In 1993 Morgan Stanley’s then Chief Strategist Mr. Barton Biggs returned from a trip to China and declared himself “tuned in, overfed and maximum bullish.”

At the time I’d recently given up on Japan and was working in Hong Kong. An old friend called from Tokyo; “Hey, you heard of some guy called Biggs? Says China’s cheap and we should get involved”. I told my friend to calm down. Just another know-nothing China-newbie discovering paved roads and electric lights I suggested?

Ahem! Wrong. Then? BOOOOM!

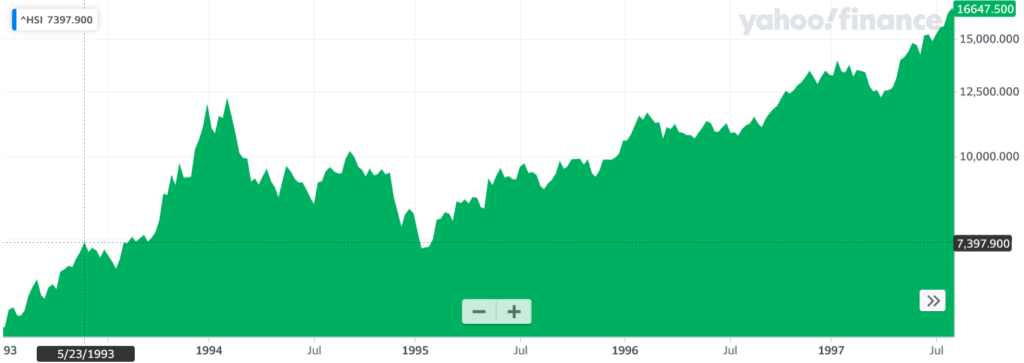

How BOOM-y? The wall of buying Mr. Biggs now famous report triggered took the Hang Seng Index (HSI, then the only real China proxy) from a 1993 mid-year high of 7,400 to an intermediate high in 1994 of 12.200 for a rapid gain of 65%. If you’d hung on through the correction that followed to the subsequent top in 1997, four years later, you’d have seen the HSI to a high of 16,600 for a four-year gain of 230%.

Source: Yahoo Finance. Hang Seng Index from 1993 to 1997. A nice ride.

The point of the history lesson is to give a sense of possible price action when investor sentiment on China changes; as it’s about to.

There’s a long essay that could be inserted here as to why investors have soured on China; but a brief summary will do. Better alternatives, slowing growth, ethical issues raised by treatment of minorities and etcetera.

There have been ways round this but for most investors, domestic and foreign, China has been a hard-to-love and unrewarding prospect for some time; but this is about to change for reasons in the plainest of sight.

The most important of these is China’s ‘good’ pandemic. The economy received only a short-sharp-shock at a time when economic activity would have anyhow gone into a planned 4~6-week hiatus i.e the Lunar New Year.

The consequences of this relatively brief turbulence are now becoming clearer, as are the consequences of the approach of others to the same problem. In comparison not only will China’s economy produce net growth this year but its recovery is gathering momentum that will progress into 2021. It is thus now, as a result, in a global growth-club of one.

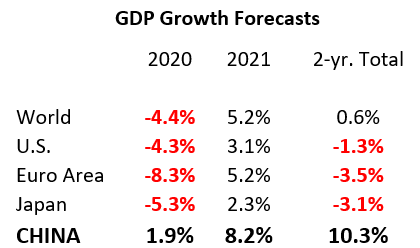

Here’s some of the IMF’s latest numbers.

China’s not just ahead of the game, it’s walloping the ball out the park; and it’s worth laboring this point. If we imagine the U.S. and China economies to have been each worth $100 at the beginning of this year at the end of 2021 China’s will be worth $110 and the U.S.’s will be worth less than $99.

This spurt compresses an advantage China might have enjoyed in the next 5~7 years into just two; and this advantage will be permanent.

Against such a favorable backdrop it’d be hard to imagine Chinese businesses doing badly and useful data-points in this regard are now coming through in the form of Q320 company reporting..

A rolling-thunder of positive data, both top-down macro and bottom-up micro, has now begun with only the timing and magnitude of the much, much more ahead in any doubt.

In this process skeptics, perma-bears, professional bellyachers and the entire cabal of for-profit China sourpusses will be forced into retreat. Then, as the good-news bandwagon picks up speed, today’s not-too-fussed scribblers will begin to get involved as cheer-leading chroniclers.

The whole operation described here can be summed up as a sentimental change; and we are today at or very close to its tipping-point.

Back to Mr. Biggs and on to Mr. Dalio*. In 1993 the conditions for a China-rethink were present but a catalyst was lacking. Mr. Biggs’ work, as it turned out, was that catalyst and Mr. Dalio may have just lit a similar fire. [* This link Ray Dalio has more if the name is new to you ]

The Financial Times last Saturday published commentary by Mr. Dalio, ‘Don’t be blind to China’s rise in a changing world‘ [Don’t Be Blind], which was one of the most measured and informed summaries arguing the case for China I’ve read. It’s sure to be widely circulated and, I suspect, may be highly influential.

I’m not saying one newspaper article will cause something to happen that wouldn’t have taken place anyhow. Surely, investor sentiment towards China will alter because facts compel such a change and not because a single high profile fund manager writes a supportive piece.

However, to date we’ve been moving towards a sentimental tipping point. Mr. Dalio may not be responsible for the inevitable inflection but he may have advanced its timing significantly.

As he puts it better than I could I’ll leave almost the last words here to him “Prejudice and bias always blind people to opportunity. So, if you have been a China sceptic for reasons that don’t square with what is happening there, I suggest you clear your mind.”

I hope you’re setup comfortably for the change? Many, I sense presently, are not.

Nial Gooding, Tuesday, October 27th 2020