If VC or PE is your thing the work this week from Zhaojun Huang and Xuan Tian from Tsinghua University may be of interest.

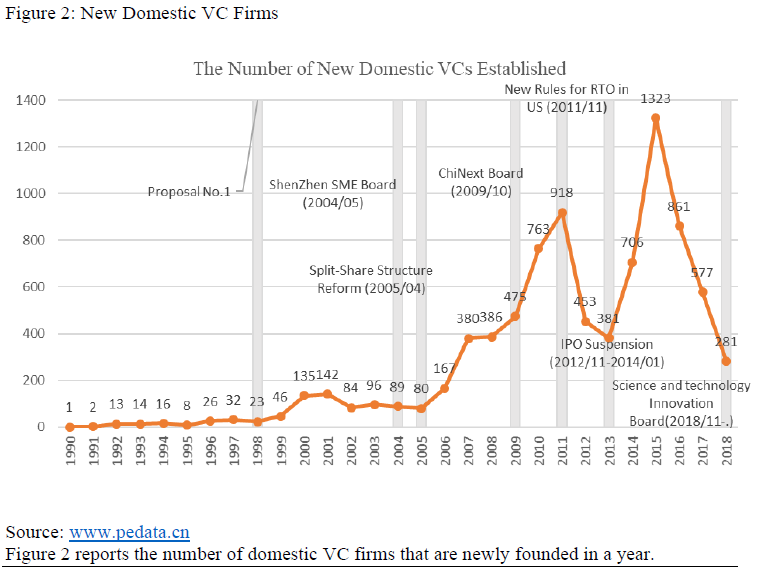

The real juice is the series of charts from around P.30 of the 58-pager and here’s just one that sums up the market neatly.

Before you get to those charts though (in prose that could have been better proofed!) you’ll learn that China’s VC market as of 2018 was worth Rmb212bn (U$30bn) which makes it the world’s second largest.

It also differs from the more established U.S. model in several ways. For example, wealthy families and individuals account for around 57% of all investment in China whereas in the U.S. the same investors account for only 2% (directly). Incubation periods tend also to be much shorter than in the U.S., typically in China these are around 3-years, in the U.S. 5~8-years is the norm. Exit strategies differ also with U.S. investors frequently using M+A whereas in China an IPO is the preferred method of egress.

The authors final note on the landscape deals with the rise in recent years of Corporate Venture Capital (CVC) and how the BATs (Baidu, Alibaba and Tencent) have come to dominate the space.

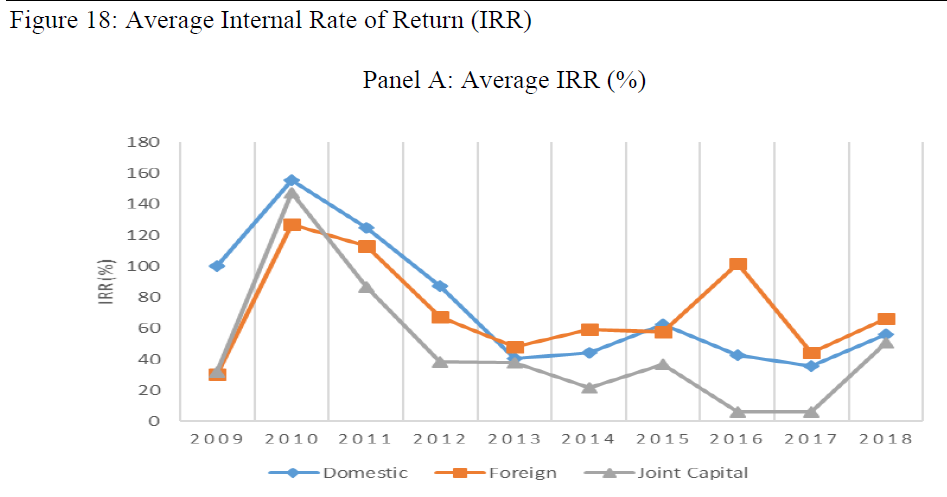

Among the charts you’ll also find the following that plots IRRs that have been achieved in the space and appear, well to me at least, almost too good to be true.

You can access the work in full via the following link China’s Venture Capital Market.

Happy Sunday.