[The work highlighted today was published in the Financial Analyst’s Journal on October 6th last year. At that time the gold price was approximately U$1,900/ounce. As I write it’s around U$1,700/ounce or 10% lower.]

Gold, in real terms, peaked in 1980 and 2011 and is now not far off those levels; and after those peaks?

From 1980~1985 inflation averaged 6.3% pear year whilst the gold price declined by 55% in nominal terms and by 65% in real terms.

From 2011~2016 inflation averaged 1.2% per year whilst the gold price declined by 28% in nominal terms and by 33% in real terms.

See a pattern here? The authors of the article highlighted today do. As they put it “Today’s high real price of gold suggests that gold is an expensive inflation hedge with a low prospective real return.”

However, could they be wrong? This time, could it really be different; and if so why would that be?

Since the earlier peaks in the ’80s and 2011 gold has been, via ETFs, significantly more ‘financialized’ and its price is more a product today of flows into these passive investment schemes. In terms of price forecasting this matters because the price of gold in the past can be used as an explanatory variable for the future. I.e. investors (shouldn’t but they do) care about where the price has been.

So, could the strong recent prices for gold lead to strong prices in future? We’re very familiar today with this process in the stock market after all.

The paper takes us on a brief discussion of how gold is NOT a reliable inflation predictor NOR is it a ‘bond’ that delivers a real return over time (noting that a definition of inflation over time is also very problematic) before getting to it’s knockout punch.

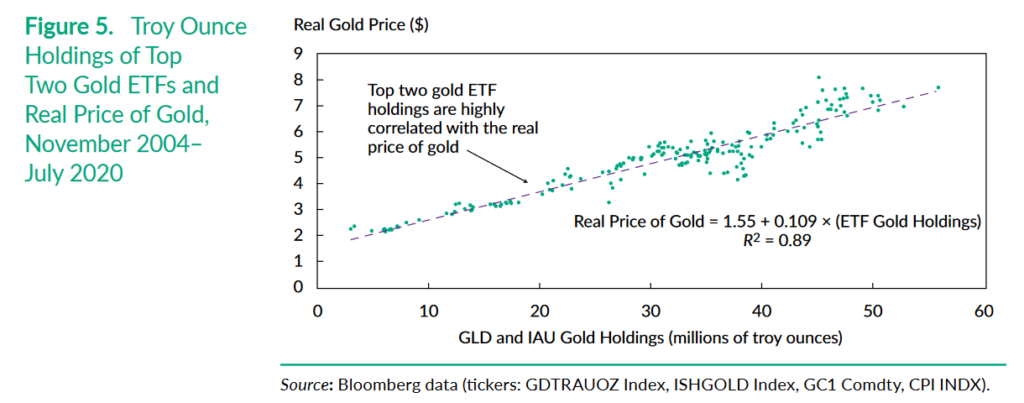

The price of gold in recent years has most closely correlated the massive-passive build up of holdings by gold ETFs.

Markets are always new and it could be that what lies ahead is, in fact, a burst of scary COVID-19-stimulus induced inflation. Gold bulls may therefore be vindicated and all’s right with the world? But, if that’s coming gold has already done a lot of work predicting the event.

So, inflation arrives; so what? What if it doesn’t? Seems the gold price today offers a poor bet of the heads you don’t win, tales you lose variety?

The best predictor of where the gold price heads next is most likely the flows around gold ETFs and not any macroeconomic womble about inflation/real interest rates/bond prices and etc.

On that note the following article from Reuters on February 16th should be of interest Gold, silver funds see biggest weekly outflows in three months. Consider yourself warned.

The original article (a pithy 10-pager) is here The Golden Constant.

Happy Sunday.