Preamble

Facts, in plain sight, convinced me in September 2014 that China was heading for a hard landing; and, thereafter plus or minus, that’s pretty much what we got. [You can find that piece here Hard Landing].

China’s slowdown has been part product of a difficult global environment and part product of a policy to jump the economy off a dangerous borrow and build binge.

After two and half years playing defense a fresh look at facts, again in plain sight, convinces me now to adopt a more positive attitude.

Summary Conclusion

Key economic series in China such as credit data, consumer sentiment and leading indicators are showing improving trends. This is at a time when a synchronous global recovery is underway which is likely to reinforce these trends.

Experience from the past suggests this process will take some time before being fully played out and, if present trends continue, investors will need to revisit baked-in-prejudice about how China is going wrong in favor of new thinking about how China is going right.

In short, it’s time to be bullish on China.

As many China stock valuations remain close to historical lows a bet of the heads you win, tales you don’t lose variety is on offer; and, notwithstanding an antipathy to gambling in general, these are odds I’m very happy to take.

Just The FIPS Maam..

In the rest of this note I’m going to address some of the ‘Facts In Plain Sight’ (FIPS) mentioned above. This discussion may not convince you; but it may persuade you to, at least, consider the possibility of China being on an improving path.

There are 9-FIPS I want to highlight and, in no particular, order they are:

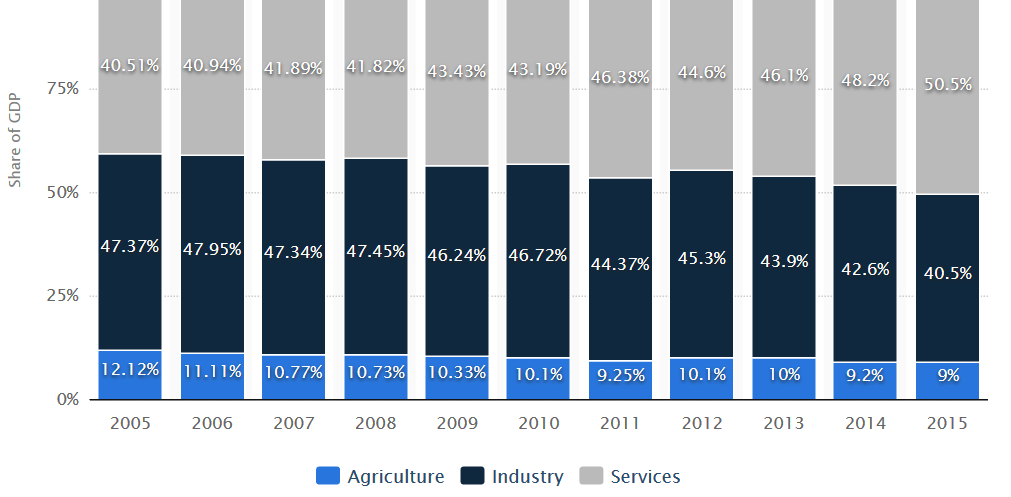

FIPS #1. Economic Transformation. It’s Happening.

It may not be happening fast enough, it has a long way to go before it achieves the OECD average and the development will be patchy; but China has turned the corner in terms of economic re-balancing. In fact, as you can see from this chart, the corner was turned in 2015.

The trend is irreversible and in 2016 services contributed 51.6% of GDP. The argument this should be happening faster is to miss an important point. China is far from being a mature economy. Roads, bridges, tunnels, new homes and all manner of infrastructure still produce reliable returns. It’s not appropriate therefore to urge the complete beating of steel mills into nail salons; but the change in emphasis on how the economy should be progressed is acknowledged at the highest levels of government and, manifestly, underway.

The trend is irreversible and in 2016 services contributed 51.6% of GDP. The argument this should be happening faster is to miss an important point. China is far from being a mature economy. Roads, bridges, tunnels, new homes and all manner of infrastructure still produce reliable returns. It’s not appropriate therefore to urge the complete beating of steel mills into nail salons; but the change in emphasis on how the economy should be progressed is acknowledged at the highest levels of government and, manifestly, underway.

FIPS #2. Money Supply Growth. The Great Moderation – Part I.

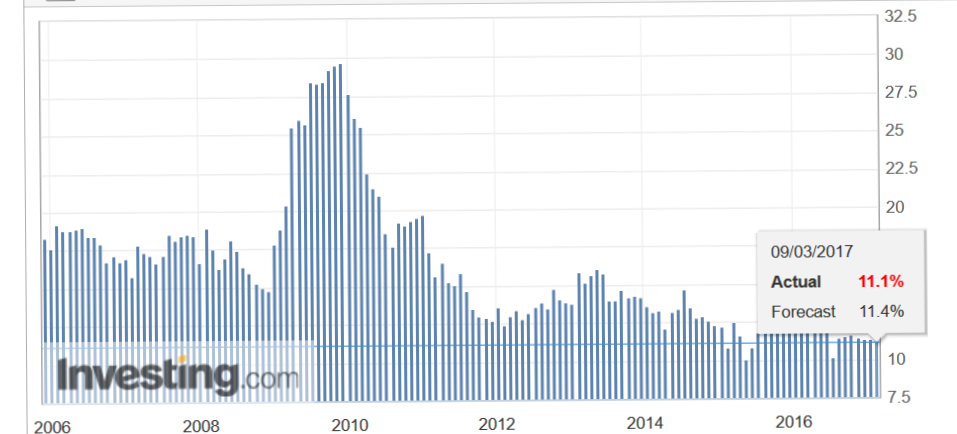

The next three FIPS are all related and speak to different aspects of the same investor concern. Has China, in reality, weaned itself off its addiction to debt funded growth? Look here at M2 growth over the last ten years. It seems clear what the difference between stimulation and prudent management is?

On it’s own this chart doesn’t tell us for sure money supply isn’t still being used as a stealthy stimulation tool; but together with data for our next FIPS it seems to supply strong circumstantial support.

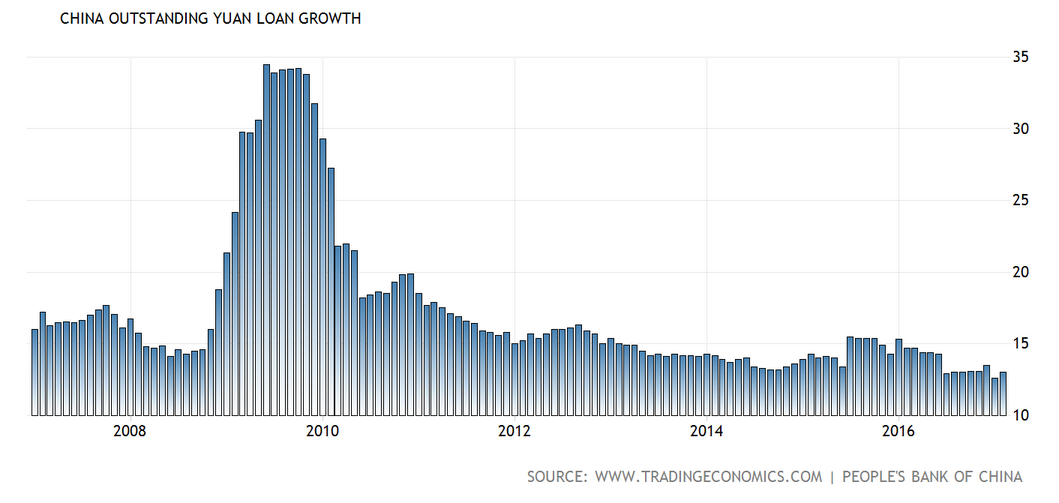

FIPS #3. Credit Growth. The Great Moderation – Part II

As with the above chart you can see what a real credit blow out looks like; and, as with the chart above, you can also put recent trends into context.

Be reminded, again, China is still a developing economy and a high amount of credit and therefore credit growth will be required for its optimal functioning. It would be of real and serious concern if growth in this aggregate was to fall sharply for any length of time.

FIPS#4. Industrial Profits. Resurgence Is A Twofer.

The chart below shows the last ten years and we’re at an all-time high. The chart doesn’t show growth clearly but it’s up smartly of late. In 2016 industrial profits rose 8.5%, that compares with a fall of 2.5% in 2015. In the first two months of this year they rose by 32%

There’s an element of higher commodity prices helping out but a lot of the gains are real as companies are benefiting from fresh capex in a number of different parts of the economy. So that’s good news. The twofer is the implication for the progress of corporate debt accumulation i.e. there’s less need for it; and that will take pressure off banks with obvious implications for balance sheet improvement.

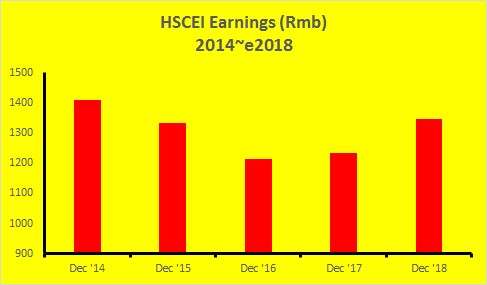

FIPS #5. Forecast Earnings. Rising Confidence.

We’re not yet done with the 2016 reporting season but so far most companies I’m interested in have indicated some sort of better year ahead. I don’t believe I’ve seen a reference to ‘new normal’ in any of the releases I’ve looked over. Quite a change from two years ago.

The chart here shows the actual earnings in Rmb terms forecast for the Hang Seng China Enterprises Index (HSCEI)of China stocks listed in Hong Kong (they’re from Bloomberg, March 24th 2017). A better 2017 is expected and a much better 2018 is forecast to follow.

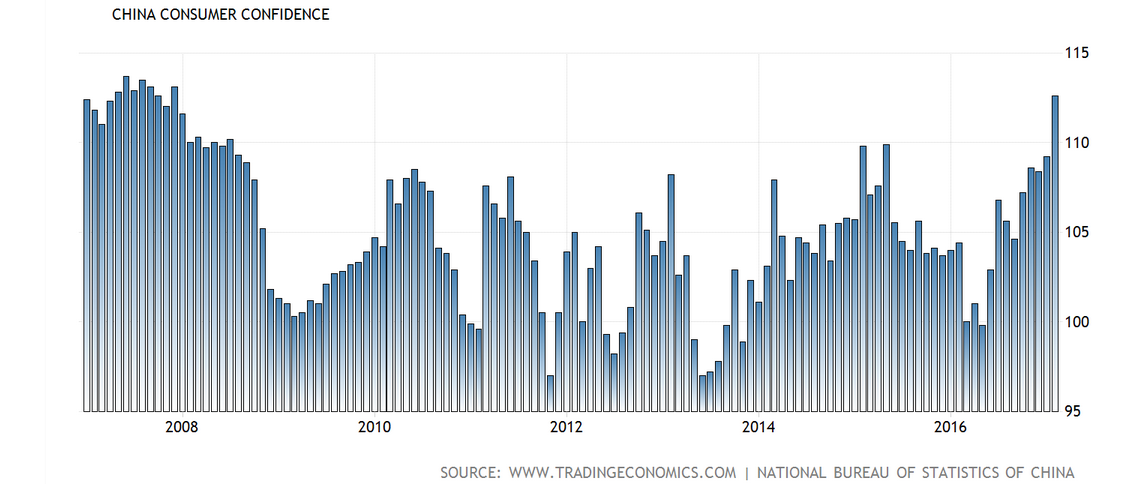

FIPS #6. Consumer Confidence. There’s A Lot More Than There Used To Be

You have to go back a way to find a reading equivalent to the most recent ones. High readings are often cause for concern as they flag irrationally exuberant heads of steam heading for deflation. That doesn’t seem to be the case here though.

The property market is warm for sure but China’s stock markets indicate a general lack of animal spirits. Consumer’s polled then are giving an honest assessment of future prospects and not letting stock market zeitgeist calibrate response; but if you don’t believe them..

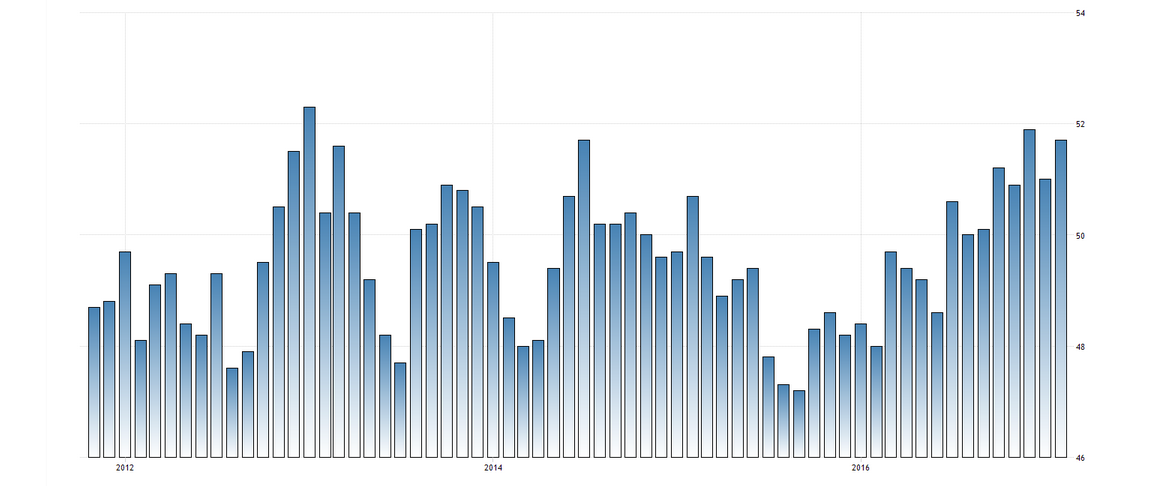

FIPS #7. China Caixin Manufacturing PMI. Eight Months of Growth*.

The official index shows the same pattern and the PMIs for both the official and Caixin surveys of Purchasing Managers in the services sector show even higher readings. We’ve now been above the economy-expanding 50-level for too many months for this to be a blip.

Business confidence also hit a 21-month high in February and while none of this data on its own can be relied upon as a future guide in aggregate it seems compelling. China is back to work. [*I.e. the index has remained above 50 for eight months signalling economic expansion]

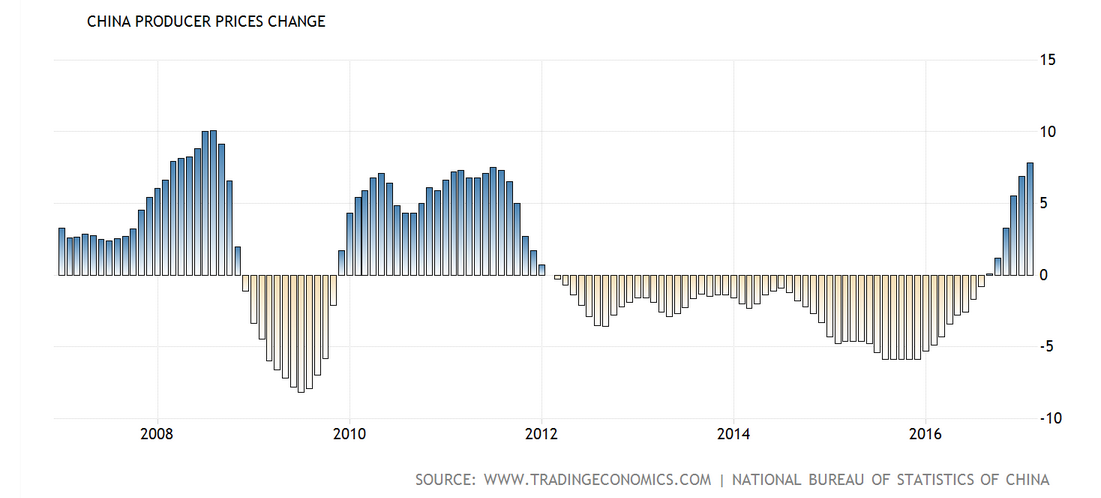

FIPS #8. Producer Prices. Back, With A Vengeance

We could simply caption the chart below ‘Whoosh!’ and it’d require no further comment. There’s an element of higher commodity prices in here but that doesn’t account for all the gain. The only way a series like this can perform as it has is if real demand is back in the mix.

Personally I’m no fan of inflation but a move like this must have inflationary consequences and there are more who would cheer a return of (‘a little’ they always say) inflation than those who would like to snuff it out.

FIPS #9. Rising Confidence Globally. Don’t Look a Gift Horse in The Mouth.

I don’t know why business confidence is rising globally; but it is. The chart below is from the OECD and is correct to the end of February. The top two lines are first the supposedly Brexit jittery U.K. and below them the now very Un-United States.

The chart shows just the G-7 members (United States, Canada, France, Germany, Italy, Japan, and the United Kingdom) but you’ll see it includes the OECD average pointing in the same direction. [Who’s the bottom line party pooper? Somewhat surprisingly Canada]

In Conclusion

Valuation, as always, is key; and here there isn’t much of an argument. China stocks remain extremely cheap; period.

[The e2017 number is 6.7x and the February 2016 low was 5.8x. Source, Hang Seng Index Services to February 2017, Bloomberg forecast for e2017 assuming HSCEI of 10, 500]

[The e2017 number is 6.7x and the February 2016 low was 5.8x. Source, Hang Seng Index Services to February 2017, Bloomberg forecast for e2017 assuming HSCEI of 10, 500]

As for the longer argument in this note the difference between being right or wrong is a highly asymmetric payoff.

Let’s say the argument is wrong; macro trends evidenced are blips and an economic condition akin to where we’ve been in the last few years is returned to. That’s the scenario presently reflected in China stock’s valuations.

Say the argument is right though and an earnings/sentiment/valuation recovery is further progressed and accepted? Fresh allocations to an already cheap market could quickly become a virtuous cycle of higher stock prices leading to more attention and in turn higher valuations.

The outlook then for we China stock investors seems to be a version of a heads we win, tales we don’t lose wager. I don’t like gambling; but these are odds I’m prepared to take.