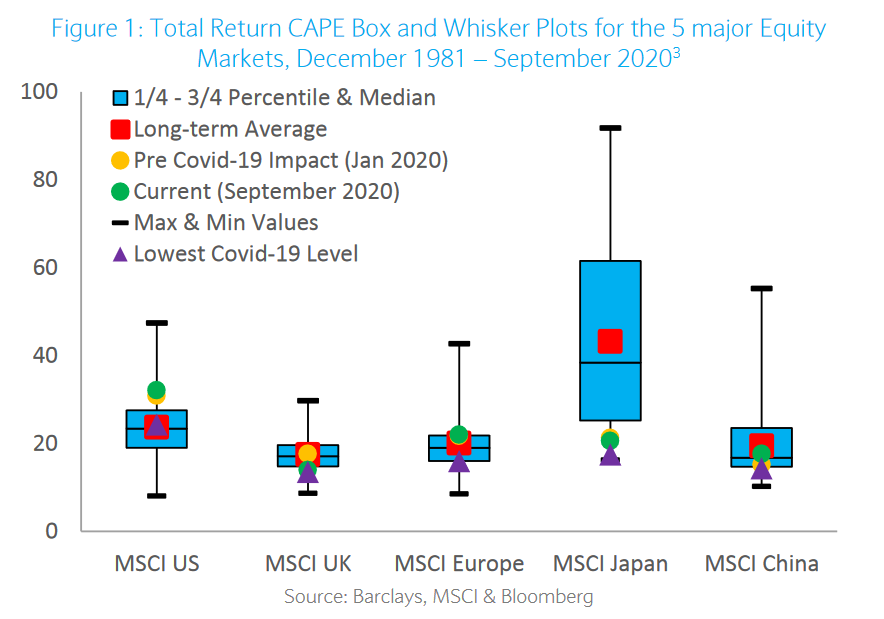

To find the world’s cheapest market relative to it’s long-term average look below for the biggest distance between the green dot (the September valuation) and the red square (the long-term average).

The cheapest market, according to this analysis, is therefore Japan. In terms of absolute cheapness the UK (at the time of this analysis) held the Yellow-Jersey for the world’s lowest valued market at only a 14x Cyclically Adjusted Price to Earnings (CAPE) ratio.

The CAPE was first introduced by Robert J. Shiller in an influential paper in 1988 and he’s also the principle author of the paper highlighted today.

In it he and his collaborators look at how much equity markets have bounced back from COVID-19 shocks and, in addition, how their resilience can be explained by adding interest rates to the valuation mix.

The paper is an easy 18-pager and I’d urge a full read; but, for those with a time-budget, below are what I think are the main points:

- By looking at the ‘Excess Cape Yield’ i.e. a measure of how much equities yield above respective market 10-year bond rates global equity markets all come up ‘cheap’.

- CAPE, in all markets, has returned to pre-COVID-19 levels. This recovery was fastest in the U.S. which is presently the most expensive on this calculation.

- Markets, apart from the U.S., are all at CAPE-levels at/below long-term averages. Videlicet: U.S. 32, Europe 22, Japan 21, China 18 and the U.K. 14.

- In all markets the leading sectors have been healthcare, technology and communications services. This is the reason the U.S. valuation is so high. It simply has the most, proportionally, of these businesses. The U.K.’s cheapness is simply the obverse of this.

- An analysis of Excess Cape Yields reveals that equities, relative to bonds, are still “..highly attractive.”.

[I’d like a ‘Hmmm…’ here. The paper notes U.S. CAPE has only been above 30 twice in recorded history; prior to the 1929 crash and the dot.com bust begun at the end of the last century. Its long-term average is 17 and in the last 20-years it’s only averaged 25.6. The ‘solve-for-Y’ of this is interest rates and that may be all there is to it. Students of history will be mindful however of how one of the best economic minds of his generation fell for a permanently-high-valuation thesis back in the last roaring ’20s Poor Irving. Mr. Shiller has at least had the good sense to hedge his argument. The cautious will continue to be well-served, IHMO, with a big helping of ‘Hmmm…’]

You can access the paper in full via the following link CAPE and COVID-19.

Happy Sunday.