I first wrote in April 2021 about the dangers of investing in New Economy Speculative Complex And Related, or NESCAR stocks (Slow Pile Up So Far).

I followed that up a year later with an update (Ample Scope for Further Significant Losses); and here’s the last word.

This is a short note because potential for loss flagged in the earlier notes has come to pass. It turns out, indeed, investing in loss-making enterprises is a route to capital destruction. Moreover, losses incurred in this sector are likely to be of the worst variety, permanent.

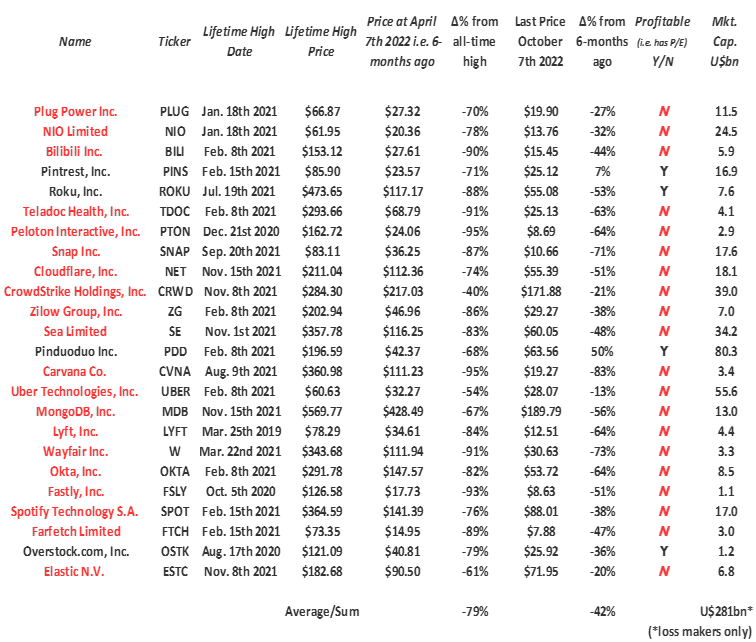

Nobody likes a smart-Alec-I-told-you-so, so I’m going to stop here with just an update to the table from earlier notes.

The lesson is now crystal-clear to the generation who temporarily believed, somehow, this time it was going to be different.

OK, two final observations.

The only two stocks on the list up in the last 6-months are both profit makers, Q.E.D., and a look at the still large capitalization of loss-makers suggests more scope for pain there before the adjustment comes to its final stop.

Here endeth, for a generation of now wiser investors (until of course yet another generation have a pop!), the lesson.

Nial Gooding

Saturday, October 8th 2022