In September 2014 I wrote about China heading toward a hard-landing Hard-Landing; and that sort of happened. I wrote again, in September 2015, about how we seemed to be then navigating a bumpy-bottom Bumpy-Bottom. I’m wondering now, is it time to start being more constructive?

Summary Conclusion

To be clear, when I talk about China I mean specifically from the perspective of stock investors. At the end of this note I answer the headline question with a no. Some things are moving in the right direction, valuations are very low and corporate earnings are broadly stable; but none of this, just yet, will likely rouse the animal-spirits of those inclined to long-term China suspicion.

It may be premature then to be out and out bullish about China stocks; but, as I’ll argue at more length in this note, if some present trends persist, it’s time to pay closer attention in anticipation of being bullish in future.

What Are We Talking About; Precisely?

We need to disambiguate three issues.

My primary concern is stock prices; and these can be decomposed into three parts. First, how the broad economy is being perceived i.e. the macro environment. Second, how corporate earnings are being viewed and third valuation, or how much others will pay for the first two factors.

Let’s address these components. Starting with..

The China Macro Environment

Discussions on many aspects of China quickly become religious. If you believe Jesus Christ is your Lord and Savior, and I don’t, an exchange on the subject will very quickly lead to an impasse. If you believe China is a Potemkin Village run by scoundrels whose repressive system must inevitably collapse under the weight of its own contradictions I have no response; other than ‘it isn’t’.

Following the ‘it isn’t’ tack what can we say today, with some certainty, about the broad economy?

Taking the long view first. We all know the glory days of super high growth are behind us; but what’s ahead? We don’t know so let’s try some pessimism. Let’s assume China’s economy continues to slow by 1% per annum from this year and it stabilizes at 2% growth. Where would that take us in the next ten years? Let’s assume we get 6.5% for this year, 5.5% for next and so on. Using those assumptions we get to an economy, at the end of 2025, just under 40% larger than today. If the U.S. were to manage growth of 2% per annum over the same period its economy would grow by 22%.

According to the IMF, at the end of 2015 on a Purchasing Power Parity (PPP) basis, this is how the world’s largest economic blocs ranked; #1 China with U$19.4trn, #2 The European Union with U$19.2trn and #3 the U.S. with U$17.9trn. Applying the assumptions above China, by 2025, becomes a U$27trn economy and the U.S. grows to U$22trn. Today’s difference of around 8% between the two grows to a difference of 23%; a position from which the U.S. will be unable to catch up.

[Ditching PPP and going with nominal GDP would keep the U.S. ahead though. Today it’s U.S. U$17.9trn vs. China at U$11trn. It would become U.S. U$22trn vs. China U$15trn using growth numbers from our example]

So we can say today, about medium term prospects and making what I think are harsh future growth assumptions, that not only will China consolidate its position as the world’s most important economy, it’ll pull significantly farther ahead. A good argument for being involved in itself I feel but, I’ll admit, it isn’t a new one.

Shorter term? If bumping along the bottom was a fair assessment last September how should we describe the economy based on recent data?

The property market is in rude good health judging by transaction, volume, starts and inventory data. The phenomena appears to be nationwide and is taking place, for a change, with the authorities’ blessings.

Most recent GDP data suggest that forecasters have been too pessimistic on prospects for this year. Where I’ve seen analysts changing numbers recently they’ve been nudging them higher.

Consumption data, whether its broad retail sales or narrower gauges like auto sales or power consumption they’re all pointing in the same direction and surprises (power most recently) have been to the upside.

Trade. It would be premature to conclude the recent jump in exports is a harbinger of a sustained improvement. We note however U.S. ports’ record Q1 data for box shipments. Coincidence? We’ll see.

Industry. The most recent Purchasing Manager’s Index release was a surprise with the official PMI clearing 50 for the first time in eight months. Industrial production growth is also at a nine-month high.

We can’t take any of these numbers and categorically state the Chinese economy is lifting off; but it’d be hard to argue that trends, where visible, are not improving.

We can discuss the speed, breadth and magnitude but I think the time has now come to begin referring to China’s economy as ‘recovering’.

Corporate Earnings

A much shorter and easier assessment here. Just fine.

We’ve recently gone through a reporting cycle and the overwhelming majority of companies we care about reported higher earnings for 2015. Most were also guardedly optimistic that 2016 progress was likely to be along the same lines and forecast data taken from Bloomberg for 2017 indicate a potential earnings rise of just under 9% for that year (for the components of the Hang Seng China Enterprises Index, HSCEI).

Yes, here and there problems, especially in the energy and raw materials complex but overall the picture is one of stability for many and growth at a steady, if unexciting, pace for many more.

Valuations

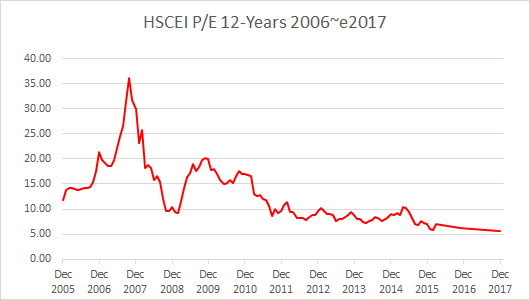

Record lows.

There are some problems with this analysis. To just look at the index in aggregate is to skim over the issue of how skewed it is in terms of banks forming a very large component. I suspect though that if we were to completely remove them the level would rise but the picture, with that 2017 point being the lowest on the chart, would remain intact. [Perhaps you know somebody with more resources than me who can do the work for you?]

Putting It All Together

Now to reassemble the components discussed.

China stocks today are reflecting an economy where a jury remains out on the strength but not presence of signs of economic recovery, where forward earnings are perceived as being likely higher than today with valuations at demonstrably record low levels. That all doesn’t seem too vexatious to me?

Dare We Bullish?

No; at least not yet. There remains a strong ambient China pessimism among investors that’ll be hard to dispel and we’ll need a lot more data to convince them this is a party they need to be at. The irony is that one of the major data points many investors reference, whether consciously or not, is the level of stock prices.

As an aside, I was surprised earlier this year by how widely circulated a sloppily written new attack on China became (and felt compelled to write a refutation Bass Letter); but it not only sat well with the then global zeitgeist but it also played to many folks’ hard-wired anti-China prejudice about an economy which is nothing more than an over-leveraged shell-game which ends, inevitably, in catastrophic collapse. [Again, it isn’t.]

What I was reminded of by this experience was how deeply rooted negative views on China are. More so perhaps than for other markets the willingness of now indifferent investors to reengage will require more robust arguments than can be mustered today.

In Conclusion

‘Bullish’ in the context of this note is the feeling, supported by data, that stocks could not only rise from current levels but that such a move would be the beginning of a trend that could persist for a meaningful amount of time, ideally several years.

As I write we are some way from this point. Valuation compels me to be fully invested, which I am; but I understand that value alone is not what prompts the majority of the world’s institutional and retail investors to action.

For a market to achieve sustained momentum there must be a good story; and today the China market lacks this. Is one in the process of developing? We can’t say at this point; but the economy is improving, earnings are increasing and valuations represent no impediment to liquidity flow. This, however, is all just kindling, what’s needed now, in some form, is a spark.

We therefore dare not be bullish about China stocks today; but it might be wise to pay closer attention to developments from here in anticipation of daring to be bullish in due course.

Sparks have the regularly observed habit of often appearing from nowhere.