All happy markets are alike; each unhappy market is unhappy in its own way. Having said that, a look back at the big market dislocations of my career (the first being 1987) reveals recurrent commonalities.

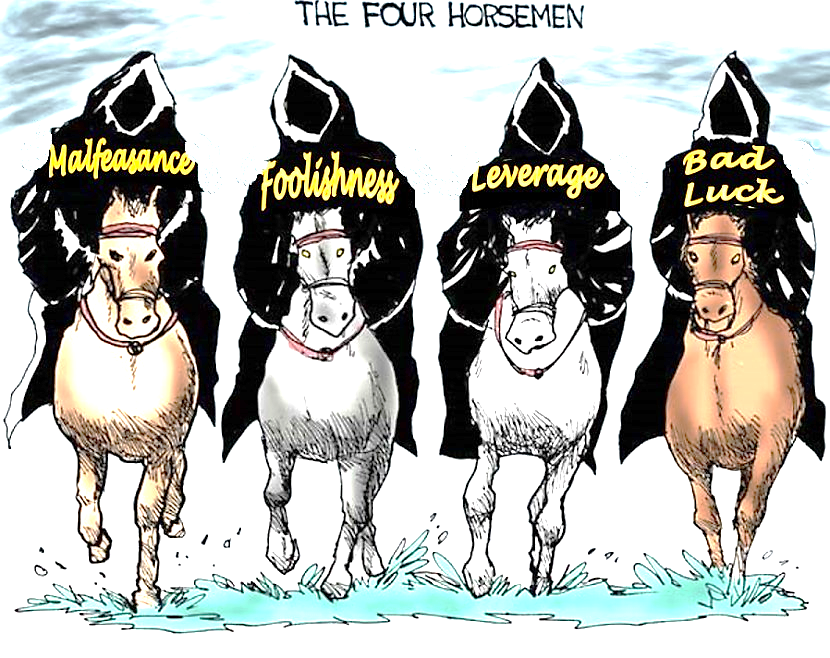

Turbulence in financial markets can be traced to one of four root causes; let’s call them the Four Horsemen of Bear Markets. They are: Malfeasance, Foolishness, Leverage and Bad Luck; and the magnitude of turbulence is proportional to how many, at any one time. ride in.

The Global Financial Crisis (GFC) of 2007~2009 (and beyond) was about as bad as it gets. At that time ALL the Horsemen showed up. That was unusual and one of the reasons it was so scary. It also explains why its taken so long to sort out and continues to cast its shadow over markets today.

As I write financial markets are still trying to find equilibria; but in time they will. From that point the question will be how they regain the poise they were enjoying at the end of 2019?

I’m not going to attempt to answer that question. Instead I want to consider what effect each of the Bear Market Horseman has had recently using the GFC as a yardstick. I could’ve picked other crises but as recent events are easiest to recall that’s the most useful. So, let’s consider the Horsemen, starting with..

Malfeasance. This was one of the hallmarks of the GFC. Then there was malfeasance in plain sight at AIG and most of the major banks (to name only a few of the actors). Fines levied by regulators around the world subsequently on financial institutions bear witness to this. Not cynical opinion here, fact. The cheating extended through the system and had been underway for years before the denouement. Rottenness, famously, went from the top all the way down to low-doc/no-doc mortgage providers in Florida (AND their clients!). Our most recent turmoil is absent this same system-wide mischief.

Foolishness. Whenever the sentimental tide recedes we discover the naked bathers. No doubt, on the fringes of today’s markets fortunes have been lost and businesses will fail due to a lack of commonsense precaution. The GFC however was the blow-off of years of institutional and individual foolishness. Credit-default swaps, multi-tranche securitized mortgage pools, lax accounting standards, Icelandic bankers, accumulators, the list of nonsense that should’ve never been permitted is long. This time around? Foolishness, like death and taxes, is unavoidable; but I don’t see the same quanta as in prior market convulsions.

Leverage. When markets are rattled many are “..shocked, shocked to find gambling going on in here.” and there’ll have been uncomfortable margin calling here and there. However, the GFC was a worry because debt was the propellant and later prop for all manner of asset prices; today this is not the case. Governments have been loosening belts for some time but, being governments, we won’t fret too much if they loosen them a little more. Banks are better capitalized then they’ve been for decades and whilst yes, airlines and cruise ship operators have a problem, they’re not the global economy or even a meaningful percentage. In short, we’ve no need to sober up from a multi-year credit binge because the majority of financial actors haven’t been on one. [Just a couple of examples to the point U.S. Household Debt/GDP, and for those vexed about corporate debt FED Interest Coverage Ratio Analysis]

Bad Luck. I said the GFC was scary because the Bear Market Horsemen showed up together; but that’s not quite true. The GFC was a predictable crisis created by scallywags who’d been operating recklessly for a long time. For me, and many of my cautious friends, the collapse then was a when, not if, issue. Our experience presently is the product, entirely, of an external misfortune. In more deity-fearing times we’d have called it ‘An Act of God’. Of all the Bear Market Horsemen Bad Luck is surely among us at present and is the best way to describe the precipitate cause of recent events. Of all the Bear Market Horsemen though this is the most easily understood and will most likely have the shortest effect.

In summary financial markets presently are, to a large extent, absent three of the four factors that in the past have contributed to protracted dislocation. We’re not afflicted today with large doses of malfeasance, foolishness or leverage; problems which, by their nature, take a long time to purge.

Markets now, in fact, are very simply understood; a virus is affecting the world and temporarily retarding all business activity. This will have consequences but ones governments are preparing safety nets to mitigate.

I believe therefore, without the need to mop up multiple messes the recovery, in financial markets, from the effects of the COVID-19 outbreak will be faster than from past dislocations.

Nial Gooding, Wednesday, March 25th 2020