‘Pants-On-Fire!’ China bashers have been quiet of late. Dire predictions about the property market have failed to materialize and breathless commentary about rising debt levels has stopped because, well, debt levels (in relative terms) have sort of stopped rising.

A few doughty muckrakers though have been trying to make a case that household debt is where macro-dragons now be; but is this true?

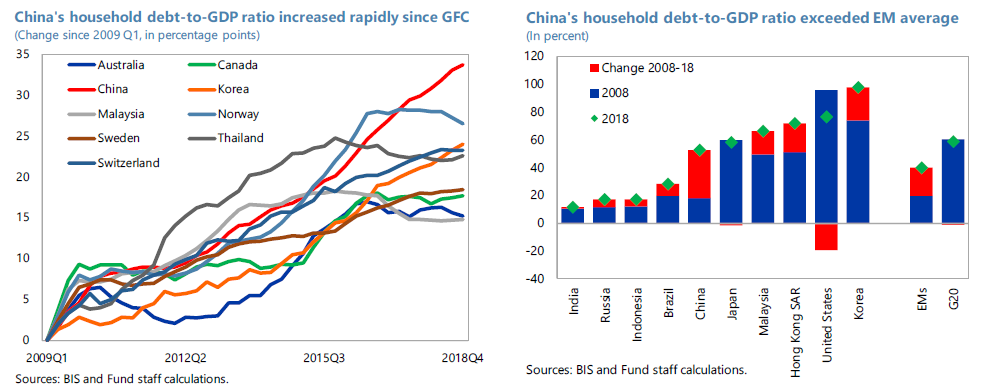

The IMF had a closer look and published their findings in a November Working Paper from Fei Han (et. al.) and the key chart from that report is extracted below.

The chart on the left shows what all the fuss is about. Yes, China’s household debt/GDP ratio has grown significantly since the GFC. The chart on the right though shows why this isn’t a problem. After this growth spurt it’s still lower than Korea, the U.S., Hong Kong, Malaysia and Japan. It’s also lower than the G20 average (but yes, it’s a bit higher than the Emerging Market average). So, no pants, no fire.

It gets better, the bulk of the increase in household debt has not been accounted for by high interest consumer loans or credit card balance-creep. It’s been mostly associated with, safe-as-houses, mortgage lending.

The paper points out that this could be a problem in time if either a) the trend were to continue unabated or, b) there was a big problem in the physical property market. This is no more analysis-in-depth than to tell us the future contains risk and we should all be on our guard. I think we have that already under advisement.

You can access the paper in full via the following link China’s Household Debt if you’re still in any doubt.

Happy Sunday