Preamble

I wrote earlier in the year I didn’t believe China stocks had entered a bull-market; and that’s still my view.

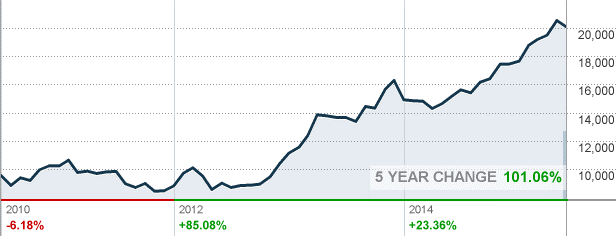

To be clear what I meant then, and now, is China stocks have yet to capture the interest of a sufficiently broad group of investors to allow for the kind of self-sustaining momentum that characterizes a ‘real’ bull-market. Look northeast (no, further up!) to see that process in more proper full cry.

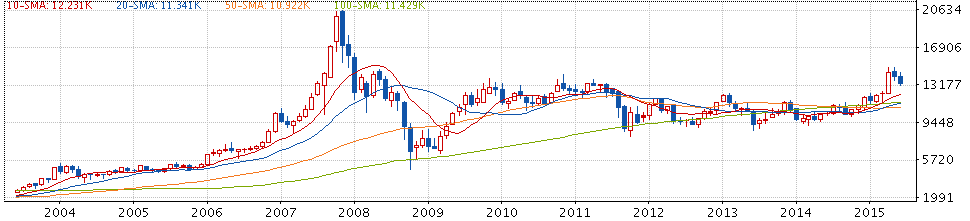

No, sorry friends, China stocks have gone up a bit but this longer term chart of the Hang Seng China Enterprises Index (HSCEI) below reminds us, when we go back to 2006~2008, what the real McCoy looks like.

So, to the title of this note; is that it?

Well, is it?

I don’t know. It might be; but if it were it’d be one of the shortest revaluation periods I’ve seen in any market over the course of my career. When markets move from a long period of either being out of favor or more often just being preferred-away-from the reversal is usually a multi-year process.

Here’s that market to the northeast I was referring to earlier. I mean of course Japan. We can argue when the low was but there’s no arguing the upward revaluation has been in progress for well over two years now.

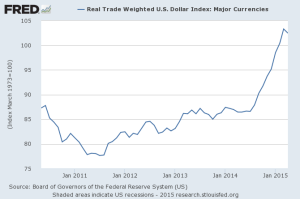

Here’s another nice example of trend persistence and it’s the US dollar in trade weighted terms over the last five years.

I don’t need to labor the point. Markets usually go in one direction for long periods of time, until they don’t. Then they go in the other direction, also usually for long periods of time [Incidentally, a day trader would note the same but using a different scale. I’ll leave the fractal nature of chart patterns for another day].

If This Isn’t a Bull Market?

So far, viewed through my value investor lens, moves to date have only been a correction to a period of unjustified valuation compression. With the exception of 2009 the earnings of China stocks (HSCEI members) have risen steadily since the Global Financial Crisis. If you look back at the HSCEI chart though you’ll see for many years stock prices failed to take cognizance of this reality. That stock prices aren’t significantly higher then than current levels is the mystery; not why they’ve popped in the last few months.

Sure, some stock prices have risen significantly but this is to ignore what’s happened to valuations. From a low point last year of around 6x the estimated (by a Bloomberg consensus not me) 2016 P/E has risen to now around 8x. That’s a 33% move and explains a few hankies to bleeding noses because that is a big change and a relatively large shift in valuations; but I deal in absolutes not relatives.

To be concerned about a market that’s had an upward move of 33% is to consider only half the picture. The other half is to analyze where that places valuations in an historic and global peer-comparison perspective and, on that basis, China stocks have barely begun a re-rating warm up.

How Might We Recognize a Bull Market?

There’s no hard and fast definition but to channel the late Supreme Court justice Potter Stewart for a moment; we’ll know it when we see it. My contention that we’re not there yet was, and is, based fundamentally on valuation. For me, a bull market has arrived when valuations progress above long run averages and, as is clear presently, we’re currently a long way below those; at least in Hong Kong.

Besides, whether we’re in a bull market or not isn’t much of an issue for value hounds. Current valuations suggest the prudent position today is to be fully invested; but it might be a good idea to at least look at the map for a sense of how a journey to over valuation might progress?

25% Higher to Base Camp

Last time I checked the consensus forecast earnings integer for 2016 for the HSCEI was 1,700. The Base Camp from which the ascent to longer term valuation averages and then perhaps on to ‘expensive’ is (for me at least) metaphorically pitched somewhere around 10x 2016 forecast earnings.

If we were to get to that point I’d begin to consider perhaps something more fundamental than a bounce out of crazy low valuation territory was underway; and that’s around 25% higher than where we are today (10*1,700 = 17,000, HSCEI last c.13,300).

In Conclusion

Maybe this is it. Maybe we’ve done as much as we were supposed to by coming off unsustainable and unjustifiable valuation lows. Maybe though this is the beginning of a bigger move. A move that in time takes us to levels consistent with both longer run averages and global peers?

Predicting markets, as I’ve observed before, is a fools game; but one thing’s for sure. A market on 8x earnings has considerably more up than downside; and that’s a good enough reason, for me at least, to stay mast-lashed no matter how choppy the present seas.