In a Working Paper from the IMF researchers Serkan Arslanalp, Barry J. Eichengreen and Chima Simpson-Bell take a look at the U.S.-Dollar (U$) this century in terms of its use as a reserve currency.

Lets start with one of the few things that’s crystal clear:

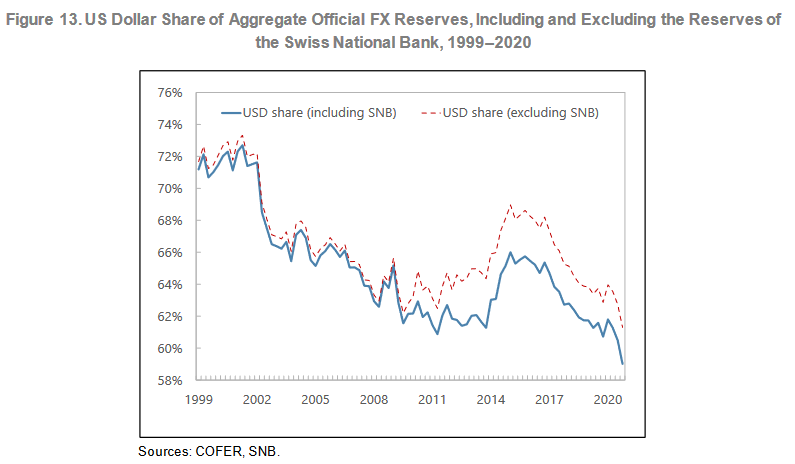

The share of U$ being held by the world’s central banks in their reserves has gone down. However, what hasn’t happened as was widely predicted at its formation, is the share of Euros hasn’t gone up dramatically. At least in this regard it turns out the Euro is a U$ compliment but no substitute.

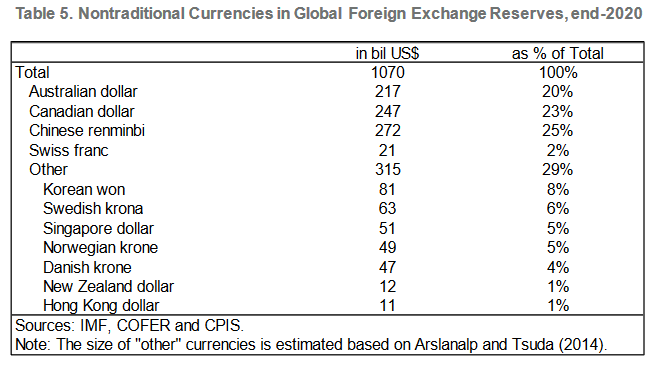

There’s been a shift in favor of the Rmb, but it only accounts for 25% of the the U$ net loss. So, again, no clear substitution effect.

The big winners have been what the authors call the ‘nontraditional reserve currencies’ (of which the Rmb is included) and you can see this here.

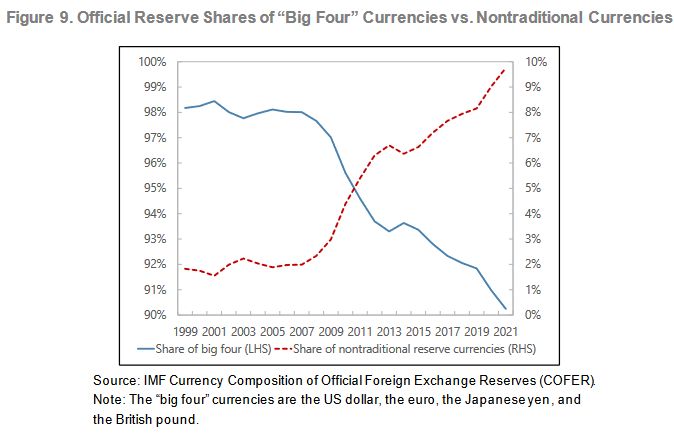

The chart below shows how dramatically this shift to the ‘nontraditional’ has affected the weighting of their traditional peers.

Under the hood analysis rules out the possibility the trend has been anything other than a conscious move i.e. it hasn’t been a drift to reflect relative valuations or trade flows.

It seems to be, pure and simple, a move by the world’s central banks to diversify which has been made possible by the increasing depth and ease of transaction in the non big-four units.

The paper concludes this is a trend that’s likely to persist. The implications of this (if any, short term?) are less clear.

You can access the paper via the following link The Stealth Erosion of Dollar Dominance.

Happy Sunday.