Six months ago today, frustrated by the nuts-cheap valuations of stocks in the Hong Kong market, I wrote a note on the subject (please, revisit it here Acres of Diamonds).

The main point was that value often presents itself very simply. There’s rarely a need to scour the world’s obscure market segments or rummage about in illiquid micro-caps. Metaphorical ‘Acres of Diamonds’ are often just below our feet.

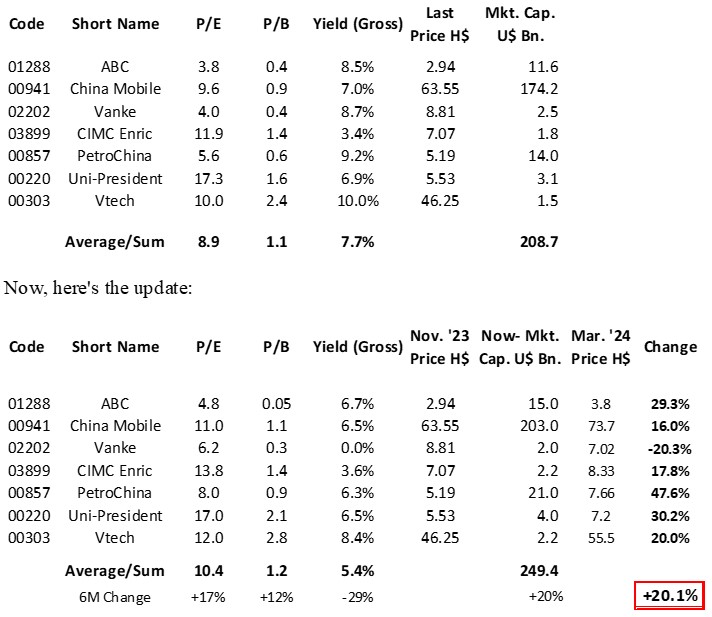

From the November 2023 note, first below is the table with the ‘Diamonds’ I highlighted then. To remind, I don’t own any of these stocks and they were chosen almost at random to highlight the point:

[N.B. Data is from HKEX and www.aastocks.com. Mkt. cap data is only for H-shares so numbers for ABC, and PetroChina are misleading. Only Vtech has paid a dividend since which I’ve left out for clarity of calculation. Yields are presented gross but dividends from ABC, China Mobile and PetroChina will be paid to most after a 10% withholding tax.]

The process is never without risk and Vanke has run into a spot of bother. Despite being state-backed they’ve become liquidity-constrained and not only has their stock price been hit as a result they’ve also cut their dividend, to zero.

However, despite this setback the aggregate numbers still shake out nicely (and I’d expect Vanke to right themselves in due course).

Not only has this mini-model-selection of nothing-specials produced a handy gain of 20% over the 6-month period (which translates to an annual return of an even handier +44%) it remains, as a bundle, ‘cheap’ and a collection most’d be happy to hold now for the yield alone.

The example usefully reminds, investing is about buying good companies in combination at low valuations when you get the chance, because this strategy works. All else is speculation, and good luck with that.

Nial Gooding CFA

Thursday, May 23rd 2024