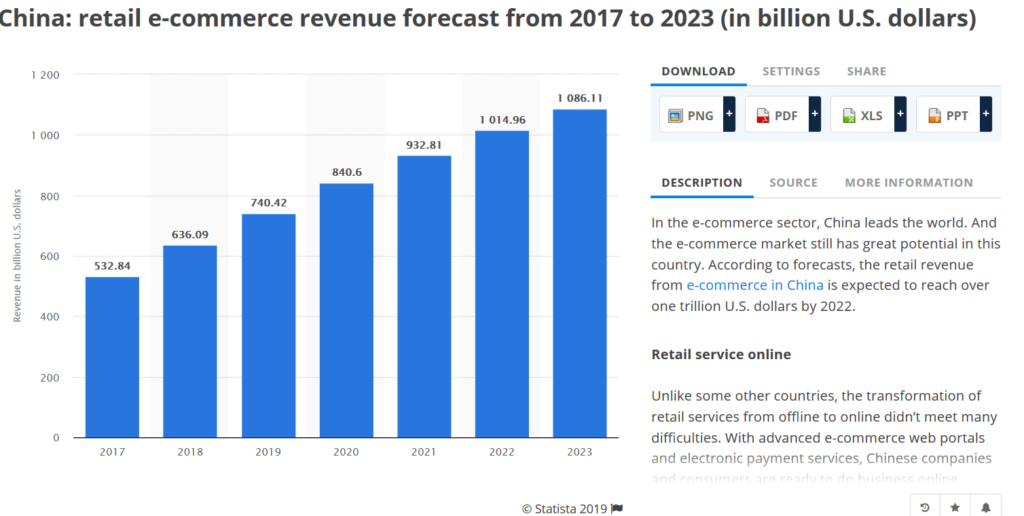

Here’s a picture I extracted from Statista and shows the projected VOLUME of e-commerce sales in China to 2024.

Whooosh!!!! Who wouldn’t want some of that action, right? A look at the RATE OF CHANGE of these numbers however is revealing.

2018 +20%

2019 +16%

2020 +14%

2021 +11%

2022 +9%

2023 +7%

You get the drift? Now for a little fun.

If we take growth rates above and assume a company has $1 of earnings in 2019. What would that have grown to by 2024? The answer is, around $1.50.

So if we want to own that stock with a five-year horizon and believe a ‘fair’ value would be, say, 15x earnings in 2024 at the end of our horizon (to remind, when growth will be slowing with mathematical certainty) what’s the right price to pay today to own it?

The answer is a multiple of around 22x. [Keeping it very simple] Investors are paying over 50x times currently to own Alibaba (which at least has some earnings) and un-calculatable multiples to own other stocks in the space with no earnings at all. Er, just saying.

You can access the paper in full via the following link E-Commerce Development and Household Consumption Growth in China

Happy Sunday.