Preamble

Nobody knows what determines the overall level of stock markets in the short term; and the short term can sometimes end up being several years. We know though that in the long term underlying earnings trends of the companies that compose an index must, ultimately, be reflected.

It should come as no surprise then that China’s stock indexes have performed well so far this year; earnings have been in an uptrend since 2009. If there’s a mystery at all it’s why stock prices didn’t take notice of this rising earnings trend sooner?

What it would help to know now though is what’s triggered this reassessment? If we can, at least in part, answer that question it may shed light on the bigger and more important one i.e. will the factors bearing upward presently on China’s stock prices continue in future?

Summary Conclusion

China stocks are being re-rated due to an upsurge of that most intangible of all stock market value governors, confidence. It’s not a view on interest rates, the future course of the economy or the likelihood of any step change up in corporate earnings that’s causing previously sidelined investors to now commit.

It’s a broad restoration of confidence, plain and simple, that’s driving buyers out of shells they’ve been in for, quite literally, years; and it seems likely that factors that have caused this mindset shift are going to persist leading to a virtuous circle of higher stock prices reinforcing confidence and so on; until it stops.

Given how long investors have shunned China stocks it seems likely that quite some time will pass before the adjustment is complete. What’s ‘quite some time’? Surely not weeks, probably not months; perhaps years?

Who Started the Party?

This is another important question. If we can answer this one we can drill deeper into the issue of confidence restoration. On this point there can’t be much dissent. The changed minds that are primarily responsible for the China stock markets’ rise to date reside within China. This process was kicked off in A-share land and must therefore be driven by retail investors as that’s who control the majority of turnover in both Shanghai and Shenzhen.

From known knowns we must now venture into known unknown territory and I’ll admit what follows is largely supposition on my part. I can’t poll the ten, twenty or thirty million (probably more?) investors in China whose collective mood swing is now driving markets as to what’s precipitated their shift; but I can hazard a few guesses, and here are my best…

2008 Stimulus Related Excesses Put Finally to Rest

With the benefit of 20-20 hindsight we now know the Chinese government panicked in 2008 and over-stimulated the economy. The good thing is they realized this soon afterwards and as early as 2010 were anxiously trying to correct some of the more worrisome collateral issues like home price inflation and a credit blowout. This process though of on-again off-again stimulus sent mixed messages and led to a negative feedback loop persuading some that forward price momentum, be it particularly of the commodity or property variety, would be met with more ‘cooling’ measures.

That’s all in the past. The government has resumed interfering in the property market; but now clearly to encourage price stability (in China that means prices can rise but by no more than local GDP gains, they must not however fall). Credit growth is moderating (although the absolute levels here and there are still worrying) and the level of retail price inflation is a Goldilocks outcome given how strong the overall economy remains.

In summary, benefits of the 2008 package, the new roads, high speed rail lines and swanky airports will endure and contribute for many years to come to the rising prosperity of the citizenry. The unwelcome side effects of the process have, at last, been put to rest.

The New Deal

Nobody has said as much explicitly but a debate about what a new economic model for China might look like appears to have been concluded. No longer will the Party be using top line economic growth to justify its legitimacy. If it’s to maintain the Mandate of Heaven it must now attend to the fabric of citizens lives and not just require them to shut-up-and-make-money.

When the majority in China were have-nots environmental degradation, land expropriations and corrupt officials were tolerated as the unpleasant but unavoidable side effects of the economic transformation begun by white-cat, black-cat operator the late Mr. Deng Xiaoping; but times change. People are now (as they are in many other parts of the developed world) prepared to pay a little more for clean water/skies/governments; and if this means a growth slow-down? Fine.

I wouldn’t be at all surprised to see growth down to around 5%, still a tremendous achievement, by 2017. That this has to happen, and why, I believe has at last become received consensus. So the old Growth At Any Price model is replaced by the Growth At A Responsible Price one and removal of this uncertainty in the policy debate must be very welcome?

The Remarkable Mr. Xi Jinping

Mr. Xi Jinping’ Presidency is just entering its second year and his personal popularity (although I’ve seen no polls to confirm this) must be at an all time high? His anti-extravagance/anti-corruption campaigns have been a huge success in terms of the sincerity with which they’ve been progressed and the effect they’ve had on restoring respect for the Party. Whisper it but he’s probably the most admired leader China has had in living memory; and this matters.

The tiger and fly extirpation campaign is essential if an established mold is to be broken. It would be impossible to progress reform if an old guard of recalcitrant rentier cadres remained at their posts and the signs are that initial success at the top of the government is now being achieved at provincial and local levels. [As an aside 2013 saw a record 1.5m candidates for the Civil Service entrance exam but this year the number dropped to 1.4m; clearly the message about nest-feathering-prospects is getting across]

Confidence in government is essential if individuals are to feel confident about their lives, their prospects and their collective futures and there was a feeling that the previous administration was mired in an in-fighting do-nothing rut. Mr. Xi’s administration, although arguably still finding its feet, shines brightly by comparison.

In Conclusion

I may be a little off in the detail here but the broad argument about ‘confidence’ is, I think, correct. It answers the question about why stock prices trod water for so long against the background of a multi-year profitability increase and gives us a clue to how the China markets may progress from here?

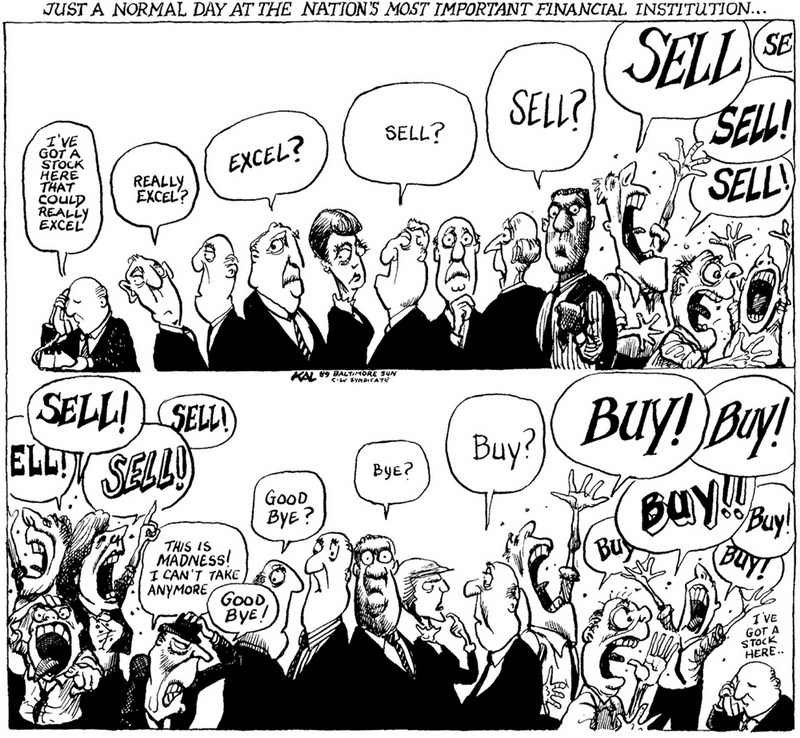

For the last word on the short-term workings of stock markets though the cartoon below, from a 1989 edition of the Economist magazine, has never been bettered.