Goldman Sachs produced an index a while ago of unprofitable ‘Technology’ companies and I thought it’d be a useful lens through which to view the coming-down-to-earth of a group of companies I’m calling the New Economy Speculative Complex And Related, or NESCAR for short.

This isn’t just a fun parlor game. It has real implications for stocks likely to be beneficiaries of a return to favor of the commonsensical investing style that’s been forced into the shade by the rise of NESCAR stocks in the last couple of years.

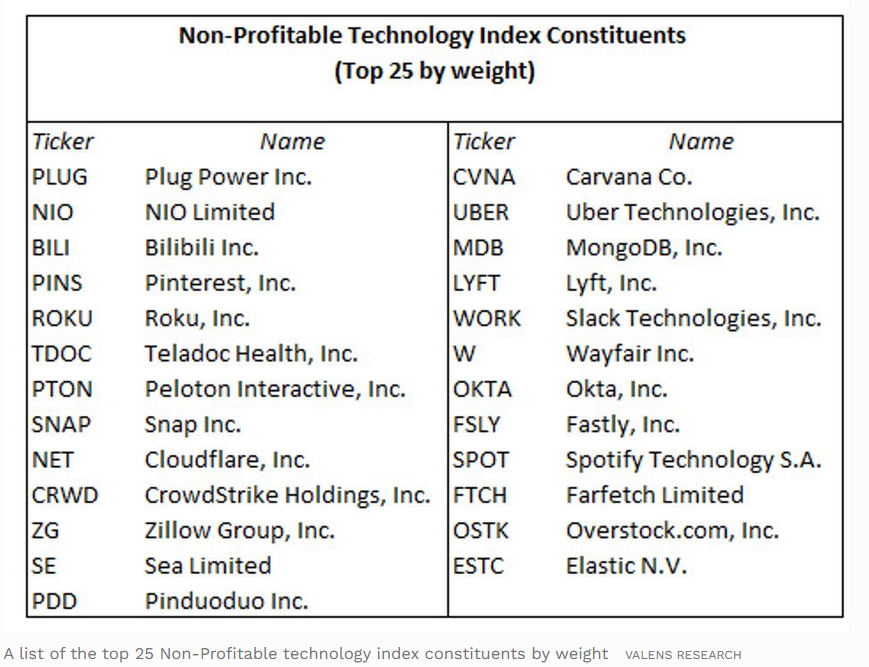

From a Forbes article published on March 4th this year I extracted the table below and it lists the top-25 in the Goldman index.

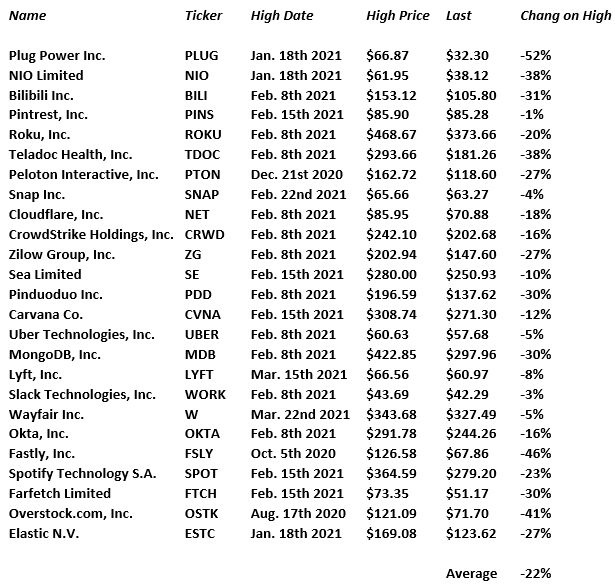

From this I’ve created my own very unscientific index of the companies above with their current share price versus all-time highs. Summing those differences produces a rough but ready summary of where we are and we can track this in months to come to see how NESCAR is faring.

[To be clear, this list is not the NESCAR. That’s a much larger herd to which this subset will operate as a cipher to.]

So, as of Friday, April 9th 2021 this is where we stand:

So, we’re an average of 22% lower as of Friday which is neither a crash nor a disaster, at least not just yet.

You’ll note though not one stock making new highs so, for now at least, let’s just call this a slow pile up and see where it goes?

Nial Gooding

Saturday, April 10th 2021