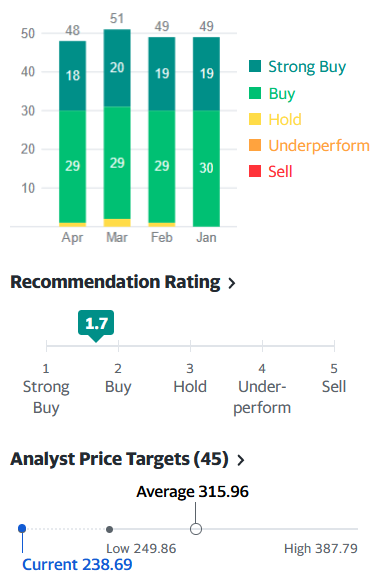

First, a relevant aside on Alibaba* (BABA). Below is the recommendation summary from Yahoo! Finance as of Friday, April 16th. Not exactly a wide dispersion of views (and check out that average target-price!).

Sure, it’s a great company changing the face of commerce in the world’s largest consumer market, and all that.

However, it’s also a company whose stock is presently over 20% off it’s recent high, who’s de-facto controller is de-facto being held in China, whose ‘true’ ownership structure is opaque to say the least, whose business model has just been quartered by Chinese regulators and whose valuation remains, how shall we put it? Fragrant?

[*The FT has a great long read on this in the latest weekend edition. It provides useful context if you’re new to the subject and appears to be very well informed. This link should get you there FT-MA-BABA]

Despite serious questions over prospects not one of 48-contributing analysts above have anything more punchy than a ‘HOLD’ on it. Is this because there’s really no way but up for the stock price? Possibly?

Or, could it have something to do with the fact that all their institutional customers (the ones that really pay the bills) still have significant positions?

Or, could it be none of the firms employing these seers want to see future investment-banking revenues compromised as this entity is likely to generate significant subsidiary spin-off and restructuring fees over time?

Hmmm… Well, who can say?

Now, to the subject of this week’s paper-in -focus.

Dawn A. Matsumoto (et al.) from the University of Washington used the two ‘shocks’ to China’s domestic stock markets of the ‘Connect’ programs in 2014 (to Shanghai) and 2016 (to Shenzhen) to see what happened to analyst’s recommendations when less optimistic i.e. global, investors joined the China stock party.

Would they stick to previous work that catered to their mostly optimistic domestic customers or would they modify views to appeal to the newer, more skeptical, investor base i.e. do analysts lead investor opinion or are analyst’s views led by investor’s opinions? Spoiler alert, they modified their views.

If the theory that analysts change views to reflect investors views (now we know, they do) is proven (it is) how would analysts behave then when/if there were suddenly a wide dispersal (heterogeneous in geek-speak) of views in the market, which is what happened after the Connects?

Theory predicts in such circumstances analysts would tend to hold more extreme views in order to get attention; and this, in practice, is what the researchers found. Optimistic recommendations became more so and pessimistic ones more dire.

The useful lesson from this for practitioners?

When you ask an analyst for a view, or (as I did with BABA above) consult analyst’s views in the public domain, what in fact you’re getting is a read on broad investor sentiment.

What you’re not getting (sometimes you might, especially in not so popular stocks) is an unbiased carefully considered and well researched summary of prospects.

So, if you’re presently nervous about BABA’s medium-term stock price prospects you should probably wait for some ‘SELL’ recommendations to appear before setting up your shorts.

The paper suggests that ahead of that change such trades may involve risk of the frying-bacon-naked variety.

You can access the work in full via the following link Catering Theory.

Happy Sunday.