[I’m fond of saying that to understand China properly you have to imagine it, in many regards, about 50-years behind the developed West. After reading this study I think, with regards to financial markets, that glib summary may be too kind.]

Grace Xing Hao of the PBC School of Finance at Tsinghua University and Jiang Wang of the Sloan School of Finance at MIT present, in the paper highlighted today, a masterclass on how to constructively criticize China Inc.

Wonks can read the paper in full (for investors in China’s domestic markets a squint is mandatory) but for most the message is simple and doesn’t require a long read. Videlicet, without increasing tolerance for risk China’s planners will continue to retard the development of their capital markets.

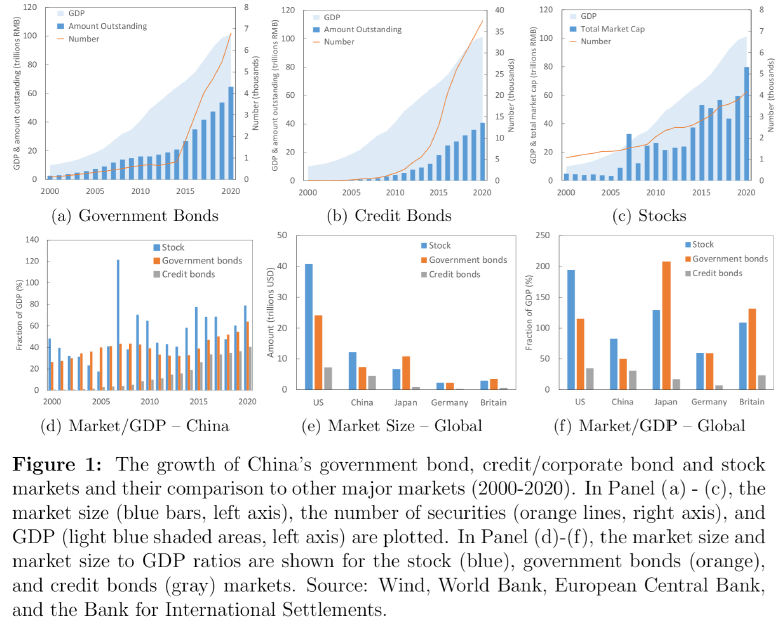

Charts below from the paper sum up just how uneven progress to date has been and how far behind broader economic development capital market development has lagged.

The paper gives a good summary of development to date, the current state of affairs and the major characteristics of each of the following segments: Government bonds, Credit bonds, Stocks, Asset Backed Securities, Financial Derivatives, Commodity Futures, Investment Management and Currency and the Capital Account and if you have a specific interest you can just fillet the section of your particular interest.

It should go without saying but I’ll say it anyway, without progress in developing their capital markets China, already lagging, will slip further behind the developed West who are refining and innovating theirs constantly.

You can read the paper in full via this link A Review of China’s Financial Markets.

Happy Sunday.