What indeed?

Scott R. Baker (et al.) from the Northwestern University has analyzed large stock market moves, their proximate causes and subsequent market performance based on media analysis.

To do this he and his colleagues looked at 6,200 jumps in 16-markets from 1900 to 2020 (the U.S. from 1900, the U.K from 1930 and the rest from the 1980s). In each market a ‘jump’ had a different definition based on ambient volatility but in the U.S. the definition was +/- 2.5%, which seems fair.

The headline conclusions were interesting but not especially useful for practitioners; with one important exception.

First, the headlines:

- Jumps due to news associated with either government policy and/or economic policy are the most frequently occurring (they use the term ‘monetary’ policy in the paper but I don’t think they mean that literally)

- Jumps associated with policy tend to be followed by less volatility than jumps caused by other factors. This also relates to 4. below where it’s noted that clarity reduces subsequent volatility.

- 1/3 of all jumps in non-U.S. markets are attributable to news from the U.S. No other market has this global effect although Europe was important in 2010 and China is more of a noise than before

- The greater the ‘clarity’ on the reason for the move the lower the subsequent market volatility. Also, policy moves produce more up than down moves, especially after periods of poor market performance

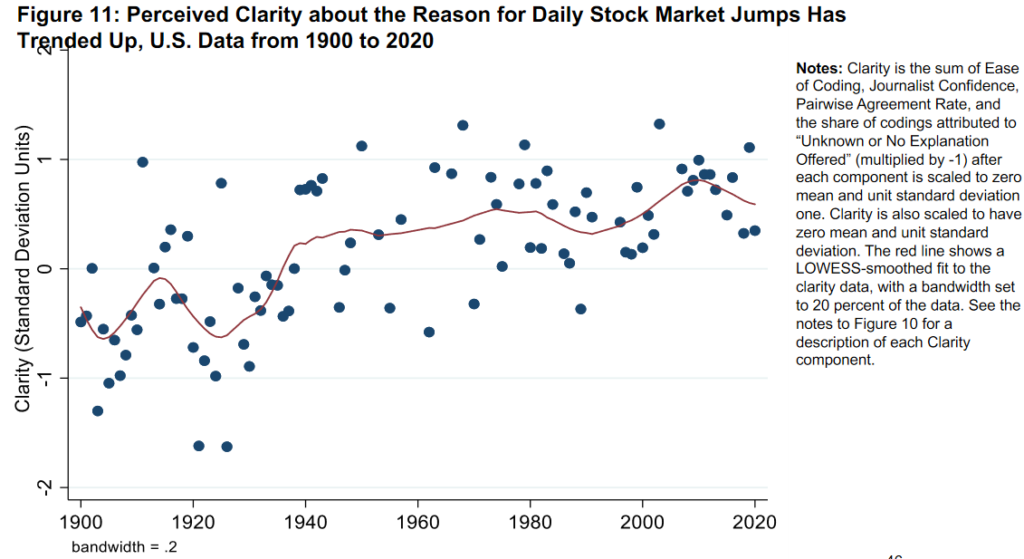

- 17% of jumps occur for ‘no-reason’ and that phenomenon is the same in all the markets observed. However, and here’s the real juice, the clarity about the reason for moves has gone steadily up over time

This last point, to me at least, was the most interesting. It highlights the trend in financial markets I’ve evidenced throughout my career i.e. that toward better information, more informed commentary and higher professionalism.

The flip-side of this trend for we real-world operators has been a deterioration in value of many types of information.

Mr. Benjamin Graham, and his star-pupil Wazza Buffett, made a good living a while back just by reading company accounts. Machines now do that and I’ve observed the value of certain types of information* has trended with the long-term price of cowrie shells.

[ * You might want to check what you’re paying for your Bloomberg terminal in this regard. Whilst about it, make sure the coal supply is adequate and always keep the steam up to pressure!]

So, if information isn’t the competitive advantage it used to be (big caveat, in public markets) what advantages are left to a diligent investor? Ah, now that’d be telling.

You can access the paper in full via the following link What Triggers Stock Market Jumps?

Happy Sunday.