Professor Kenneth Rogoff of Harvard University and Yuanchen Yang of the IMF, writing in a new paper from the National Bureau of Economic Research (Cambridge, MA, U.S.A.), supply a fresh and perhaps the most up to date look at China’s residential property market.

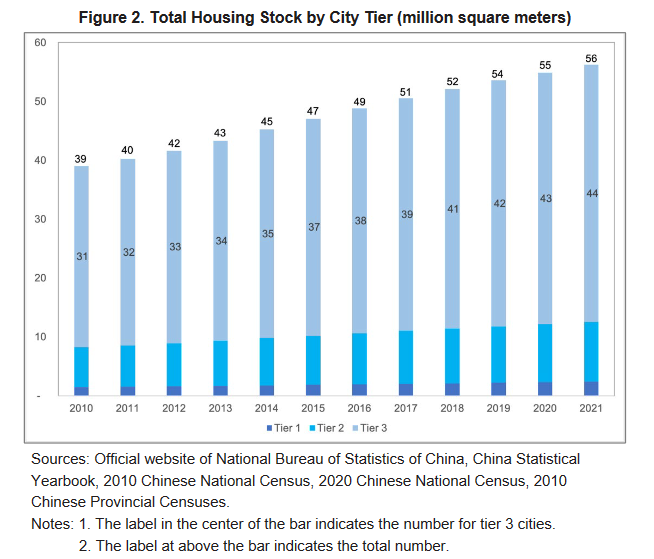

The focus of the paper is not the widely reported-on Tier 1 and Tier 2 city dynamic but the less well covered situation in the Tier 3 cities. In aggregate 60% of China’s GDP comes from these locales and nearly the same percentage of residential property is located there.

Moreover, and as you can see from the picture, this is where most of the growth has occurred in the last decade.

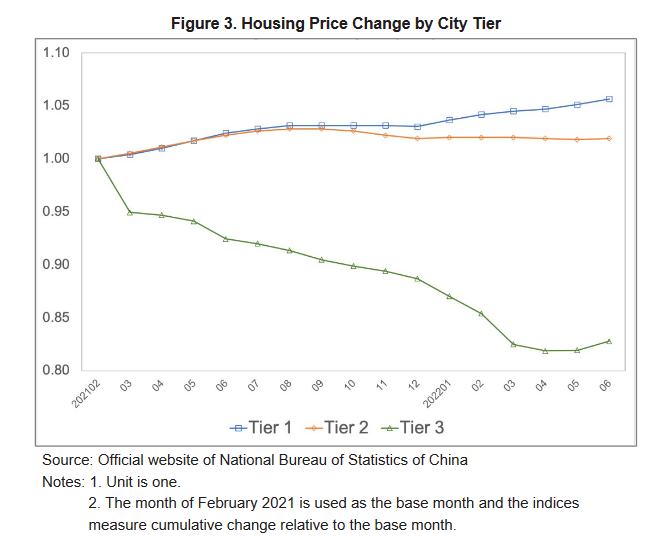

Now we get to the problem. Using a combination of publicly available data and inference the researchers tease out from aggregate data what’s been happening to home prices in the various centres.

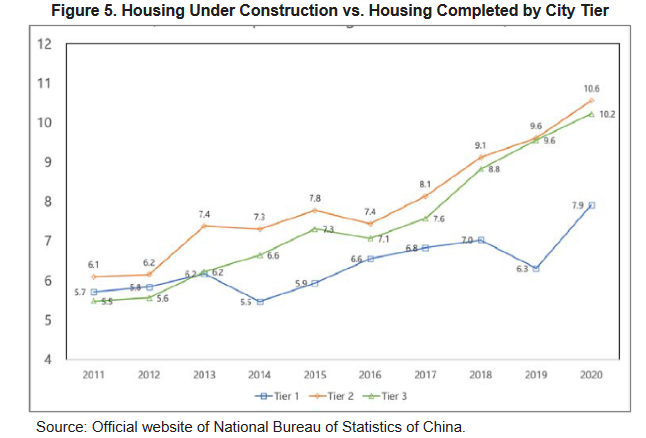

In addition to the supply and price problems the aggregate population of Tier 3 cities appears also to be in retreat and the level of home starts to home sales is exacerbating the problems (it’s a Tier 2 problem as well as the picture below shows).

The cheery analysis is rounded off by a brief note on infrastructure which goes hand in hand with property development. Trends here also are worrisome with Tier 3 cities accounting for a disproportionate share of investment and therefore potential problems in the pipe.

The key takeaway is perhaps to highlight not so much that China has a minor-city-property-overbuild issue (thanks, we knew) but just how constrained planners are if they intend to use either property or infrastructure development to stimulate the economy henceforth.

The paper in full, with useful charts in the appendices, can be accessed via the following link A Tale of Tier 3 Cities.

Happy Sunday.