A short paper from Ruwei Zhao at the School of Business at the Jiangnan University in Wuxi has a very clear message that requires no real elaboration. So here it is:

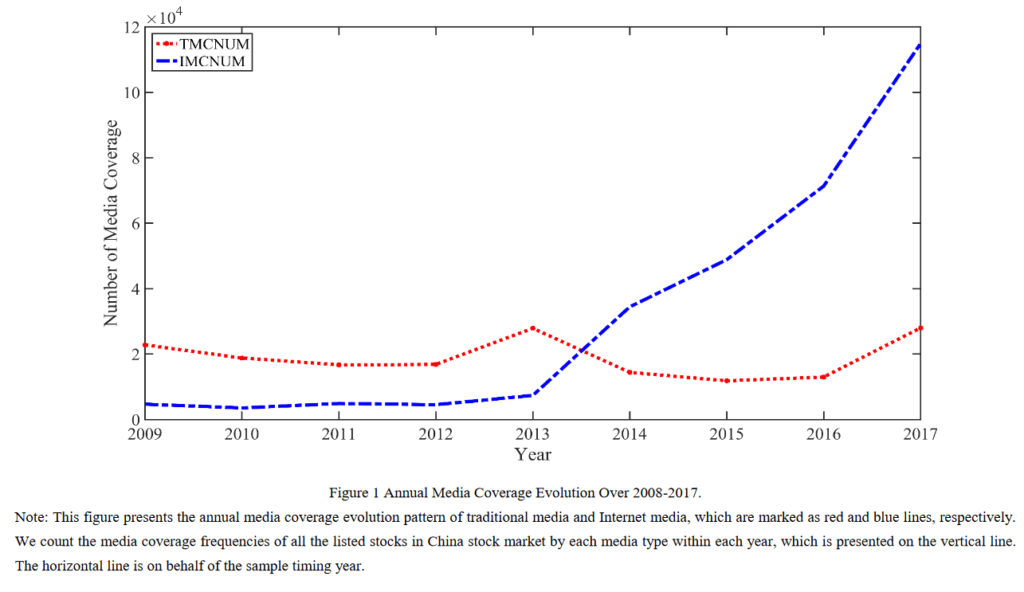

There is a clear correlation between an uptick of interest in TMC a year ahead of a stock price collapse; but there is no significant relationship between an uptick of interest in IMC and future stock price collapse.

A couple of caveats. The study is of only Chinese stocks and the time period studied, especially the very short period of increased IMC activity, mean this study may, or may not, have wider implications.

While we ponder that the pro tem conclusion certainly chimes with my own experience i.e. that all opinions in markets are not equal and the rubbish that’s found in the shabbier corners of the internet is well, mostly, rubbish.

You can access the paper in full via the following link Media coverage and stock price crash risk.

[Subsequent to this post I’ve written a longer piece on how investors might better handle information these days and that’s at Old Friends New Enemy]

Happy Sunday.