[I was in Chengdu and Chongqing last week looking at property with Ms. Nicolle Wong of CLSA and her China property team as my guide.]

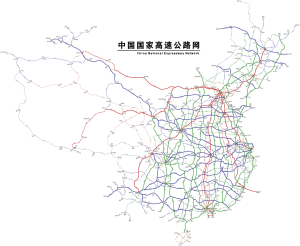

A look at a regular map of China makes you wonder why Chengdu and Chongqing are described as being in the West? To the casual observer they look sort of in the middle. A look at a China highway map though reveals a little highlighted reality; China is, practically speaking, half the size many think it is.

There’s clear evidence prices and demand have stabilized in the Tier-1 cities; but the periphery is where more serious problems are believed to still lie.

I’ll admit to draw firm conclusions about the China market as a whole after ten site visits in two and a half days is to peer through somebody’s letterbox and state confidently what’s cooking at the back of the house. The smell of roast beef though usually indicates beef on the stove.

Just the Facts

This doesn’t need to be a long note. I’ll just list the anecdotes picked up from sales staff and leasing personnel on our jaunt and you can decide for yourself just how good the news is?

Chengdu

- Vanke reported no price changes, until recently, for residential property for three years but noted incomes have risen by 10% pa over the period. Affordability must have increased significantly as a result

- Mortgage rates have been reduced from 1.1x base to 0.95x for first time buyers. Second home buyers have had their rates reduced from 1.2x base to 1.1x base; effective May 1st

- Most demand is now in 120~130 m² units. That’s where the upgraders are usually most active. First timers are usually looking for smaller units, investors bigger

- Prime-prime now goes in Chengdu for c. Rmb14,500/m², fully fitted. A 130 m² unit therefore in the nicest part of town will set you back around Rmb1.9m (U$305k)

- Malls are a mess. Wangfujin’s sales dropped last year for the first time ever. 80% of tenants in the CR Resources mall visited were believed to be merely breaking even. Wanda appear to be doing better

- When next in Chengdu a must visit is the Swire Properties/Sino Ocean Daci Temple shopping complex. It’s like nothing else you’ll have seen anywhere in the world. I have seen the future, and it seems to work

Chongqing

- Price are rising, albeit modestly. Shimao reported a gain from Rmb5, 800/m² last November to Rmb6, 500 m² at one of their suburban projects. Franshion reported rises from Rmb6, 100/m² to Rmb6, 500/m²

- Deposit requirements have been lowered and first time buyers can now stagger deposit payments over as much as 60-months

- Construction costs are c. Rmb3, 000/m² so in places like Chongqing it’s hard to make money. Agile are taking a haircut at their ‘Chairman’ development; but lower prices have been met with a sales pickup

- At a Coli development sales in the first three months were running at between 30~40 units pcm. In April the same development registered 140 sales

- A Sunac development of 70~100 m² units had seen a similar April sales lift and asps there had risen from Rmb8, 000 to Rmb8, 200

In Conclusion

Sales are happening and prices are rising on the edge. Are there problems further off the map? Maybe, but since few of the quoted developers are anything but peripherally involved in these areas I’m inclined to wonder whether it matters to China property-stock investors at all?