Preamble

The last time (and I’ve sworn to never do it again) I was foolish enough to call the market was October 2010. At that time I confidently wrote we were most definitely and without a doubt entering a grand bull market.

What a putz! That call was followed by the annus horribilis of 2011. A devastating wall of water smashed into Japan in March, a self immolation in Tunisia in December of the prior year turned into turmoil throughout the year in the Arab world, America lost it’s AAA credit rating in August and Greece threatened throughout to deeply, perhaps even fatally, wound the European monetary system. None of this was of course relevant to the earnings’ prospects of China stocks*; but it walloped them hard nonetheless. Welcome, China, to the global village.

[*Throughout I’ll be referring specifically to Hong Kong listed China stocks and the Hang Seng China Enterprises Index HSCEI]

In this note then I won’t be making another bold call. Instead what I want to examine, given the recent pop in China stocks, is whether we’re yet in what can properly be called a ‘bull’ market i.e. that place where a virtuous circle of fresh liquidity meets rising confidence and produces self-sustaining upward momentum?

Summary Conclusion

To answer the title of this note directly; no, in fact we’re in less of a bull market today than when I called it back in 2010. Looking at my note from that time I’m reminded how some of the defining characteristics of a true bull market, manifest then, are conspicuous by their absence now.

From a value perspective though there’s more reason to be invested today than nearly four and a half years ago; price action to date has only had the effect of shifting stocks from extremely to very cheap.

Will this momentum persist? I don’t know. What I do know is that valuations are still a long way from merely fair; and for that reason, and for value investors at least, it’d be a very shortsighted strategy to begin discussing leaving the ride.

What’s missing and what was going on in 2010 that isn’t happening now?

Valuation

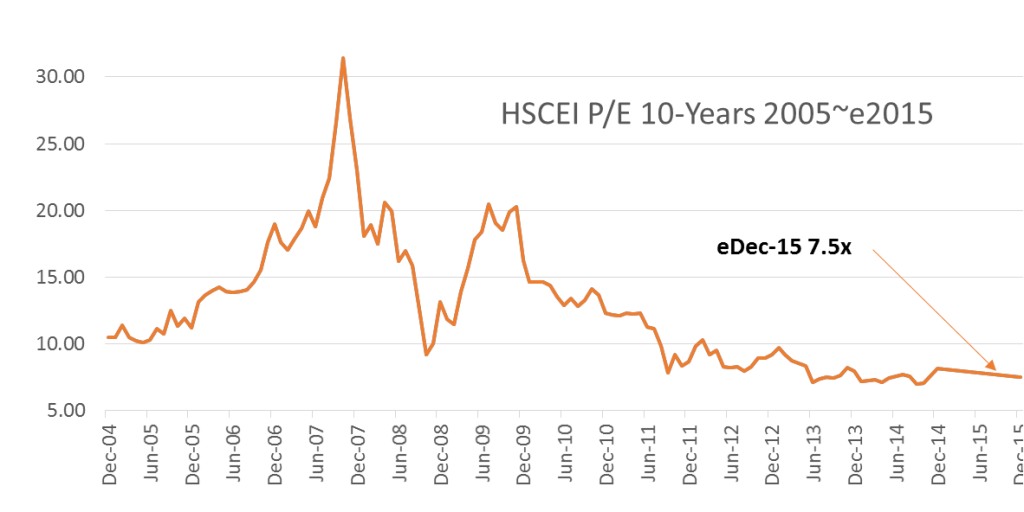

The chart below is how investors can best make sense of our current market. For all the talk of rallies and breakouts (look at a chart for the HSCEI and you’ll see even the term ‘breakout’ seems a little premature) in valuation terms we’re still extremely depressed.

Yes, you could have bought in a few months ago when the aggregate P/E was just a little over 6x. The present valuation though is a long way south of what would be regarded by a non-partisan as fair for a market where earnings prospects remain solid (if not necessarily spectacular).

Look back at 2010 and you see a market on nearly twice the valuation of today. High and rising valuations are one of the hallmarks of a bull market and until we get into much higher territory ‘correction’ will better describe the present state of affairs.

Broad Participation

Back in 2010 mid and small cap stocks were hot and many in those sectors were at 52-week highs. Look today at those segments and a different picture emerges. Sure, there are stock by stock reasons for lack of progress but overall the picture is one of narrow participation. Hong Kong based punters seem to be short of animal spirits and as far as the bigger institutional investors are concerned I’m guessing last year was for most a year of net outflows? Moreover, I doubt the direction of funds flow has reversed materially in the last few weeks?

As if to substantiate my hunch the performance of the Hang Seng Index versus the HSCEI over the last three months, plus c. 3% versus plus c. 18%, seems to support the notion that an A-share up-suck has taken Hong Kong listed China shares higher rather than a radical re-think of prospects by key investor groups.

Some retail investors may be committing but the big institutional guns are for the moment, and the most part, apparently not buying it.

Absence of I-Told-You-So Chatter

I don’t see it all but I see enough sell-side research to make a reasonable assessment of the zeitgeist in that particular community. Moreover, like you, I read the press, Bloomberg and etcetera and the pattern that emerges from all this is not one of a broad sea-change in confidence.

What prompted me to write a note in 2010 was the substantial pick up of what I called then I-told-you-so chatter. You know how this works. Fund managers purr publicly of being substantially committed for some time, sell-siders begin to regularly reference long forgotten ‘buy’ notes and if you’re unfortunate enough to be an agnostic you begin to feel like the character at the center of a Batemanesque cartoon.

Presently I believe there’s still a high degree of skepticism about the China market (possibly an early bull-market flag?); and why wouldn’t there be? The economy is slowing, home prices are falling and the export manufacturing complex continues to limp. Even the CSRC has voiced concern about the unsustainable nature of the domestic rally.

No, this is not yet at least, all consistent with a real bull market.

Absence of Theme(s)

Bull markets are driven principally by sentiment. A change in this is required to ignite them but a theme or themes are required to keep pots bubbling and, unless I missed it/them, our market seems short of these? In the US for example two letters, QE, have been enough to keep a multi-year party rocking and closer to home ‘Abenomics’ [What is that? Ed.] has been a powerful one-word touchstone for Japan. Over in India the word ‘Modi’ seems to have been all the catnip investors needed to have turned that into one of the best performing markets of 2014.

Perhaps for China the word ‘reform’ might, in time, assume the role of bull market propellant? Today however it remains a descriptive rather than explanatory term. In fact if there are any major themes in the market presently they’re negatives such as the collapse of the Macau gambling stocks or over-owned Tencent’s recent faltering progress?

No friends, we’re far from in the grip of any going-up-because-its-going-up fever judging by the post ante arguments currently in use to explain recent progress.

If This Isn’t a Bull Market, What Is?

There isn’t a reliable definition; but just because I can’t draw an elephant it doesn’t mean I won’t know when one’s standing on my foot! Here then is my brief checklist of you’ll-know-we’re-in-a-bull-market whens:

Valuations break-out. The e2015 consensus earnings integer for the HSCEI is around 1,600 so refer back to the second chart and work out for yourself what might constitute a valuation break-out? To me, very roughly, somewhere north of 10x would suggest we were developing sustainable momentum i.e. a lot higher than today.

Consensus fructifies. There’s too much dissent for this to be a proper bull market. Only when critics have been silenced or find there’s no market for their views can we talk properly about being in a bull market. Cheerleaders will emerge, but until they do there’s still too much argument and counter argument to believe the rally can be self-sustaining.

Clear themes and narratives emerge. I’ve already discussed this above but one of the reasons this is so important is to give investors and analysts a justification for pushing investment horizons further (and further in time) out. The longer your investment horizon, as a rule, the more valuable your investments are judged today.

Institutional big-guns commit. Retail investors can do a lot of the heavy lifting but if liquidity is a coward their’s is usually the most lily-livered. To produce the kind of ongoing and sustainable price gains that characterize a true bull market customers of Fidelity and their like must feel they want to commit too; but I see no signs of this at present.

In Conclusion

We may be heading into a bull market for China stocks but as I write today we’re not there yet. A very oversold and depressed situation has had a correction which may turn out to be the first stage of a much bigger move; or it may not.

For investors guided by a disciplined value style though it’s clear, despite recent strength, China stocks remain attractive. Having been extremely cheap they are now less so but still a long way from valuation norms that characterized much of their past.