In Brief

The short-term macro outlook for Emerging Markets (EM), of which China is the largest, is poor; but stock prices have moved a long way to reflect this. This isn’t a compelling argument for fresh engagement. It is however a strong argument for investors already involved to Hold-Fast.

Preamble

The macroeconomic outlook for EMs and China in particular has rarely, if ever in my experience, looked worse. This informs decisions to stay away, as well it might, from markets with so many questions and hardly, if any now, answers about long term prospects.

Neophytes and old hands though should remember some almost-iron-laws of investing. Optimism, and its kissing-cousin hubris, should always provoke caution. Pessimism, on the other hand, is the harbinger of sentimental inflection and should provoke analysis for opportunity.

This note is not aimed at the fearful on the sidelines. There’s no argument that’ll sway that constituency. Instead I want to socialize an argument for continued engagement; for myself and others already committed (to China specifically for the balance of this note) to remind what we’re doing here and to remind ourselves now, above all, to Hold-Fast.

[Hold-Fast – Originally a nautical term probably borrowed from the Dutch “houd vast” (hold tight) referring to the importance of securely gripping a ship’s rigging. Urbandictionary.com]

How Bad are Things Now? In General

It’d be hard to imagine a scenario worse for emerging markets than investors are presented with presently. In no particular order the main issues, which require no elaboration, are as follows:

i) A strong U.S. dollar and therefore downward pressure on EM currencies

ii) Rising U.S. interest rates offering a more attractive home for global cash

iii) Signs of resurgent U.S. inflation acting as an accelerator for the above

iv) Trade wars, everywhere

v) Persistent strength of the U.S. stock market undermining all argument for alternatives

How Bad are Things Now? For China

Again in no particular order and with equally no need for elaboration China’s main issues are:

i) An economy that’s seen peak-growth

ii) A trade war in the process of becoming a permanent feature

iii) Serious questions about the legitimacy of the current leadership

iv) Shifting emphasis in domestic policy towards greater government participation in the economy

v) Stock market weakness, especially pronounced in areas representing the vanguard of a new economic model i.e. tech, internet, Fintech, education, biotech, new energy and et cetera.

But Who Doesn’t Know?

I’ll be honest. I didn’t see a lot of this coming. I thought in the beginning of the year the outlook for the global economy looked pretty good, the U.S. in particular, and progress there would be reflected in stock prices in other markets. Only partly right as its turned out.

I may have been incorrectly optimistic about China stock prices a few months ago; but Ms. Market never bought in.

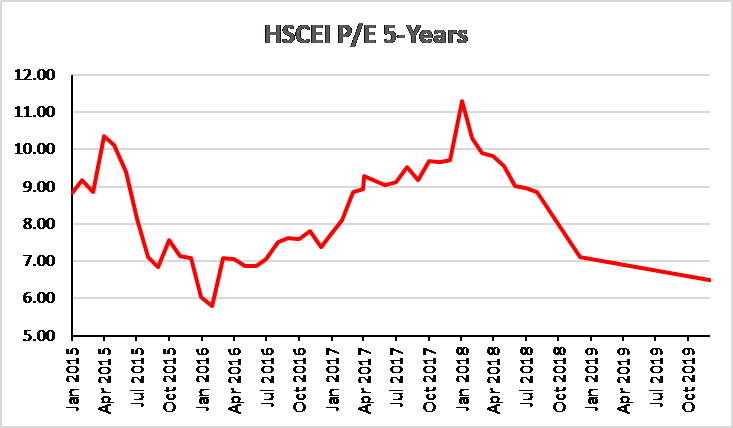

You can see here optimism peaked in January this year (about the same time as my own, d’oh!); but since then there’s been a steady unwind of feel-good. The forward P/E for December 2019 is 6.5x and very close to the low, established in a very panicky January 2016, of 5.8x.

You can see here optimism peaked in January this year (about the same time as my own, d’oh!); but since then there’s been a steady unwind of feel-good. The forward P/E for December 2019 is 6.5x and very close to the low, established in a very panicky January 2016, of 5.8x.

The Time To Panic is When?

When a market, or stocks within in it, present the possibility of permanent capital loss exits should be checked irrespective of whatever price moves have already taken place. Enron, for example, for as long a bid was posted was a sell all the way down. Japan, despite the odd respite, was a sell for the 20-years following its peak in 1989.

Malfeasance, technological change or very expensive assets in correction are all falling knives to be avoided; but China stocks are (mostly) none of the above.

To return to the seafaring theme in the title of this note, if the macro environment is the sea then stocks are vessels on that sea and a bottom-up analysis is an inspection of seaworthiness. We don’t want to find ourselves in leaky vessels and can, via careful analysis, usually spare ourselves that fate.

Sturdy Vessels

My analysis of the China stocks that most matter to me i.e. the ones I’m invested in reveal a flotilla of sturdy craft; and I believe China stocks in general to be in, mostly, the same ship-shape.

Corporate profits are growing with the strong possibility this will continue well into 2019. Borrowings are prudent and, as noted in the chart above, valuations are at levels not usually associated with significant downside.

None of my chosen capital-carriers are holed below the waterline and none appear to be being swamped by angry seas. Engines are still pumping, propellers doggedly turning; and this analysis probably extends to the majority of the listed China stock universe

There’s therefore no reason to man lifeboats or recommend anybody begin to abandon ship(s).

Another Almost-Iron-Law

I referred above to ‘.. some almost iron-laws of investing.’ with regards to optimism and pessimism.

There’s another almost-iron-law about valuation which I know all will be familiar with but, for the avoidance of doubt, let me remind; extremes are nearly always followed by reversals.

The chart above highlights how extreme valuation has become only for stocks that comprise the Hang Seng China Enterprises Index (HSCEI) of Hong Kong listed China stocks, but its a reasonable cipher for China stocks in general.

The last time we were forced down to current valuation levels was in January 2016. At that time the HSCEI troughed around 7,500 from where it went on a 2-year recovery to a high in January this year of 13,700, a recovery of just over 80%. History may not repeat itself, but if it only sloppily rhymes there’s clearly more reason to remain involved than bail.

In Conclusion

I understand why faint-hearts will want to continue to stay off troubled waters; and they should. For those of us already committed though there seems little downside in pressing on with the very real possibility of a strong recovery.

This is not a time to obviously pile in; it is though a time history suggests investors should at the very least Hold-Fast!