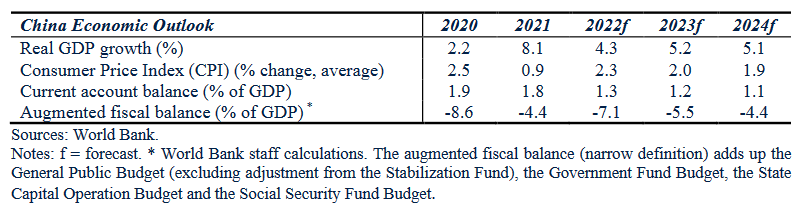

This is how the World Bank is now summing up China’s prospects:

2021 was the bounce-back year, 2022 is about finally squishing COVID and 2023 will be about getting back on the front foot.

The forecast recovery, it should also be noted, will occur without the inflationary blight the rest of the world is having to wrangle.

The analysis deals with obvious challenges: the zero-COVID policy at home, the Russia/Ukraine situation abroad, global demand disruption/destruction and a largely self-induced stressed domestic property market; but, on balance, its reckoned China will manage a way past/through/around/over these hurdles.

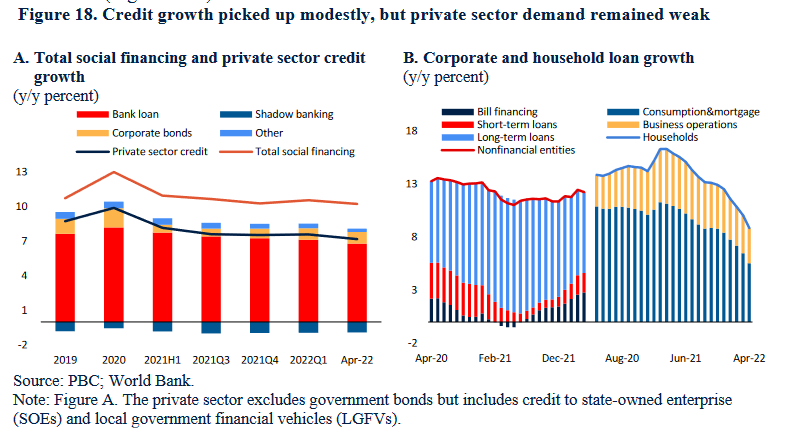

Worth keeping an eye on though is private sector credit. It’s been weak, no surprise, but there’s a concern it may be a horse that gets led to water via interest rate signals but once there will to refuse to drink.

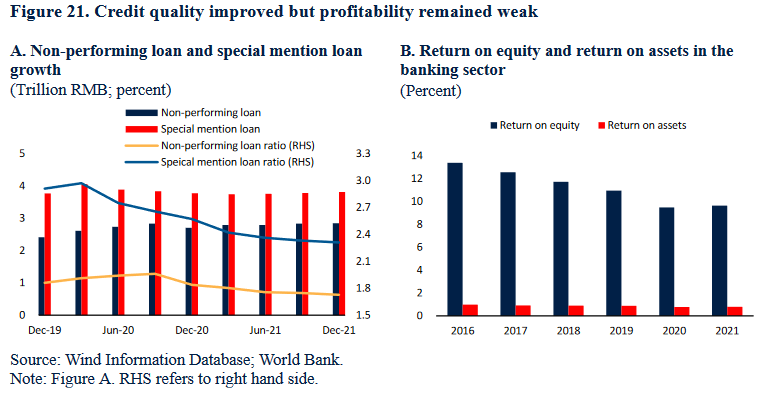

The financial system, a particular bête noire for China worrywarts, is in fine shape given massive capital buffers at the big state banks. The imprudent on the periphery though could always produce surprises.

There’s a bone for the cautious though. The long-persistent trend of improving credit quality going hand in hand with deteriorating profitability is unlikely to change much [Come on! There are worse things].

For those vexed about China’s property market the report has a very useful deep-dive on the subject (from P.46). The section covers all the major points concluding on property taxes. These have been long discussed and still not implemented but the team believes a ‘Saint Augustine’ approach is best i.e. their introduction should be progressed, but perhaps not just yet.

For your convenience I’ve filleted the property analysis into a separate file here World Bank China Property Analysis 2206 (copy the link if you want to send it on, no need to download the whole file) and you can access the full report via this link China – Between Shocks and Stimulus.

Happy Sunday.