I’m a fan of Einstein, and who isn’t? One of his most applicable quotes to finance is the one about everything needing to be simple; but not too simple.

In recent weeks, and ones to come, we’ve heard and will hear a lot of talk about markets from people who, mostly, haven’t a clue what they’re on about; but they’re, mostly, paid to be noisy so we forgive them. They’re just doing their jobs.

As I don’t wish to be tarred with the same brush I’ll get straight to my hopefully simple, but not too simple, point; something we all know something about.

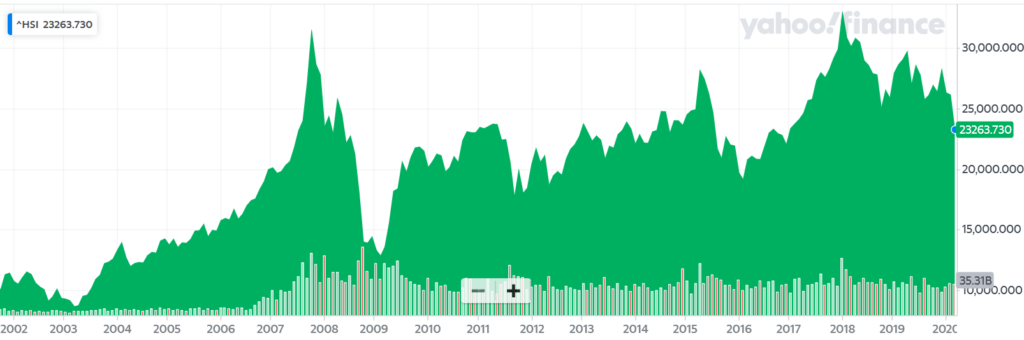

The chart is the Hang Seng Index (from 2000~now), a poor descriptor for opportunities in the Hong Kong and China markets but one most are familiar with so I’ll use it anyway. Besides, as I’m only making a general point it’ll do just fine.

You’ll see three big dips: 2003, 2009 and 2016. I wondered what the return would have been (excluding dividends which could add to at least another 10% over the period) if you’d had the foresight to buy each dip and hang of for the next three years?

If you’d bought in March 2003 and held on until March 2006 you’d have been returned about 85%. If you’d done the same in February 2009 and stuck around until February 2012 you’d have been 70% better off. Finally, if you’d entered the market in February 2016, by February 2019 you’d have been 50% better off.

The past is no guide to the future; but we don’t need an Einstein to tell us that there seems to be a lesson here?

Just sayin’