[Researchers at the independent U.S. think-tank Rhodium Group produced a report earlier this year in July I’m revisiting today. It has particular merit being produced before the stimulus measures recently announced and highlights China’s biggest problem that those measures appeared to largely ignore.]

It’s clear, China has a real problem with consumption, or the lack thereof, and the recent ‘stimulus’ measures seemed to be almost oblivious to this. Hence initial market cheer and now subsequent disappointment.

This is the big problem:

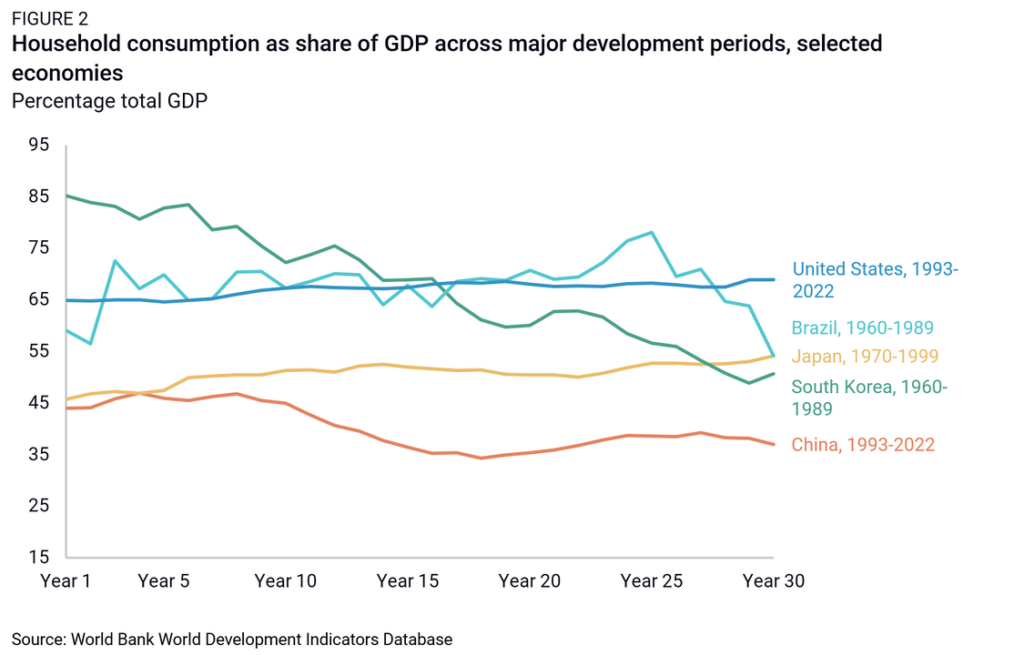

As China has grown households have spent more but they’ve also been saving more so the percentage of consumption in national GDP has gone down. Whilst investment led growth this wasn’t a big headache, but now the investment-led-growth engine is sputtering it brings this issue out to the front and center.

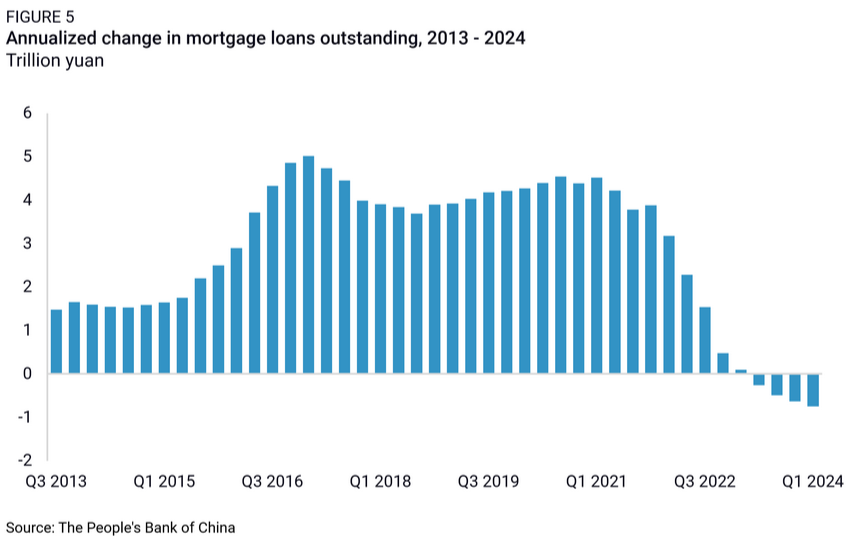

This has been the response (below), at the consumer level, to the housing crisis. Households have been paying off mortgage loans like never before i.e. they’re not gagging to get into more bricks and mortar even though the government has just made this easier.

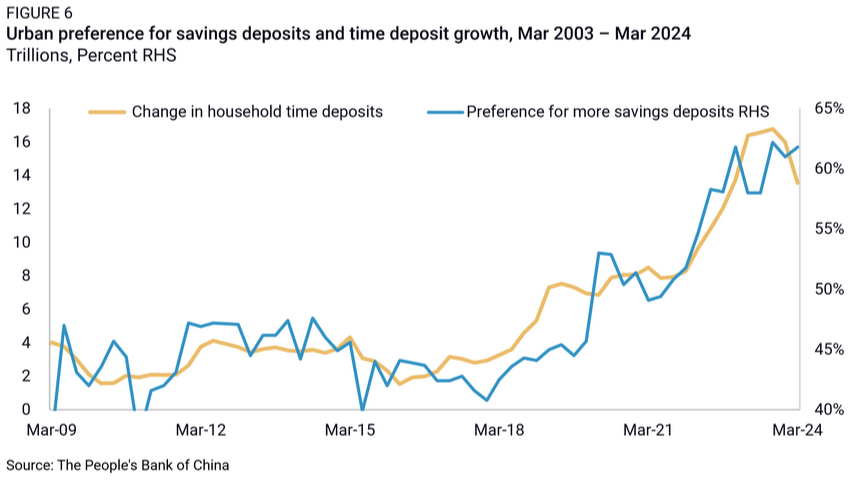

The report also notes other savings increasing, especially time deposits, which indicates quite clearly no desire to consume in the medium term.

Unlike governments elsewhere China didn’t throw money at its citizenry during or after COVID and part of the reason for this (most likely) was memories of 2008. The huge stimulus applied then ended up resulting in runaway asset price inflation, local government profligacy and a collection of white elephant infrastructure projects.

But the 2008 experience can’t fully explain the government’s recent parsimony and the researchers think a key component may be official attitudes to welfarism. They usefully refer us to this telling passage from President Xi Jinping a little while ago:

““To promote common prosperity, we cannot engage in ‘welfarism.’ In the past, high welfare in some populist Latin American countries fostered a group of ‘lazy people’ who got something for nothing. As a result, their national finances were overwhelmed, and these countries fell into the ‘middle-income trap’ for a long time. Once welfare benefits go up, they cannot come down. It is unsustainable to engage in ‘welfarism’ that exceeds our capabilities. It will inevitably bring about serious economic and political problems.”

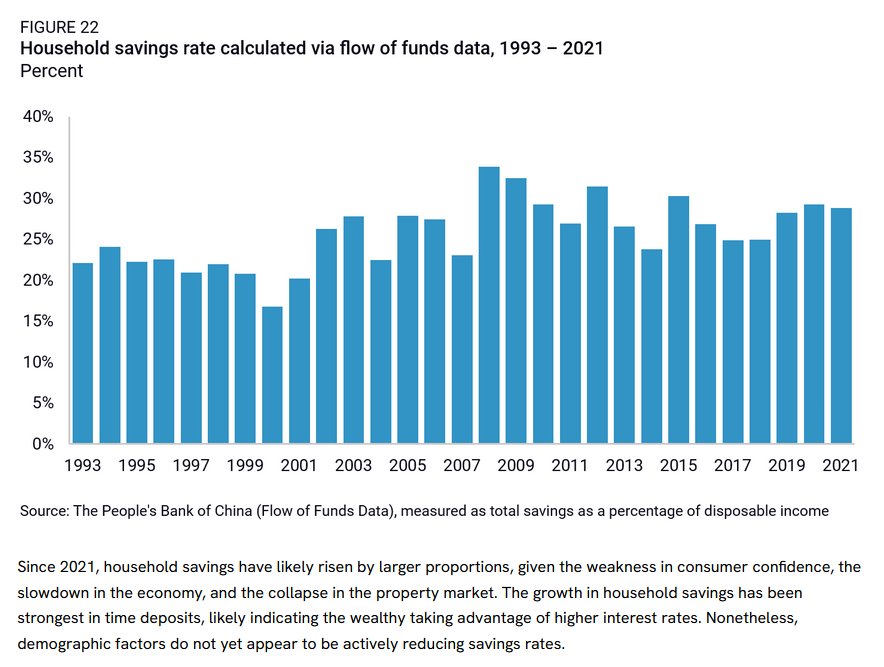

Add to the lack of consumption China’s notoriously high savings rates, which show no signs of reducing, and a picture of stubborn gridlock presents itself.

The report concludes with a list of remedies which look very similar to the list highlighted in the note last week from the IMF. The reason for the overlap is what needs to be done seems so obvious.

If it’s that obvious then why don’t China’s planners seem more alive to the fixes? The recent stimulus measures, basically, amounted to relief for home owners on borrowing costs and easier access for those waiting to get on the ladder. Completely missing the point.

China stocks remain cheap notwithstanding their recent little pop. But they’re cheap for good reason and until the government shows signs of acknowledging the real elephant-in-the-room they’re likely to stay this way for the indefinite future.

You’ll find the report in full here No Quick Fixes: China’s Long-Term Consumption Growth.

Happy Sunday.