Preamble

A few years ago in China’s stock markets the retail/consumer sector was the hottest. Rising incomes, a huge population, what could go wrong? For investors in the space the bet has proved a poor or disastrous one depending on where it was placed.

That such a sure-thing should have turned out so badly should be no surprise to seasoned operators; confused neophytes may yet harvest gains if they bear in mind in future some very China specific lessons that can be learned from this experience.

Summary Conclusion

With such a large population the demand side of the China equation is indeed huge. However, with many agents having access to effectively free money and a developing market copy-cat modus operandi, a supply excess is often the end result.

Monopolies, niches or very young businesses therefore in China make selective sense. Highly competitive spaces with no capital, experience or intellectual-property moats do not.

Yesterday’s investors in retail/consumer stocks have learned this the hard way. Today’s investors in Macau are being taught a variation of the same lesson and, I suspect, the same one lies ahead for those presently keen on all things China-internety.

How Bad is Bad?

Before going on it may help to look at some specific examples. What could be a better business in China than noodles? Wouldn’t a company that dominated the space through all price points be one that would benefit in lock-step from rising demand and incomes? You would have thought so.

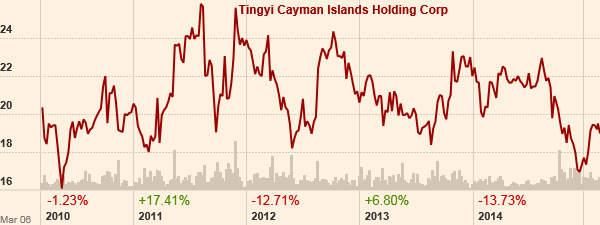

You can see from the stock price chart the somewhat more prosaic reality for Tingyi. I’ve met the management of this enterprise on several occasions and, IMHO, they’re focused, capable and energetic. Moreover they’ve grown sales over the last five years from roughly Rmb5bn to over Rmb10bn. What they’re not is immune from competition, and the net profit over the period is almost unchanged.

OK, noodles are tough and anyone with a bit of capital can buy a noodle making machine (I searched Alibaba for ‘Industrial+Noodle+Machine’ and got over 6,000 suggestions) and keep prices depressed; but something like a supermarket where you’ve got location and daily necessity on your side should be a safer bet, right?

Not really. Five year sales growth (to Dec. ’13, it’s probably worse to Dec. ’14) of around 60% is trailed by profit growth of 5%; and that’s in total, not the CAGR.

How about department stores? Surely if it’s about location-location-location and you were an early mover that would have put you in one the sweetest spots i.e. the luxury-hungry aspirant emerging middle class?

The internet has something to do with what ails this segment but capacity has at least as much to answer for. That and a China-centric model where stores are really nothing more than sheds into which brands are slotted with no broad marketing strategy has taken the shirts from investor’s collective backs here (for a lesson in how it should be done check out JWN – NYSE, that’s a class act).

I’ve picked these examples not to stick a knife in to specific names but for a reason that may surprise. In my experience the management teams at all three companies are impressive in the flesh and have executed methodically. They all came to the party with experience and have managed their businesses consistently over the period.

We can then rule out company specific problems for poor performance. It must be the environment in which they’ve been operating which is to blame; but what, specifically, is so toxic and peculiar about China?

Supply

I’ve already touched on this but it’s so fundamental a point you’ll forgive a little repetition. The next time you hear an argument for China based on demand, run! China is short of nothing and can make anything. Occasionally there are bottlenecks, coal for example a few years ago. A shortage in that market persuaded a former colleague to describe demand on a track of infinite progression and concluded the price of China’s largest coal supplier, by then already juiced, would double again (it’s subsequently halved).

This progression-without-alteration conclusion is a common forecasting problem made famous by The Reverend Thomas Malthus; but an eye to the future that doesn’t consider the human response is always going to be incorrectly focused (for some fun have have a look at http://www.historic-uk.com/HistoryUK/HistoryofBritain/Great-Horse-Manure-Crisis-of-1894/).

In China’s case any prediction of future demand leading to anything other than increased supply will always be wrong; and especially so when so many players, being state sector affiliated, have access to what amounts to free capital.

Demand

It’s finite, even in China. There comes a point at which you can’t sell any more TVs, air conditioners or autos because everyone who can buy one has done so and in these sectors investors have been taught the lesson. Somehow though a fresh crop analysts and investors springs up when a new-new dynamic presents itself all ready to draw straight lines from rising trends.

Not only is demand cyclical for most things even demand for so-called staples fluctuates. A recent example. I met the Tingyi management in Q4 last year and was surprised to learn that demand, even for their lowest end products that retail for around Rmb2~3, had been affected by the anti extravagance/corruption campaign. How so, I inquired? It seems that gift giving extended to low end noodles and this has been curtailed. Whoda thunkit?

Remember also, sure, China is getting richer and Rue Saint-Honoré stores now employ mandarin speaking sales assistants; but it’s still a long way off developed market per capita norms. The population may indeed be over 1.3 billion but the addressable market for many products is a small fraction of the total. Louis Vuitton are only the latest to be finding this out (http://www.businessinsider.com/louis-vuitton-losing-sales-in-china-2015-2).

Emerging Means Emerging

No one would question the notion that China is still an emerging market. Why then do investors look to developed markets and assume that’s where China must be headed? Why do so many look at companies who are the product of decades of hard scrabble on their home turfs and assume they’ll be able to graft that success into China (Tesco and Walmart spring to mind)?

Yes, there are some universal truths in business; but as we all know past performance is no guide to future returns. This is an especially important point in a market as vast, dynamic and riddled with structural and cultural peculiarities as China.

Too frequently one hears so and so is the Walmart/Amazon/GE of China. These are sloppy and dangerous summaries; appropriate for Bloomberg commentators and their like but for investors these labels tow in their wake a raft of presumptions that are simply not correct.

Macau isn’t Vegas, Alibaba isn’t Amazon and Sany isn’t Caterpiller.

Valuation-Valuation-Valuation

A mistake made by investors in the China retail/consumption space a while back has been again made by Macau boosters and is presently being made by fans of China internet-related stocks. It’s possible to grow into a fancy multiple; but it’s rare. Impossible for sure is for every company in a sector to grow into a fancy multiple.

Two of the three companies I used as examples early on in this note have (in my opinion) increased in value over the last five years; but their share prices haven’t reflected this because it was assumed, five years ago, they’d improve in value by a whole lot more.

This is Investing 101 but in China’s case the problem seems to get magnified as regularly too much money ends up chasing a very small group of companies. Sector specialization at a number of large investing institutions often compels managers who know better to play this game and you can see this pronounced presently, for example, in anything health care related.

As a rough guide bear this in mind with regard to China; never, ever pay a premium to play, and if you can’t get into something at a sensible valuation? Walk away.

In Conclusion

The downward revaluation of the retail/consumer sector in recent years in China carries universal and China specific messages for investors. The most important being; don’t overestimate demand or how that pattern will develop, don’t underestimate the scale of the supply response and above all don’t pay a premium to play.

Despite the clarity of this recent lesson wishful thinking will continue to triumph common sense for many investors and to them all I can say is; good luck! Never to be confused with disciplined investing.