Beneath the widely reported headline of a cut to their 2021 China-GDP growth projection from 8.2%, made last October, to now 7.9% there was a lot of more useful data in this release from the IMF on January 8th.

Below are some other observations and my selection of some of the more informative charts from the full report which you can access via this link IMF China-2020 Report.

First, the headlines:

- GDP growth for 2020 will be +1.9% and for 2021 +7.9% (incidentally, now the same figure the World Bank rolled out on January 5th. In their case it was rise of 1% from their June 2020 forecast)

- Corporate leverage will rise by 10-percentage points of GDP

- The current account surplus will widen from 1% of GDP to 1.9%. A temporary shift caused by higher exports and domestic savings (seen in charts below)

- The general government deficit will rise to 18.2% of GDP from 12.6%

- Total stimulus from reduced taxes, increased welfare payments and loan repayment forbearance may amount to 4.7% of GDP

Now, some charts:

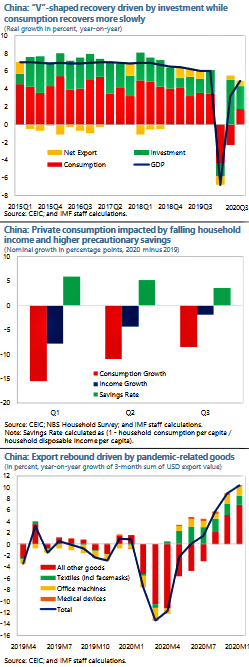

The recovery..

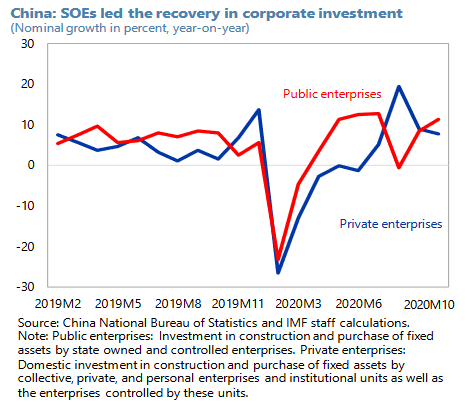

‘National Team’ back on the job. Of course!

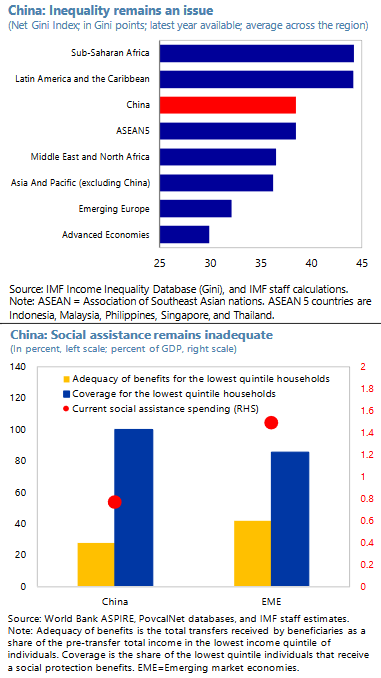

Poverty eradication? Check. Inequality? The next task perhaps?

The reality of why the U.S. can’t be tooo rude to China. Thank heavens for paid lobbyists..

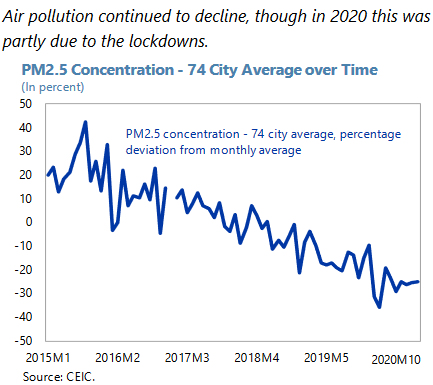

You have to like this..

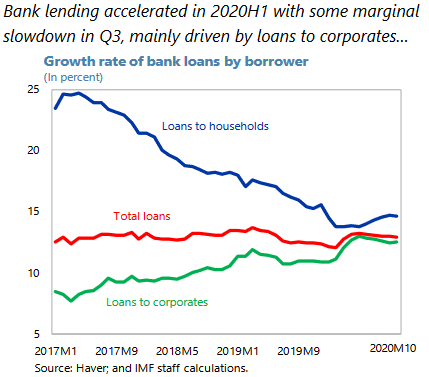

.. and this is as it should be in the circumstances..

All in all China has had a ‘good’ pandemic and lessons from the 2008 over-stimulus-panic have been wisely incorporated in the 2020 fiscal and monetary responses.

A final two-pennyworth from me. The IMF folk talk mostly to their friends in the government. My updates from business doers on the ground is the economy is progressing into 2021 at a tremendous clip.

I’d wager therefore all growth projections will be marched up as the year progresses. You heard it here first.

Happy Sunday.