[This is the first time I’ve seen the phrase ‘G3’ used to sum the economic world. It refers to the U.S., China and an aggregated (big country) Europe and is a descriptor whose utility will no doubt cause it to stick.]

In the paper highlighted today Luis Bauluz (et al.) from the University of Bonn add usefully to the literature on how, globally, the rich have gotten richer since 1980. They focus particularly on the mechanics of this phenomenon which may in part surprise you.

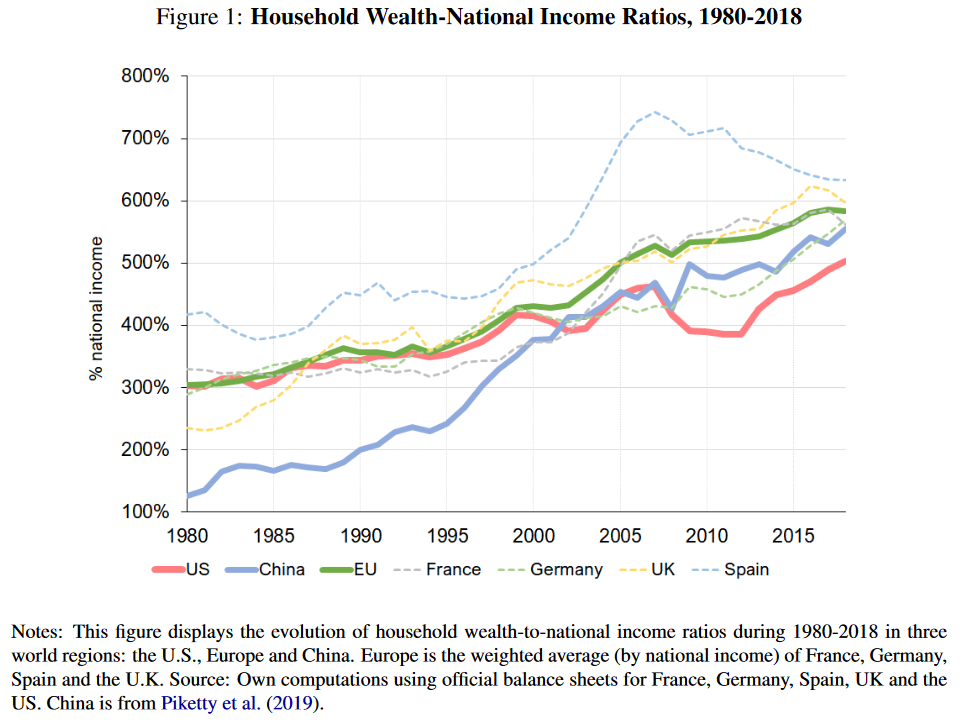

That this has occurred we’re all aware and is in no doubt as the chart below extracted from the paper shows (but, goodness, just look at that line for China!).

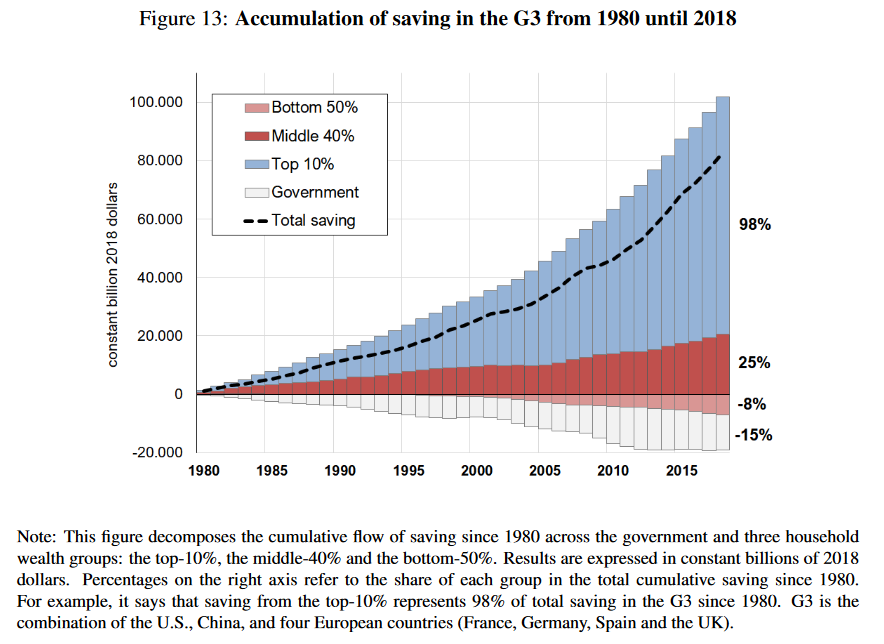

What’s new in this work is the finding that the rich have gotten richer from not only the capital gains of their investments but also indirectly via the increase in corporate savings that’s occurred over the period.

The owners of pension plans, investment trusts and stocks (i.e. the rich) have enjoyed the double whammy of the values of these assets rising and the net cash position of many of companies they indirectly own rising too.

The middle class, particularly in China and Europe, have become more indebted over the period but this effect has been counterbalanced by the gains they’ve enjoyed (almost certainly due to the interest rate environment over the period) in the value of their homes.

The bottom 50% have made no progress being unable to enjoy the housing price lift, the appreciation in value of risky assets or the indirect benefits of ever more-muscular corporate balance sheets.

This picture, when expressed in actual dollars, is almost unbelievable.

The researchers steer clear of the two elephant-in-the-room questions the work raises:

First, why and how have corporations been able to a) become so profitable over this period, and b) why are they holding on to so much of their gains?

Second, how will interest rates in reverse affect this dynamic and what are the likely social consequences?

My own two pennyworth would be to note that the have-nots, having been quiescent losers for the last 40-years, are unlikely to suddenly emerge as a fractious bunch as a result of any/all changes to the status quo ahead.

There’s potential for serious fractiousness though from the middle-classes if prices of what they perceived as multi-generational value stores i.e. property, start to go into structural reverse. In this scenario they could co-opt the nothing-to-losers in an angry alliance against the top-10-percenters.

But this is just my idle speculation. Property prices only go up and interest rates don’t really affect asset prices much, right? If she were still with us Ms. Marie Antoinette, I’m sure, would agree there’s not much to be concerned about in how this dynamic might shift. Cake anyone?

You can access the paper in full via the following link Global Savings Glut.

Happy Sunday.