If, and it is an ‘if’, China stocks aren’t perched on a ledge before another big tumble then they’re consolidating in a bear market. If that’s the case, this would be good news.

To be clear, a bear market is different from one that’s just gone down. A true bear market is when all hope of things being different from the way they are is abandoned, which sums up many investors’ views presently of China’s prospects; and this would be good news how?

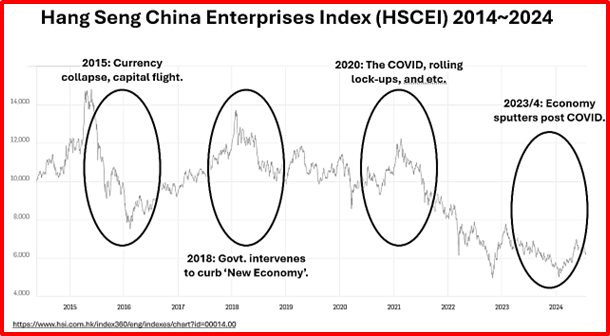

China’s stock prices have been falling for several years; but until recently I’d thought the moves were successive responses to single factors whose individual effect would fade and from which we’d recover in time.

In fact, this series of ‘one-offs’ has fused together driving us to the place we find ourselves today, which looks to me like a proper bear market.

Above is my none-too-scientific synopsis of the last decade. Over the period the HSCEI, which peaked around 14,700 at the end of April 2015, has fallen from there to 6,000-ish last, or by nearly 60%.

Dividends, not included here, will have dulled the pain but nearly all investors* active over the period will have less in their investment accounts than they started with.

[*N.B. The China Dream Absolute Return Fund (which I manage) has risen c. 13% over roughly the same period, dividends and all charges included.]

So where’s the good news? The getting here has been miserable, but if we’ve correctly identified our present condition what’s most likely to happen next is an encouraging prospect.

Some apposite quotes will assist here:

“You make most of your money in a bear market; you just don’t realize it at the time”, Shelby Cullom Davis.

“There will be bear markets about twice every 10 years and recessions about twice every 10 or 12 years but nobody has been able to predict them reliably. So the best thing to do is to buy when shares are thoroughly depressed…”, John Templeton.

“It is only in a bear market that the value investing discipline becomes especially important because value investing, virtually alone among strategies, gives you exposure to the upside with limited downside risk.”, Seth Klarman.

If we’re in a bear market (agreed and as noted, it’s possible we’re on a ledge before another swan dive) long-suffering holders of stocks must hang on and if possible commit more resources, this isn’t a place to cut and run. The lucky uninvolved should get ready and be prepared to engage.

The slightly longer argument:

First, we’re in a bear market. That’s it. To return to Mr. Klarman, if we’re in a state where investors have lost hope, pundits have given up calling a turn and all are staring into the same black hole then downside is limited. As Mr. Klarman put it we have from this point “..exposure to the upside with limited downside risk.”

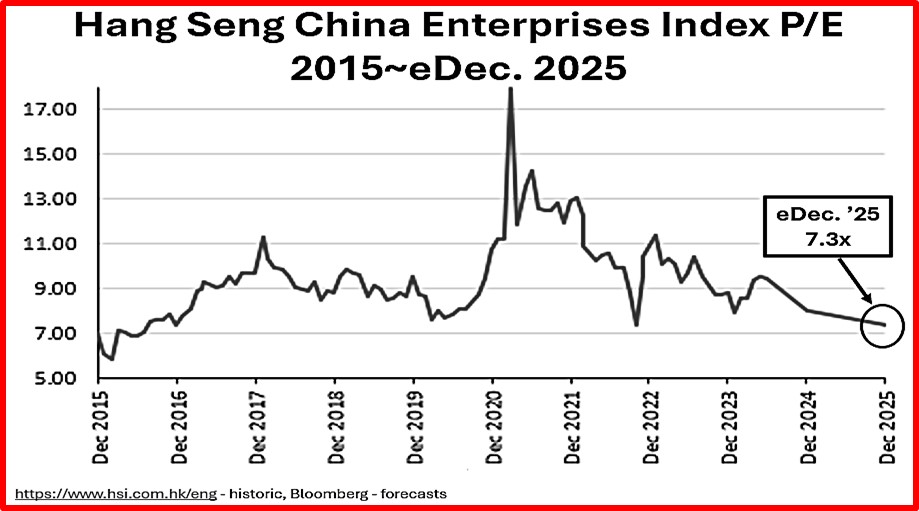

Second. Value! Value!! Value!!! Value is a necessary but never sufficient condition to justify a stock purchase; but, as a general rule, more is better. Moreover, absent an earnings collapse, value is an insurance policy whose worth increases the more of it you have.

To that point, the forward valuation of the HSCEI to the end of this year is a P/E of 8x. To the end of 2025 it’s close to its ten-year low at 7.3x which seems like a respectable margin of safety.

Third, there’s the Chinese government’s necessity for success. China bumbled through COVID and fumbled its way out. That painful recent past plus a rolling property crisis has led to a ‘confidence-deficit’ reflected in slow new home sales, anemic credit growth, weak investment trends, etcetera. This confidence-deficit must be recovered.

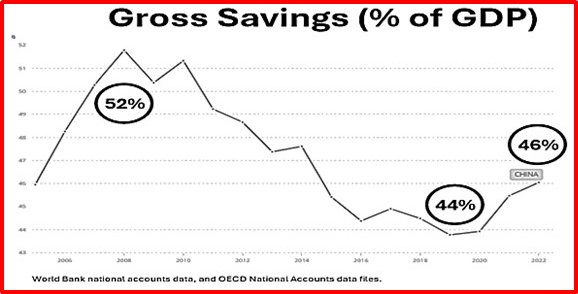

To that point, China’s savings rate fell handily from 52% in 2008 to the low of 44% just before COVID in 2019. Then it starts to head back up again (to 2022, we don’t have data yet for 2023, but I’ll bet it’s higher).

This trend reversal, and the other issues fingered above, is/are a product of the confidence-deficit of which depressed stock prices are just another symptom. China’s planners now have no alternative but to try a lot harder than they have been to fix what, in its broadest sense, is a faith-in-government problem.

To recap and conclude:

China stocks are at what is likely a sentimental nadir, valuations offer considerable protection and policymakers are under the cosh to bring about change. We may presently be in a real bear market, which is never going to feel great. But if this assessment is correct a way forward is clearer than its been for some time, and that would be good news indeed.

Nial Gooding CFA

July 26th 2024