China’s stock markets have progressed, in the last three years, not necessarily to investor’s advantage. A look at the performance of broad indices over the period is self explanatory:

Shanghai Stock Exchange Composite Index -25%

Shenzhen Stock Exchange Composite Index -36%

Hang Seng China Enterprises Index -7%

Summary Conclusion

Presently, nothing good can be said about China’s economy, political system or medium term prospects. A country that seemed on a sprint to greatness appears now to face hurdles; and, unlike issues of the past, these fresh obstacles can’t be analyzed with precision.

In this note I’ll make the case for engagement. I’ll conclude the race is still on but it’s nature has changed. The direction of travel is unaltered; but obstacles must be negotiated and investors will have to live with and get over them.

I’ll also set out an argument that looks beyond today’s problems and makes the case for those committed. I hope it may also encourage the wary to take a more measured look into markets which offer now, on a stock by stock basis, outstanding opportunities.

However, before we get there I need to briefly digress on the yesteryear bogeymen.

Old Challenges

Three years ago China pessimists challenged optimists with three main ‘whadabouts’. These issues have been so discussed I won’t spend a lot more time on them. More to the point, the passage of time has revealed them to be, in fact, non-issues. For the record they were:

Whadabout? #1 The property market. ‘I hear there are ghost-towns all over China’. China, here and there, suffered and suffers from over-build. Guilty as charged; but this, where it can be identified, was/is nearly all a problem in areas of piffling economic significance. It’s mostly not debt driven and the authorities have been on the curtailment case for many years.

Whadabout? #2 Infrastructure. ‘I hear there are bridges to nowhere, empty highways and two flight a day airports built to handle two hundred’. Here and there, perhaps, a bit. China’s a big place, go looking for problems you’ll turn some up. Infrastructure I’m familiar with though is of the carefully planned, manifestly beneficial variety; and much is already near maxed out.

Whadabout? #3 Debt. ‘It’s out of control!’ No, it wasn’t and it isn’t. Aggregates rose sharply after the 2008 stimulus. Since then those aggregates have either leveled out or are declining. Credit intensity has risen, yes, and may continue to; but this is normal in a developing economy. Subway line-1 will always produce a bigger benefit than subway line-13 (Beijing now has 21, BTW).

Continue to vex on the above if you wish; but you’ll be driving using the rear view mirror.

New Obstacles

I’ve been, and will continue to be, dismissive of the above issues.

Problems ahead though can’t be easily solved or decisively settled. They’re issues that’ll dominate discussion about China for the coming years and they’re not ‘whadabouts?’ They’re fact-of-life-hurdles that must be gotten over if we’re not to lose ourselves in the fog of short-termism that’s infected China-discussion recently.

In no particular order, they are:

Hurdle #1. The trade war and America’s broader containment agenda. President Xi and his administration have fluffed up (more on this below). The Belt and Road Initiative, The Chinese Dream and the Made in China 2025 policy may have all been designed to galvanize the Chinese citizenry. The socialization of these and other plans have instead stirred up a bi-partisan movement in America that’s decided it’s now mad as hell about China, and not prepared to take it any more. This sentiment isn’t going to go away and, being an amorphous issue, presents a nailing-jello-to-the-ceiling prospect for analysts brave enough to try and speak with authority on it.

Hurdle #2. That Party fluff-up in full. The legitimacy of China’s government relies upon its ability to deliver tangible progress to its citizenry. This it’s done well; but a new generation has grown up with no memory of winter cabbage on street corners. The apex of this system, President Xi, has granted himself lifetime incumbency and the population seemed OK with this when it appeared to be just a way-marker on the journey to renewed greatness. Now, that move and others by the Party in the last couple of years, are starting to look like signs of regressive authoritarianism. No analysis of this situation will lead to reliable conclusions.

Hurdle #3. Economic transition. A lot of ‘stuff’ needs to be sorted out, economically, if the economy is to progress. This sorting out requires visionary and focused leadership. Something economic policy in China has lacked, arguably, since the days of former Premier Zhu Rongji. This isn’t the place to itemize issues in full but chief among them would include SOE reform, overhauling the social security apparatus, property tax implementation, income inequality issues and the tax system, credit market reform and development, financial market deregulation, capital account reform and the promotion of the Rmb as a more accepted method of international payment (and et cetera!).

Hurdle #4. Perception. China’s soft-power account, never troubled with an embarrassing surplus, is in deficit; and the deficit is increasing. From the small-power-pettiness of bouncing an FT journalist from Hong Kong for organizing lunch with a local nutter to playing tag with U.S. warships to finally admitting it locks up (a lot of) people in Xinjiang without trial for, er, being Muslims? China hasn’t been going out of its way recently to win warm-n-cuddly awards. I won’t dwell here on the rights or wrongs of any of this. I note only this situation is unlikely to improve in the medium term.

So, here we are today; a place we’ll be for a long time. If you’re invested in China, or considering becoming so, you’ll have to live with all this. There’ll be times when one or other issue will appear less or more serious; but going away? None of them are/will.

China – Certain Certainties Five Years Hence

Investors often read the present as a guide to the future (yes, really); but to allow us to think beyond today’s noise it’d help to jump forward and imagine what we can say, with absolute certainty, about the distant future. Let’s try the time-warp then and see what might be there not a year or two hence but, say, five years on?

Certainty #1. In 2023, China’s economy will be bigger than today. How much bigger? Let’s look at the five years (2018 is virtually done) to the end of 2023. This year the economy will grow by around 6.5% so let’s fade that in a straight line to 2% for 2024; a harsh assumption you’d agree? Top-line GDP growth for each of the next five years then would be; for 2019 5.75%, 2020 5.0%, 2021 4.25%, 2022 3.5%, 2023 2.75%; and that all sums to? Just over 23%. Fault the math if you care; but there’s no doubt, China’s economy will be much bigger in five years’ time.

Certainty #2. China’s companies will, in aggregate, be bigger. This has to happen. Top-line GDP growth is a cipher for hundreds of thousands of separate increases. Banks, or at least the financial system, will have to increase in scale to cover the increased volume of savings/payments/loans that a larger economy will surely promote. Infrastructure providers will see existing facilities’ capacity grow. Who thinks Beijing Airport will be handling less passengers in 2023 than today? Other incumbents in key industries (power, rail, water, to name just a few) must also be managing larger businesses than today.

Certainty #3. Consumption, of just about everything, will increase. If you’re prepared to accept the first two points you’ll have to concede this one. China in five year’s time will need more lipsticks, broomsticks and chopsticks than today. If it needs more finished goods it’ll need more of the inputs that go into creating these goods. Commodities will therefore be in more demand than today. Technology may alter the pattern of demand but the aggregate trend, no doubt, is up.

Certainty #4. Urbanization will continue. The move from countryside to town won’t stop; because two powerful constituencies wish, very much, for it to continue. Videlicet, the government and those imprisoned today on the land will continue to enthusiastically pursue the process. Cities will therefore get bigger and demand for services in those cities will rise. Medical, social and leisure infrastructure will need to continue to increase. This will require not just more bricks and mortar but the software pool of doctors, barkeeps and masseurs will enlarge.

Certainty #5. China will achieve global technology leadership in certain areas. The ‘smart’ money today is on China showing the world a clean pair of heels in areas like AI and online payments. My guess is it’ll also be teaching the world a thing or two about waste management, smart-grid operation, hybrid and full-electric vehicle technology, life sciences, and new materials five years hence. Me, I’m not smart enough to want to place bets on any of these potential outcomes today; but if no-premium investment vehicles (see more on Rules for Investing in Chinese stocks below) were to present themselves (they will) due-diligence will be worthwhile in time.

So, surprisingly perhaps, we can see a lot of clarity through the present fug of noisy uncertainty; and if we can do that we should be able to talk with confidence, always in the context of value, about some investment themes?

A Brief Reminder About Investing In China Stocks

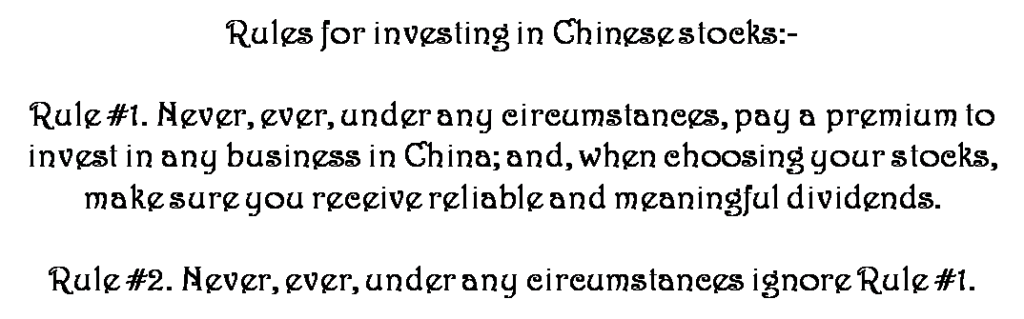

There are only two rules that should never be broken when it comes to buying China stocks.

I’ve framed these here so you can cut them out and post them on your monitor. Re-read these every time you’re thinking about buying a China stock.

Lucky For Us

As I write China stocks are very depressed. A-share markets made a four-year price low recently and stocks listed in Hong Kong, measured on a P/E basis, are in aggregate not far from all-time lows.

Stocks are depressed because the near term outlook, as flagged, is putrid; but will this situation persist in perpetuity? Never say never but I’d say the odds, in the context of trends flagged above, are against it.

For investors prepared to take the over-the-horizon view the risk-reward equation is in their favor; and it’s possible to find any number of stocks that not only fit the Rules above but also offer direct exposure to the mega-trends.

For example:

Financial sector exposed stocks can be bought at huge discounts to their book value today and offer sustainable yields far in excess of money market rates.

There are property stocks on offer at less than half their book values with modest gearing and double digit dividend yields in prospect.

There are companies selling all manner of goods and services to Chinese consumers offered at historically low valuations, also with attractive patience-compensating dividend yields.

There are companies trading in commodities China will only need more of in the half-decade ahead priced substantially below their equity value, many also with respectable dividend yields.

Lucky for all, the above are not hidden gems. Toss a dart at list of China stocks right now and you’ll most likely hit one of these situations.

In Conclusion

China’s prospects appear dim today; and arguments to counter concerns are impossible to make. The nature of the concerns suggests no resolution, quick or otherwise. This will have to be accepted, priced, and gotten over; but China isn’t going away. It’ll be here in five years time and it’ll be stronger, bigger and more advanced than it is today.

For those committed this is worth being reminded of; and for those fearful on the sidelines? They’re reminded the combination now in China’s stock markets of low valuations and ubiquity of opportunity are rarely present, in any market, for long.