The IMF raised its 2023 GDP growth forecast for China to +5.2%* on January 30th and, given we’re only in February, it seems likely there’ll be more favorable revisions to come.

[*Some confusion. In the China Report, dated February 3rd and highlighted below, there’s a forecast of +4.2% for 2023 GDP, but in the World Economic Outlook WEO and in the China Report press release the number is +5.2%. It’s not clear to me why this is. It might be a timing issue as the Report is compiled as to January 9th?]

Reading between the lines of the report (and strictly my personal view) reveals IMF frustration that an over-emphasis on a futile tussle with COVID in 2022 led to a retardation of reform.

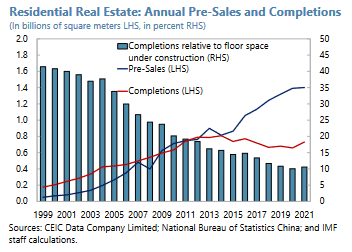

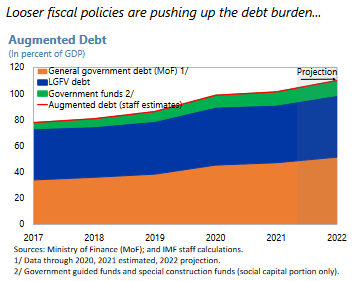

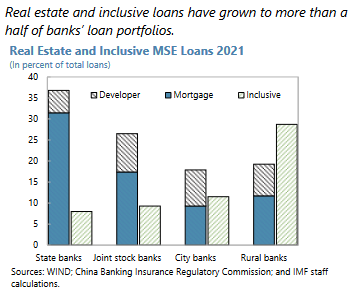

Explicitly, the IMF team notes the property market still requires a proper fix, SOEs remain too big for their boots and taking an eye off the ball on alternative energy will make it harder to achieve near-term climate goals.

You can read the full report via this link IMF China 2023 but below I’ve extracted some of what I thought were the more interesting panels.

For serious wonks there’s useful color at the end where the Joint Statement by the IMF and Chinese government allows China Inc. to push-back on criticism from the IMF team.

‘Could try harder’ is the overall message I received but, as we’re still not far into 2023, there’s plenty of time to see if China’s willing to. I’ll wager they are and we’ll see a more determined focus on growth and reform as the year gathers steam.

Happy Sunday.

[For super-super wonks; a companion piece was published last Friday, here PEOPLE’S REPUBLIC OF CHINA SELECTED ISSUES. This work zeros in on some of the subjects touched on in the Annual Report i.e. the Zero Covid Strategy, Short Term Fiscal Multipliers, Monetary Policy and the Role of Credit Policies, Market Reforms in China’s Power Sector, Fostering the Development of Climate Finance and Sustainable and Balanced Growth in the Long Term. Enjoy.]