Preamble

Bar the last condition in the definition* below we are living, right now, in an economic boom i.e. a ‘Period that follows [The] recovery phase in a standard economic cycle. A boom is characterized by an economy working at full or near-full capacity, strong consumer demand, low rate of unemployment, and a rising stockmarket, usually accompanied by rapidly increasing consumer prices’. [* Boom – Definition]

This reality it is at odds with a zeitgeist focused by a news/media-apparatus no longer incentivized to inform paying users; instead, forced now into impractically short news cycles and a desire above all, and at almost any reputational cost, to be viewed. Never more so has it been the case we should treat with great caution what’s in/on our newspapers, broadcasts, podcasts, social media (especially toxic) and other stops we make in the hope of better informing ourselves.

The zeitgeist though is about to shift. The shift will be towards a more optimistic view of economic prospects, a broader realization of present economic reality and a much more widely held notion that post Global Financial Crisis (GFC) economic gains can be maintained and, more importantly, built on. This will happen because facts, now in plain sight, no longer support tropes and memes that serve presently as the received wisdom about what kind of economic mess our world is in.

The global economy is not in a mess. It is, in fact, in splendid health; and this condition looks set to persist for some time.

Summary Conclusion

General optimism about economic prospects will likely increase from tepid levels we note today. As this happens this new sense of reality will be more fully reflected in stock prices. Markets and stocks that have to date lagged the U.S. should do best; and China stocks stand out particularly as worthy of closer inspection.

Of Cycles

Unless we deny such things exist we must have a sense of where we are in these? Two cycles are key for stock investors; the business cycle and the stock market investment cycle.

The business cycle is simple. Are the world’s major economies, and the earnings of companies within them, expanding or contracting? It’s been the former for several years; and it doesn’t show signs of stopping. So, the global economy is growing and this growth looks set to continue.

The Stock Market Investment Cycle

Defining this is trickier. I’m going to combine two guides, one from Sir John Templeton and the other from veteran commentator Mr. Laszlo Birinyi to identify four stages of markets. The reason for this is to add more color to the snappy template which may help us more easily to a conclusion.

The four stages of a stock market cycle then are (Templeton/Birinyi): pessimism/reluctance, skepticism/digestion, optimism/acceptance and finally euphoria/exuberance.

So where are we in this process? To answer this question it helped me to stand it on it’s head; by ticking off where we’re not.

Let’s look at extremes first. Are we now in a pessimism/reluctance funk? Given global stock market performances in the last couple of years it’d be hard to progress that argument. Are we then in a euphoric/exuberance state? Here and there with some of the Chinese-BAT and U.S.-FAANG activity perhaps; but markets and investors as a whole? Not really, today feels neither like 1999 nor 2007.

We must then be at either skepticism/digestion or optimism/acceptance; and if I had to plump for one of these I’d go with skepticism/digestion. Even if you disagree and want to go with optimism/acceptance there’s still a whole condition north of your assessment where some of the best stock market returns are often to be had.

The Optimism Pump

Having established we’re in a growth cycle and stock markets have more upside I want to take a step back and look at how we’ve arrived at our present state and how the mechanics that have brought us here will continue to operate.

Ground zero for the more agreeable world we find ourselves in today must be the government intervention, begun with a massive stimulus by China in 2008, and followed by the world’s other major economies largely in the form of quantitative easing. One can quibble details but what’s in no doubt is that government intervention saved the world from a protracted 1930s style depression. The economic recovery pump was thus primed.

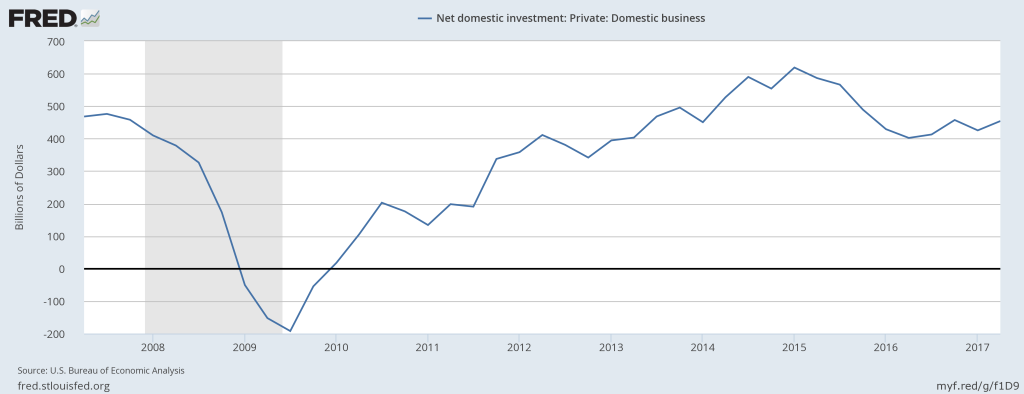

Economic stability, fostered by government intervention, has led to increased corporate profitability. This increased profitability, a global phenomena, has meant better returns for shareholders. It has also meant an increased risk appetite on behalf of business owners which in turn has feed into a recovery in investment.

As you can see in the chart the rate of growth has been unspectacular but that’s to ignore the levels, which have been consistent and are now back to and surpass those prevailing pre-GFC (the data is for the U.S. but I believe it’s a reasonable proxy for the world).

As you can see in the chart the rate of growth has been unspectacular but that’s to ignore the levels, which have been consistent and are now back to and surpass those prevailing pre-GFC (the data is for the U.S. but I believe it’s a reasonable proxy for the world).

This investment has led to productivity gains which in turn have fed into higher economic growth which has in turn fed back into corporate profitability.

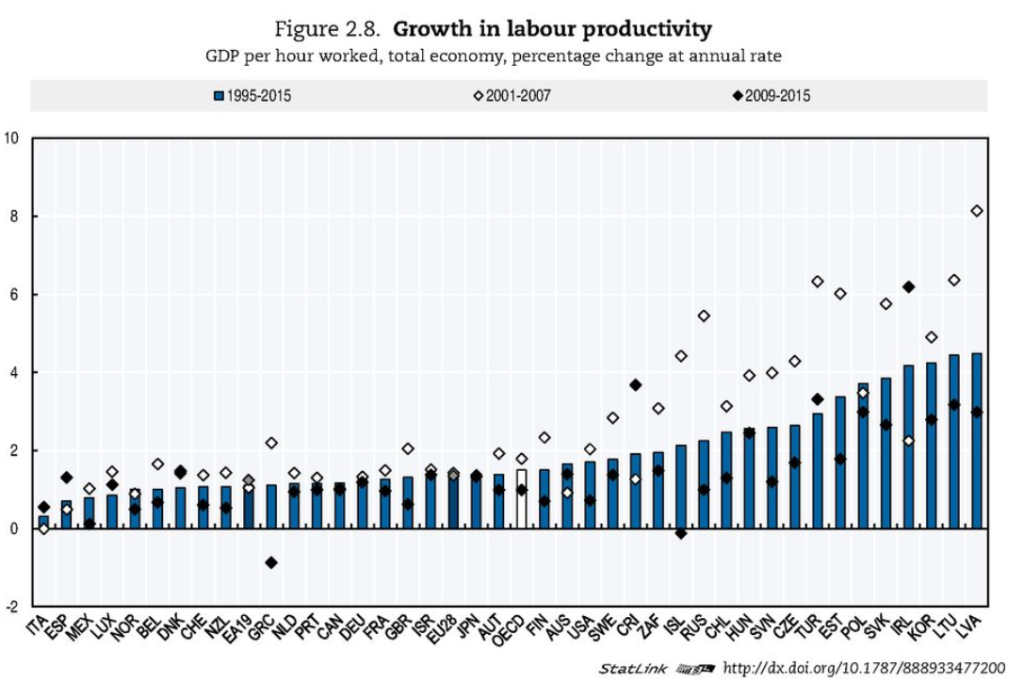

Productivity gains? Surely, it’s a well documented fact these have been poor in the post GFC period. Have a look at the picture below though (extracted from the latest OECD Compendium of Productivity Indicators 2017, link OECD Compendium 2017).

Rates of growth are again unspectacular, especially compared to prior to the GFC; but gains have accrued across almost the entire sample.

Rates of growth are again unspectacular, especially compared to prior to the GFC; but gains have accrued across almost the entire sample.

In summary, this is how the optimism pump works; governments backstop economies, companies make more money, which leads to more investment, which converts to higher productivity, which leads to higher economic growth.

I’ve left out the impact here on stock markets; because it’s well, sort of, obvious.

The Pump That Keeps On Pumping

Pessimists will at this point note that governments may no longer be as supportive in future as they have been in the past. China will probably never hit the accelerator as hard as they did in 2008 given the collateral issues they’ve had to deal with in terms of runaway asset prices, credit growth and etcetera. Elsewhere quantitative easing programs are due to be scaled back with the hope, in time, they can be cancelled altogether; but this is to identify a far, far-off place in the future.

The here and now of the global economy is that the Chinese government is still continuing to stimulate its domestic economy in all manner of ways from walling the e-commerce garden to making sure SOEs are kept at the front of credit queues. Yes, elsewhere interest rates are set to rise and bond buying will be tapered off; but nowhere will the economic policies of the past nine years be withdrawn if top line economic growth starts to sputter.

The circular reference of government primed economic growth feeding back into corporate profits will surely continue into, what for practical purposes we can call here, the indefinite future.

.. And Of Accelerants

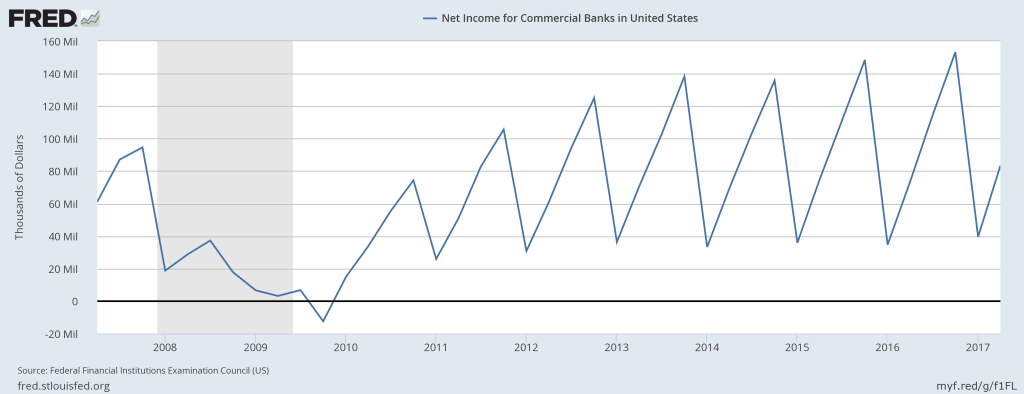

The recovery and progress of bank’s profitability from the GFC has been uneven but now appears to be entering a period of global synchronicity.

The recovery has been most spectacular in the United States as you can see here.

The peak for U.S. Commercial Banks profitability was 2006 when they made a combined Net Income of U$123bn. That peak was exceeded in 2013 when they made U$138bn. In 2016 they pulled in U$153bn and if we take this year’s Q2 total of U$83bn and just add the H216 total to it they appear on course to make not less than over U$160bn; 30% higher than the pre-GFC high (The situation is less dramatic if one looks at just the biggest U.S. banks but they too are set for records this year. There’s also a definition issue here but I’m confident the trend repeats however you chose to describe the U.S. banking system).

The peak for U.S. Commercial Banks profitability was 2006 when they made a combined Net Income of U$123bn. That peak was exceeded in 2013 when they made U$138bn. In 2016 they pulled in U$153bn and if we take this year’s Q2 total of U$83bn and just add the H216 total to it they appear on course to make not less than over U$160bn; 30% higher than the pre-GFC high (The situation is less dramatic if one looks at just the biggest U.S. banks but they too are set for records this year. There’s also a definition issue here but I’m confident the trend repeats however you chose to describe the U.S. banking system).

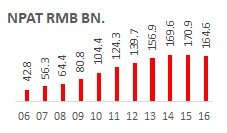

Chinese bank’s profitability growth has stumbled in recent years but they’re still phenomenally profitable beasts as a look at China’s longest listed Big-4 player, Bank of China, demonstrates.

Moreover, the recent interim results indicate profitability accelerating (BOC posted a near 11% lift) and problem loans, as a percentage of totals, now falling.

Moreover, the recent interim results indicate profitability accelerating (BOC posted a near 11% lift) and problem loans, as a percentage of totals, now falling.

The picture in Europe is more mixed but problems on the periphery and in Italy specifically appear contained.

The likes of HSBC, Soc. Gen., UBS and Santander appear to be coming out of the woods as a look at their respective H117 reporting shows. HSBC described their results as “..providing further evidence of a successful repositioning.” Soc. Gen. noted “..good commercial and operating performances..”. UBS said “..second quarter results were very good and contributed to a strong first half of the year.” and Santander had nothing to apologize for pointing out “We have continued to deliver on our commitments, creating strong profitable growth,..”

So we’ve established the world’s biggest banks are either achieving record profits or are on their way there; and, to remind, higher interest rates will only assist their progress.

How does this help accelerate the global economy?

Bad Banks

If ground zero for the post-GFC recovery has been governments, ground zero for most of the problems associated with the GFC was the banks.

Capital deficiency was at the heart of the crisis. The need to replace lost capital in the immediate aftermath was why governments were convinced of the necessity of quantitative easing. It was the only practical way to rescue systems facing banking-related liquidity crises.

It was clear to me, back in 2007, that weaker banks were going to have a devastating effect on asset prices and I put pen to paper on how that mechanism was likely to play out. [History fans can re-read that remarkably prescient, if I do say so myself, analysis here 2007 Prediction]

The key to understanding why weaker banks were bad for asset prices is contained in the banks’ multipliers. The numbers vary by jurisdiction but banks are typically allowed to expand their balance sheets by between $7~$10 for every $1 of primary capital held.

Destroy $1 of primary capital though and the system must be put into reverse; and wholesale destruction of bank’s capital, in a nutshell, was the root of our financial crisis.

Good Banks

If capital destruction at the world’s largest financial institutions was a bad thing for the global economy what must we now make of, in many cases all-time-high, capital creation?

It can’t be a bad thing. In fact it’s likely to have the same self-reinforcing characteristics as we find at the heart of the optimism pump. In the banks case it should work something like this; higher and sustained profitability will lead to increased risk appetite, which in turn will lead to longer lending terms and more credit, which will lead to more investment, which leads to further productivity gains which brings us full circle to more profits (for banks and their customers) and stronger-for-longer top-line economic growth.

If, on top of the above the condition absent in the boom definition, inflation, should show signs of return that’ll be an accelerant to the accelerants as what would be a monetary phenomenon would surely benefit institutions whose assets and liabilities are also (mostly) monetary.

Stocks and Stock Markets

Assuming I’m broadly correct, the global economy continues to grow, corporate profits continue to rise and banks take on a more active role in greasing the wheels of progress how does all this translate for stock market investors?

From January 2010 this is how, very roughly, the world’s major stock markets (ex-dividends) have performed:

S+P-500 +115%

FTSE-100 +35%

Nikkei-225 +80%

Shanghai Comp. +5%

HSCEI -8%

From the above its clear investors have committed most enthusiastically over the period to the U.S. stock market. They’ve been sanguine about Japan’s recovery and, to a lesser extent, about the prospects for stocks listed in London.

What leaps from the table though is how investors in China stocks have refused to express much, if any, faith in prospects for improvement there (yes, there was a rush of blood in 2014~15 it should be noted; but it’s now more than fully reversed).

It’s not the purpose of this note nor my regular habit to predict stock price trends or by implication stock market movements. What I will point out though is investors in China stocks, having not participated in the broader revaluations elsewhere in the world, appear to have little to lose if my notion of increasing optimism is misplaced.

In Conclusion

The global economy is in robust good health. Companies in the world’s largest economies are faring well; and these conditions are most likely to continue. With the world’s largest lenders now entering what is most likely a multi-year sweet-spot in terms of profitability economic and corporate profit growth can be sustained for a prolonged period

The U.S. stock market appears to be ‘getting-it’; but investors on Tokyo/London and particularly Beijing omnibuses have yet, it seems, to appreciate by how much economic and business conditions have improved.

General optimism about economic prospects will likely increase from tepid levels we note today. As this happens this new sense of reality will be more fully reflected in stock prices. Markets and stocks that have to date lagged the U.S. should do best; and China stocks stand out particularly as worthy of closer inspection.