China’s stock markets have been noisy places of late. Take a step back though and nothing that remarkable, in the context of what markets are regularly observed to do elsewhere, has taken place. I believe schadenfreude on the part of the doubters, the majority of international investors, accounts for much of the amplification of what in fact is nothing more than a healthy correction.

Keep Your Arms and Legs Inside The Ride at All Times

From Forbes yesterday “Mainland China’s stock market continued to gyrate wildly last week after crashing by more than a third since mid-June.” ‘Gyrating’, oooh. ‘Wildly’, well nobody likes that; and crashing? Bet you’re glad you weren’t caught up in that train wreck?

Now let’s pull back a bit. Here’s Shanghai, for the last ten years.

2007~2008, when the index fell from c. 6k to c. 2k, or by 2/3, that was a crash. We’ve just done c. 5k to c. 3.5k, or around 1/3, which is not nothing; but crash? Oh pluheeeze!

China is an emerging market. Buy side analysts are young, many domestic institutional investors are still learning their craft (although an aside here on CFA exam takers is useful, this June in China 29,689 candidates took one part of the test, only the US had more) and yes, Mr. and Mrs. Wang make up a much bigger percentage of trade than other more ‘developed’ markets; but you know all this.

Only the very new or the very naive should expect matronly progress in this space. There are three speeds in the China stock markets and you can see them all above; stop, full ahead and full astern. A manager who expresses surprise about this is either on the wrong side of a trade or very fresh off the boat.

Understanding the Three Star System

Astronomers refer to star clusters as being either ‘open’, where the stars have little interaction with one another, or ‘globular’, where they interact very closely, and it helps our understanding to acknowledge the ‘China’ stock market is in fact composed of three distinct stars.

The youngest and smallest is Shenzhen’s ChiNext with the other two being the Shanghai and Hong Kong stock markets. From the distance many scribblers operate though this system often appears as a single point of light. For example, the headline of the Forbes article referenced above is ‘Watch These Charts To Better Understand China’s Stock Market Crash’ (in fairness they elaborate in the text, but you get my point).

One thing new in the recent volatility is the degree of interaction between the various China stock markets. In the past often large moves in one went unregarded in the other. Perhaps it’s the Stock Connect? Perhaps it’s a looser capital account? Whatever has caused it this system has shifted from open to globular. What we don’t yet fully understand is the nature of the interaction; but it seems clear Hong Kong has been pulled closer to Shanghai’s domestically orientated gravity.

A Tale of Three Cities

Having identified three separate markets that describe the ‘China stock market’ it will help if we look at what just happened in each.

Shenzhen

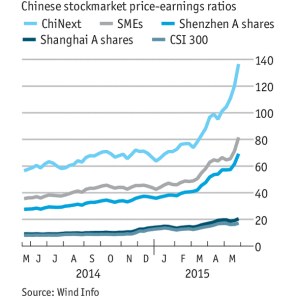

ChiNext has been a world of it’s own for some time. Go back just over a year and you see even then it was on around 60x earnings. As I don’t know any of the now 464 companies listed on that exchange it’s hard for me to say with authority whether that was a fair price? It’s a little easier to guess though that by June this year, when the multiple was approaching 140x earnings, that perhaps things were ripe for a pull back?

In stock price terms the index climbed from around 1,600 in January this year to nearly 4,000 in June or by around 150%. Since then? A slap for sure, at one point over 40% off, but now around 2,500 a still handy 50+% gain for the year.

Crash? A high flying market composed of mainly concept stocks suffers a 35% retracement. Sounds more like a dog-bites-man story to me.

Shanghai

Go back to the chart at the top of this note and you’ll see from 2010 that market did nothing for five years; apart from go down a bit. Funny that; because earnings over that period were, in aggregate, rising while the economy was steaming ahead. Only the timing of an upward stock price adjustment to reflect underlying earnings reality then should have been the moot issue?

A bubble? Look again at the P/E chart above. Warm? Yes, and at its peak, depending on which Cassandra you were tuned into, perhaps a P/E in the high twenties? Sure, my value pennies were never likely to be hurried in but we’ve seen valuations like this persist and grow elsewhere in the world; and often over extended periods. Bitcoin was a bubble that’s now burst; have a look at that price chart if you want to see what the genuine article looks like.

The Shanghai stock market may have had an attack of nerves but again, crash? Hardly.

Hong Kong

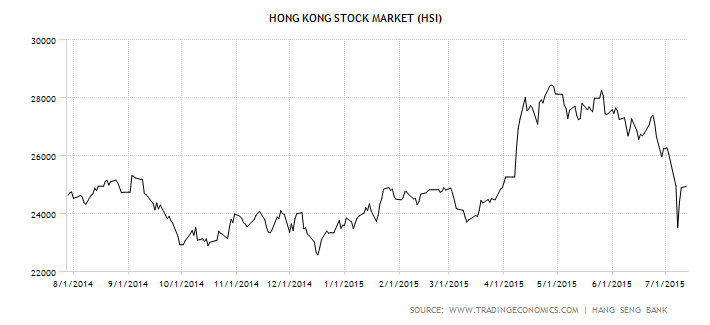

Perhaps it was too caught up with yellow umbrellas and blue ribbons in H214 but for whatever reason it failed to notice it was falling into Shanghai’s gravitational field until about March this year; and then, as you can see from this chart, it had a bull market whose life could be counted in days. [I’m using the Hang Seng Index (HSI) here; normally I like to use the Hang Seng China Enterprises Index (HSCEI) but it makes the point better about how late Hong Kong was to the party]

[I’m using the Hang Seng Index (HSI) here; normally I like to use the Hang Seng China Enterprises Index (HSCEI) but it makes the point better about how late Hong Kong was to the party]

From that sudden rush of blood to the head in March~April you can see the move has been handed back almost entirely so of all China’s markets you could argue Hong Kong has suffered most and overall participated least.

Disappointing reversal? Yes. Crash? No.

…and Now?

As far as markets are concerned; who knows? Value tells me always what to do and the message from my opportunity set of Hong Kong listed China enterprises is to stay fully involved; and so I will.

As far as general points to be made about the recent fun and games are concerned, for me, three things stand out:

1) Government meddling. With it’s efforts to stabilize the domestic China markets the government have given punters what looks like a put. This is worrisome. Either the put is real and more effort and a lot more money may be required next time around or its not and this realization will trigger more selling in due course. My guess is what we have in fact is a ‘soft’ put. Clearly the government were rattled by the speed and magnitude of the descent and, with better access to margin data than me, may have acted to prevent a circular contagion developing. Whatever, the Austrian in me can see little good news in their taking such a microscopically close interest in the movement of stock prices.

2) Margin financing. If there was an 800lb gorilla in the room that nobody wanted to point out it was, and still is, this. At the peak the size of lending was around 9.5% of market value. It’s come down a bit now but is still around 8%. The US by comparison has a figure presently in low single digits. Nearly all financial dislocations have, at their core, leverage and the only real mystery to me surrounding recent events is how this had been allowed to get so out of hand? I suspect though from here it goes down and by quite a lot. That may take some of the froth out of the domestic markets and in the process retard the new issue queue but for the long term health of the market a deemphasis on this would be most welcome.

3) Image deterioration. If, as Ms. Swift assures us, haters are indeed going to hate, hate, hate then China critics have been handed an own goal by the hitherto dynamic duo of Xi and Li. The chattering classes have even insinuated that Premier Li’s fumbling of events led to President Xi unceremoniously taking the reins. Politics, not my thing. Whatever just happened China Inc. looks foolish. Yes, President Obama had to care about some stock prices a while ago, notably General Motors, AIA and etcetera; but that was when the world seemed on a precipice not just because some Moms and Pops in Biloxi were getting margin calls. Many international investors, of the view that China is just too hard and too complex, will view recent events as a vindication of that view; and that’s not good news for valuations.

Markets eh?

As I write I see nothing unusual, unique or final about recent moves in China’s stock markets. They’re not even unprecedented. They came at a time though when the authorities had (goodness only knows why?!) greased the way and been guilty of taking too close an interest on the way up and so had to get involved to try and end the rout.

Lost in the commentary was the fact ChiNext was and remains a bubble, Shanghai had too much underlying leverage and Hong Kong barely participated. None of these facts have anything much to do with government intervention. They can all be explained by reference to moves we’ve seen many times and in many places many, many times before.

In Conclusion

Markets are only scary places if you haven’t done your homework. If you have, and you own good companies run by responsible stewards, the best thing to do at times like we’ve been through is nearly always nothing. The China stock markets are not Japan c. 1989 or NASDAQ c. 1999. They were (and ChiNext remains) a bit frothy and due a correction; which we’ve now had.

The valuations of China stocks have certainly had a reassessment in the last few weeks; but has the value of the underlying enterprises changed that much over the same period? I doubt it and if for you, as it is for me, value is your North Star then there’s not much to be done. Apart from perhaps revisiting a few old friends whose stock prices may have been particularly roughly handled over the course of all this.