Holy smoke! Every investor, institutional or PA-punter should print out the extract below from the paper highlighted today. The former should pin it up in a prominent location in their office; the latter might want to put it on their refrigerator door.

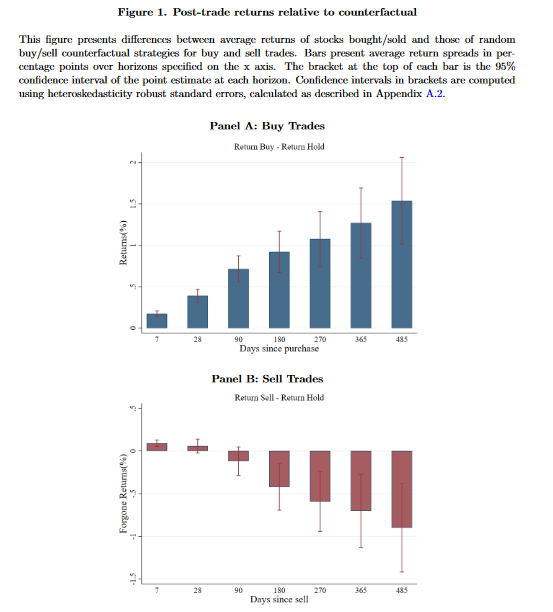

What you’re looking at (at the top) is how well stocks do after their purchase by institutional investors. The chart at the bottom shows how much money those same investors lose by selling stocks that do well post-sale.

In a nutshell; institutional investors are good at selecting stocks and, as many advertise on their respective tins, have real stock-picking skill. However, they give back up to 70-bp per annum by making reliably poor sell decisions.

What’s going on? Klakow Akepanidaworn (et. al.) from the University of Chicago, using a study of 783 institutional portfolios between 2000~2016 puts it dryly thus; the problem is “.. an asymmetric allocation of cognitive resources between buying and selling decisions.” In English? Fund managers do a lot of work before buying stocks, but they sell them frequently on nothing more than whims (or what academics call heuristics).

If you recognise this tick (everybody’s guilty) here are some of the habits the researchers observe causing the biggest problems (you might want to pin this list next to the charts).

First, managers are often selling stocks to raise money (the study is on funds with a long-only bias) for their latest ‘hot’ idea. They’d do better to hang on to old friends for a little while.

Second, there’s a bias to sell positions that have done either very well or very badly. This is analysis based on price performance and bound therefore to be sub-optimal.

Finally, the worse than random behavior with regard to sell decisions strongly suggests heuristics are at work i.e. managers are resorting to some kind of ‘gut instinct’ to time sales. The ‘process’ they’re using to get into stocks, which clearly works, is absent when it comes to sale decisions.

So, the message is clear. Take your time when selling and do some (real!) work before pulling the trigger. Ideally, use the same process leaving a position you used when considering going into it in the first place.

Easier said than done for many. You can view the paper in full via the following link Selling Fast and Buying Slow.

Happy Sunday.