‘Because people are idiots!’ is something you hear in finance when something happens that, well, shouldn’t. However the real world is filled with examples of things that finance-theory says are ‘wrong’ and ‘shouldn’t happen’ but happen anyway.

An outstanding example is the stock-split. This is when a company has done so well its stock price has risen to a level that looks ‘high’ compared to the rest of the market. Management often decide then to deflate the stock price by changing the number of shares in issue.

For example, imagine a mining company that’s done well and it’s stock price has gone to $100 but other stocks in the sector trade in the $20s. Managers often decide to split the stock at this point to ‘bring it in line’. In this case they might decide on a three-for-one split. Existing holders will be given with three ‘new’ shares for every one they hold and the price should then adjust to 100/4 or $25. This is a 100% cosmetic exercise, no money changes hands, no value is lost (some administrative costs perhaps) or advantage gained. Why then when this happens do the new shares often trade not at $25 but some higher price?

The answer is not ‘Because people are idiots!’. In the paper highlighted today from Chenyu Cui (et al) from the Tsinghua University they begin by debunking some of the ‘idiot’ tropes. Investors do not believe they’ve been paid a ‘magic’ dividend nor does the smaller lot size increase liquidity (an often BS excuse given by managements for the exercise) and therefore encourage more money into the stock. So what’s going on?

They analyzed this phenomena in the China markets from 1998 to 2017 and found some very rationale reasons behind the effect. China is a good place to look at this as it’s not affected by capital gains tax effects (much) and is largely invested in by non-institutional investors, usually considered less rational than institutional operators. Over the period of observation it also had around 150-splits each year.

They discovered four things:

- Stock splits generate consistently positive stock returns BEFORE and after the event. The higher the split ratio the higher the return.

- Firms that split usually go on to have better business performance after the event [The key point]. They also pick up more favorable analyst commentary after a split.

- When a firm splits and its business performance declines the hit to the stock price is heavier than had they not split.

- Stock returns tend to be higher when a stock that splits has a low concentration of institutional owners. Also the higher the stock price pre-split the lower the subsequent return.

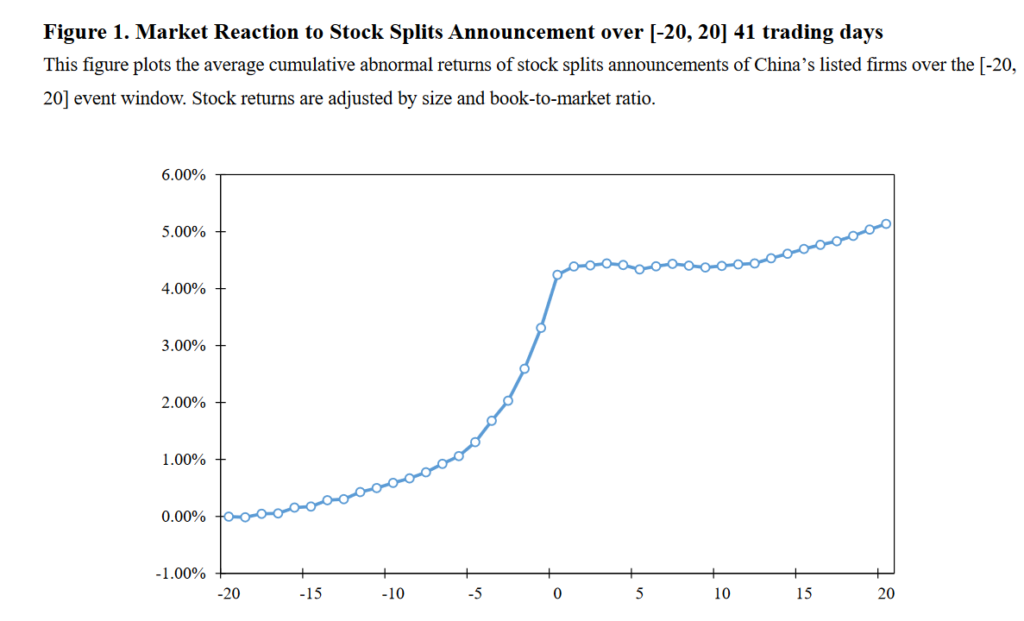

From the report here’s a graphic that shows how the effect plays out pre and post split.

Far from being idiots investors are, in fact, responding very rationally to this process.

First, ( to 1, above) the fact the process works regularly is reason alone for buying stock ahead of the next event. Especially as there are good gains to be had before and after a split.

Second, (to 2, above) it seems only confident managers tend to do this. Take our hypothetical mining company, the stock probably went up in part because better times lay ahead?

Finally, (to 3, above), investors know managers will be punished badly if they fail to deliver post a split so can rationally assume the managers wouldn’t be taking the split-risk if prospects were rocky?

So, no idiots here. Just smart investors that have observed that a splitter is likely to go up before AND after a split. Moreover, as the work also shows these effects are persistent so gains don’t melt when the process is complete.

You can access the paper in full via the following link Why Stock Splits Work.

Happy Sunday.