In the last couple of months the Chinese stock markets reminded me of an old joke.

A sinner is sent to Hell and told to choose eternity behind one of three doors. She asks to have a look first before deciding. Sure says the Devil and shows her the first option. In the first room souls are suspended upside down in boiling battery acid. Hmm. Can I see the other options she asks? No problem says the Devil and leads her into the second room. Here other sinners are suspended upside down in boiling tar. Hmm. The final option? The Devil leads her into a third room where a vat of raw sewage is boiling away; but this time the sinners are all upright and drinking coffee. OK, she figures, the coffee might compensate some for the eternity in the boiling ordure; and she makes her choice. Not long after she’s installed, coffee in hand, the Devil reappears and says “Alright everybody, the coffee break’s over; back on your heads!” Boom-boom.

Investors in China seemed to be catching a break in the first half; but in the last two months have been cruelly, like our friend above, stood back on their heads [To be clear, the analogy stops there. China’s stock markets are not a metaphor for boiling poo, or vice versa. Well, perhaps for some]. Just when we thought we might have some right to cheer our world has been returned to the low-valuation norm that’s persisted for several years.

So?

If one was happily invested before China stocks began their sun-dappled-clearing gambol one should be OK with their return to the darker parts of the valuation forest. Only if you committed in size somewhere near the top (some will have of course), should you have much cause to regret the market’s repricing.

For the value investor, who if only from dividends, expects to invest more in the future an expensive market can only ever be a temporary friend. Their true friend is a market where well run companies with reliable dividends are priced at levels that don’t fully reflect their fundamental long term value; and that about describes where China stocks find themselves today, again.

Government Intervention; Desperate or Decisive?

If you’re nervous about China stocks now a lot of that might have to do with whether you think the Chinese government’s intervention in July was desperate or decisive; the only difference between the two actions being their aftermath. In 1998 the Hong Kong government intervened in their stock market in what can now categorically be described as a decisive manner; because it worked. Will the Chinese government’s stock market interference prove decisive? To channel the late Premier Zhou Enlai; it’s probably too early to say.

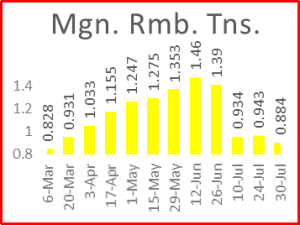

What we can say though, and you can see it clearly in this chart, is they appear to have tamed margin finance; and there at least the move is likely to prove decisive. Every school boy knows at the heart of financial calamities there’s usually an inappropriate level of debt somewhere. Why this manifest distortion was allowed to run away as completely as it did we may never know. Perhaps in the great game of Whack-a-Mole that is Chinese economic management this was just a varmint that authorities were slow to bring the hammer down on? Whatever, I doubt it’s one that’s going to pop its head back out soon; and for this the authorities must be handed some credit.

Elsewhere?

SNAFU is probably the best description of the broader picture; which, in China’s case represents the normal steady state.

The economy? Bumbling along. Mumbles from some official quarters are now talking about an H2 pickup but I wouldn’t bet on it. Full year growth will probably be less than 7%; but it won’t be less than 6%. Which is fine; we’re working with a high base now so these are still very big numbers

Tigers, flies and all that? Ongoing. The government are trying to shift a mind-set that grew up over a 30+ year period. Many in the administration, especially the older generation probably can’t be re-tooled but until opposition has been crushed this will take a toll on growth due to lack-of-decision-taking inertia

Commodity prices? Must be a huge plus for China Inc. but the effect is probably muffled by the lack of progress in many areas that the anti corruption/extravagance campaign is having. We have some anecdotal evidence of margin boost for some companies; but it’s not a bonanza.

Corporate profitability? In a month’s time when all with June half-year ends will have reported we’ll have more granularity but we know industrial production is picking up. From the March low of 5.6% we’ve had 5.9%, 6.1% and 6.8% for April, May and June respectively; which is also fine, if not a runaway.

Fresh concerns? We seem to have put debt and shadow banking behind us (perhaps only temporarily, other varmints that regularly need whacks) but we can never be sure. There may be further fall out from the stock market correction and we can never sleep soundly about the reform process in a country where just about everything needs some kind of reform.

In summary here; China looks much like it looked a few months ago and probably how it’s going to look a few months hence. It’s an emerging/developing economy and to those coming fresh to it it’ll always look a bit messy; but that’s the Situation Normal, All Fouled Up reality of the beast.

Valuation

When stock prices go down, valuation improves (D’uh, to self). The argument about what’s ‘right’ or ‘fair’ though is one that can never be resolved. What we can say, based on experience over time and from around the rest of the world, is investors rarely come to too much harm paying single digit earnings multiples to buy reliable earnings.

My preferred yardstick for gauging China multiples is the Hang Seng China Enterprises Index (whose constituents, unlike A-share land, can be bought by any investor) and there the e2016 multiple based on consensus forecasts is now below 7x.

Valuations may have gotten a bit frothy in the onshore markets but in Hong Kong they’ve moved back to levels that, even a non-partisan would concede, could be described as attractive. Being partisan I would describe them as, once again, compelling.

In Conclusion – A Nod To An Early Mentor

My first sell side job was with a gilt monger in London. Morning meetings began at 0830 sharp (yes, really) and were moderated by the senior partner on the desk Mr. John Willmot. Being a Gentleman John was courteous enough to solicit everybody’s opinion including those from pond-life such as myself. As a return courtesy somebody would often ask John for his opinion at which point I and the other Young Turks would have to control giggles. He nearly always said the same thing; “On balance I think clients would best be advised to be in the market rather than out”. It may have taken me 30-years to grasp the wisdom of that advice but John, wherever you are now, I thank you for it.

Over any extended period it’s nearly always right to be in equity markets; but never more so than when valuations provide the kind of downside protection I find in abundance today in China stocks; again.