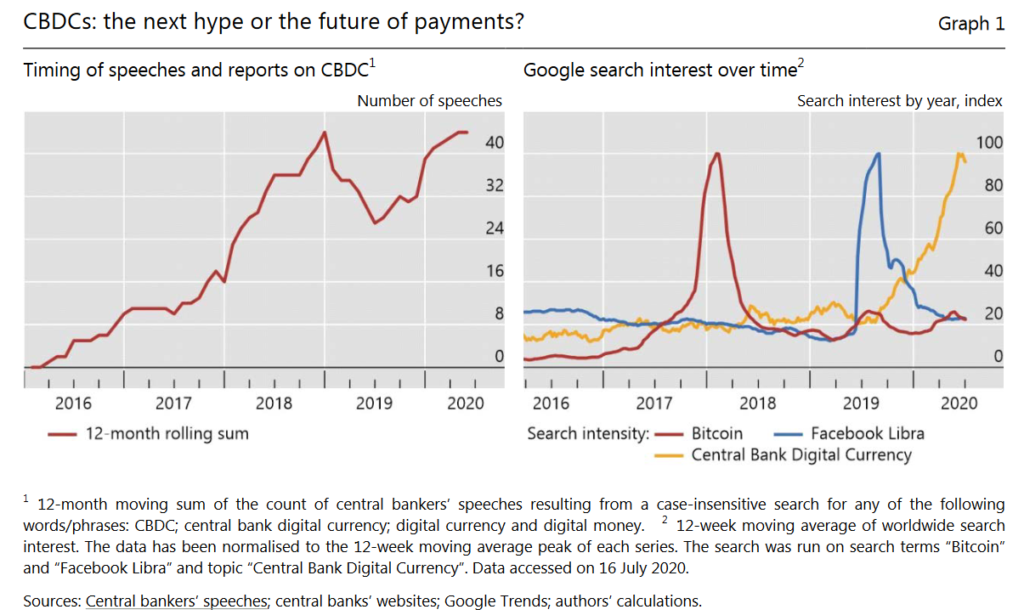

Cryptocurrencies get all the headlines but the real interest of late, which COVID-19 appears to have intensified, is with Central Bank Digital Currencies or CBDCs.

In the ‘Working Paper’ highlighted today Raphael Auer (Et al.) of the Bank for International Settlements surveys the current development landscape and (sort-of, seems-to) concludes nobody is ready, yet, to push the button in a big way on this.

China has the world’s most developed plans (go to P. 25 for the specifics) and rolled out trials in five areas earlier this year (Shenzhen, Suzhou, Chengdu, Xiong’an and the 2022 Winter Olympics site).

Sweden and Canada also have advanced plans but again seem to be some way off widespread introduction.

If there’s a common theme that runs through the paper it’s this: as clever an idea as CBDCs sound, and as much as governments may be keen, the question that doesn’t go away is what problem are they trying to solve?

As is often the case the private sector (Paypal, Alipay, Octopus, Oyster, Visa, Mastercard, BOC Pay, Apple Pay and soooo on) may have already rendered government innovation [An oxymoron surely? Ed.] redundant?

You can access the paper in full via this link Digital Currencies.

Happy Sunday.