Almost exactly a year ago I wrote about the hard landing then taking place in China [China Hard Landing. September 2014]. It’s been therefore interesting to see variations of this same analysis presented in recent months as new or unexpected when, in fact, its neither.

If we knew a year ago that China was hard landing what can we say today if we revisit the same series that were then so unequivocally pointing downwards?

Summary Conclusion

To predict any economy is foolish. What we can do though is, via a look at present trends, ascribe a probability to their persistence. In China’s case we can see today a number of series either stabilizing or improving and it doesn’t seem too much of a reach to imagine these trends continuing. There may be further wobbles; but the picture overall appears more encouraging than a year ago.

Value investors find themselves today in the same position they were in then i.e. presented with stocks whose valuations incorporate little or no good news offering a free option on potential future improvement. As firm a reason as I can find for full commitment.

Let’s then take a look again at the variables (and some new ones) that gave us cause for pause last September and see what we see today.

The Property Market

A year ago this was manifestly weak; both in terms of sales volume and price trends. Today we seem to find ourselves in a Goldilocks scenario. Developers have stayed away from increasing land banks and are taking advantage of a now nationwide pickup in demand to reduce inventories. Prices are rising again; but in most areas only modestly. Sure, problems are persistent in smaller cities and there’s an argument that a drop in housing starts and investment in the sector bodes ill down the track; but, all in all, I’d say the situation could fairly be described as a recovery.

M2 and Lending Data

From the PBOC in August ‘China’s broad measure of money supply that covers cash in circulation and all deposits, M2, has [Grown] faster in the second quarter, and is expected to grow even faster in the future’. Last year at this time it was flat-lining. Part, but by no means all, of this improvement may have been due to margin finance which has now been curtailed. Lending data is more mixed and the July numbers were clearly distorted by the stock market intervention. The latest from August though suggests stabilization with total social financing picking up to Rmb1.08trn or 13% over August last year.

PMI, Power, Imports

Let’s take these one at a time. First, the manufacturing Purchasing Managers Index (PMI). This has been and remains unequivocally weak. The August reading for the Caixin Manufacturing PMI was 47.3, down from 47.8 in July. Power consumption though appears to be ticking up. August consumption was the highest this year rising 2.5% YoY and the forecasts are for a full year rise of between 2~3%. Imports. August data was weak continuing the year’s trend; imports fell 13.8% YoY last month.

Other Indicators

Auto sales. Dismal for the year but up 0.6% YoY in August. Industrial output. Up 6.1% YoY in August. Fixed asset investment. Up 10.9% Jan-Aug versus the same period last year. Retail sales. Up 10.8% YoY in August, the highest monthly gain this year. Machinery on-duty ratios. Excavators up to 70%~75% in early September, truck cranes c. 80% versus August ratios of 55%~65% and 60% respectively.

Nothing in the data above is conclusive; but, taken in aggregate I believe, the readings support a bottoming hypothesis. What they clearly don’t point to is a further significant deterioration.

Anecdote I

Last year I noted my experience from an investor forum I’d just attended where companies seemed bewildered by the operating environment they were then finding themselves in. This year, judging by remarks contained in half year reports, the mood seems to have shifted from frustration to resolve. The phrase ‘New Normal’ in it’s China context appeared first in remarks made by President Xi in Henan in May last year. However, at this time last year few were really getting it. Since then it’s become a profound meme that percolates through the entire Chinese economic complex. Companies now in aggregate seem to be taking back the initiative. A year ago they were having the economy happen to them, now they seem to be adapting to changed fortunes.

Anecdote II

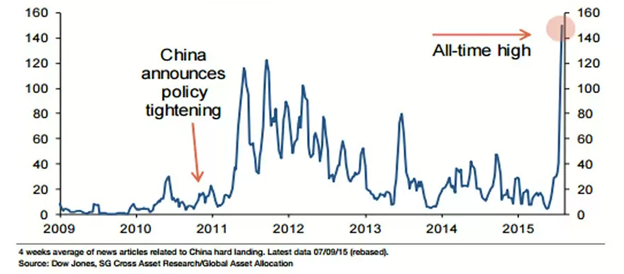

In markets, as a rule, when everybody knows something it should cease to be important. Or, when everyone is anticipating an event, there can be little juice left in a trade that’s set up based on a consensus view it’ll occur.

I found this graphic recently and it tracks the number of references in news articles to a China hard landing. When I was writing about this last year the reading was around 20. As of September 7th it had risen six fold to an all-time high. A door well and truly shut after the horse has bolted perhaps?

Why All This May Not Matter

I’ve described the Chinese government in the past as being the Rodney Dangerfield of emerging market planners; no matter what they do it seems, they don’t get no respect. In addition to performing the greatest economic transformation in the history of the world, raising over 700m souls out of poverty in the last thirty years, they’ve recently achieved another near miracle. The Chinese economy has now shifted decisively away from a manufacturing to a service centric model. On this at least the data is incontrovertible.

The old vexation with output growth as the necessary condition to support full employment therefore may be redundant. The service sector is now a bigger component of China’s GDP than the manufacturing sector and the latest growth numbers from there are impressive. National data for employment shows a jobless rate of around 4% or close to the 3% (allowing for frictional unemployment) below which it’s hard for any economy to go. So this transformation is being managed without massive labor market dislocation.

As China matures so must it’s long term rate of growth and investors will have to think in terms of between 4% to 6% as a respectable outcome for top line GDP growth for the next five years. Looking at present employment trends though I wonder if the aggregate level of top line economic growth really matters at all from a stock pickers perspective?

Why All This Certainly Doesn’t Matter For Value Investors

In my analysis a year ago I made the point that risks then seemed to be over-priced in; the same is true today. With pessimism so deeply embedded (again) in valuations there’s little downside even if apocalyptic predictions of a full-blown China stall materialize.

A look at results from Chinese companies recently also shows that while growing profits rapidly is a tough gig for many it is possible to grow profits in the current climate. Also bear in mind value growth accrues over the medium to long term for companies that merely hold profits steady; which many are also currently managing.

In Conclusion

Valuations, in aggregate, of Hong Kong listed China stocks suggest a further and serious deterioration of both their and China Inc.’s prospects. Data presently available however suggests a-bumping-along-the-bottom outlook.

The difference between these overly pessimistic valuations and the more prosaic reality of a dull, but not disastrous, period for the economy ahead is all the reason I believe one needs to remain fully committed.