Human beings have inherited ticks from their ancestors that were handy when roaming the plains of the Serengeti but are now dangerous if not commonsensically moderated.

Two notable examples are dietary preference and risk taking.

Our ancestors gained a reproductive advantage from gorging when they could, especially if what was on offer was either sweet or salty; and as far as risk is concerned I’m here today because one of my ancestors decided to try getting to that speck of land on the horizon.

In our recent history though unscrupulous operators have found ways to profit from these old-friend habits and they’ve become, in the process, new-enemies.

Obesity, the scourge of developed societies, is a diet related problem (it can’t be anything else!). This problem is exacerbated by food companies who play a cat and mouse game with governments to keep the largest amounts of the least healthy food in front of consumers for the lowest price, whilst claiming they’re in the nutrition business. [It’d be unfair to single out a single operator, a Google search will throw up dozens of examples of this bald hypocrisy].

Gambling, or ‘gaming’ as the complex of providers and supporters prefers it to be called exploits the human risk taking preference. Governments seem better at controlling this than they’ve been so far with bad food but again a cat and mouse game is constantly at work as operators dream up more elaborate ways to mask their business models. The so called ‘integrated resort’ being just one such recent euphemistically and poorly cloaked ruse.

So far so exploitative; but bad food and gambling are problems in plain sight. Surely nobody today believes (if they ever did?) a candy bar a day can help you work, rest [!] and play or that the gambling industry offers punters any sort of fair shake?

There’s a fresh, new, new-enemy abroad though now and like other human-tick old friends it’s being manipulated by unscrupulous operators with governments slow to recognise and deal with its corrosive effects. I’m referring to information.

Whilst roaming the Serengeti seeking information on the nearest uneaten wildebeest was a good habit to cultivate. Information seeking is therefore a primal habit of humans and has been essential to our survival. But, just like binge eating and risk taking too much information seeking is a bad idea. In the case of information too much gets in the way of more productive activity and, the main point of this note, so much of what is now forced on us is of little or no ‘nutritional’ value.

Books have been written and many more are to come about how information ubiquity is changing our world and I don’t want to waste time with a long digression on that. Instead I want to cut to the chase and propose three simple rules that investors especially should keep in mind when handling information in this new always-on but rarely-relevant world.

Rule #1: All opinions are NOT equal.

Information providers now regularly mix authoritative voices with twitterati drivel and ‘news’ broadcasts often fill time with their own correspondents talking to each other. The worst form of this problem is to be found among the millions of hours of ‘..reacts to’ rubbish on YouTube. A simple rule to keep in mind this one. Unlike the next two which are more nuanced.

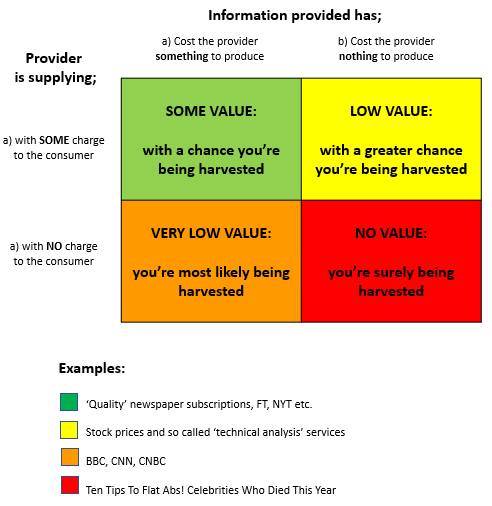

Rule #2: Information provided at a cost is likely to have some value. Unless the providers have themselves paid little/nothing for it.

Some feel that information that comes at a price is more valuable than the free sort. This may be true, especially with regards to some of the high quality journalism available at the Economist or the New York Times. But when the paid service is passing on free data that information is likely to be of a very different (negligible) value-added content.

Rule #3: Information provided at no cost is likely to be of low quality even if the provider has spent money to collect it. It will most likely have no value if it came to the provider free.

Information consumers are all now, to some extent, being harvested. The intensity and depth of this though varies from the helpful (ads for restaurants in my area are OK) to the downright icky (Facebook, I need say no more on this malignant model). The general rule though is time spent on any ‘free’ service is highly likely to be time wasted and where you’re providing the real content. For fun, perhaps they have some utility, for basing investment decisions on? Er, no. Absolutely not.

To help me sum up the last two points I created the following slide which I hope provides some clarity.

In conclusion I wanted to highlight that our ancient and ‘good’ predisposition to seek data is today often being corrupted by time-wasting unscrupulous operators with business models none could have imagined twenty years ago.

Until two decade ago, as a general rule, investors were correct to assume that more information was better information; but this is no longer the case. In fact, there’s now a tipping-point in the discovery process over which an analyst can fall and waste hours of valuable time chasing useless noise. So, where’s the best, highest quality, most reliable and valuable information to be found these days?

Ah, now, that’d be telling…