From the Economic Research arm of the U.S. Federal Reserve in a ‘FEDS notes’ post from June earlier this year researchers Hunter L. Clark and Anna Wong take a closer look at this important question.

The data is problematic for two main reasons.

First, it’s clear U.S. importers found a way to massage down the numbers they were reporting for imports when tariffs got involved (surprise!).

Second, Chinese exporters were presented with a number of tax incentives on their side of the trade, over the same period, which resulted in them ‘improving’ their reporting which made it look like exports were rising when, most likely, they weren’t really.

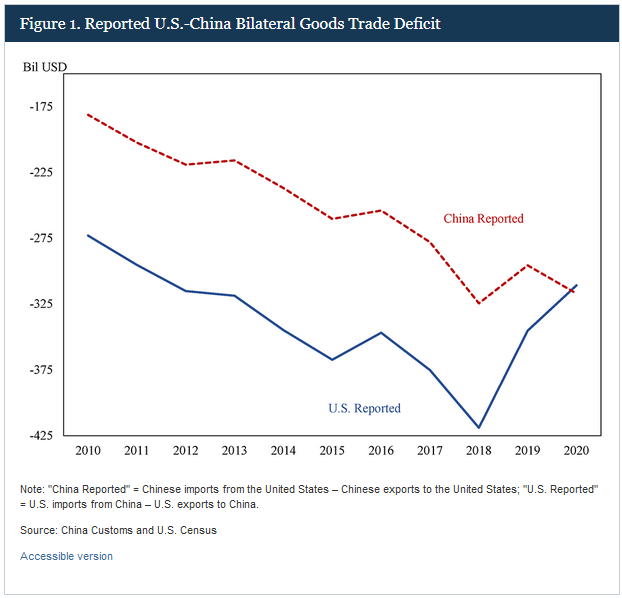

As if this didn’t create a big enough headache the Chinese and U.S. numbers have never agreed anyway. In the past however the gap between the two was fairly stable but from 2018 the two numbers began a convergence which just added to the enigma wrapped in the riddle.

The keen can read the work in full by following this link China – U.S. Trade Deficit but for the merely curious the bottom-line is that there may have been a slight dip in China-U.S. trade when tariffs were first introduced. Since then though it looks like business, more or less as usual.

What’s clear from the research is there’s no sign tariffs have in any meaningful way upended China trade.

It must surely therefore be only a matter of time before even the most partisan U.S. consumers realize they’re the ones paying effectively higher consumption taxes for an economic policy that, as the still amply stocked aisles at COSTCO, Walmart and etc. demonstrate, doesn’t, hasn’t and won’t work?

Or, perhaps they’d argue existing tariffs are too low which is whey they’re not working and should be increased to make them more effective?

Whatever, it seems unbelievable, to me at least, we’re even discussing let alone employing multi-example-failed 13th-Century economic policies in the 21st.

Happy Sunday.