The citizens of Pompei weren’t wiped out by the sudden eruption of Mount Vesuvius. They were treated first to an 18-hour rain of pumice during which many fled with belongings and lives preserved.

Only after this unpleasant but unequivocal harbinger of something far nastier did the pyroclastic flows, from which no escape was possible, commence seeing off the tardy stay-at-homers.

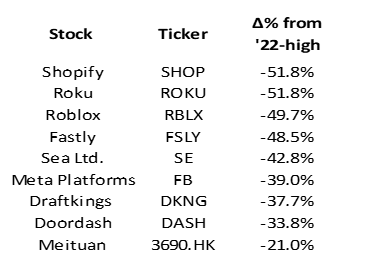

Dramatic falls so far this year of some former new-economy darlings from just their 2022 peaks (many on top of already large falls from all-time highs) put me in mind of this.

The NASDAQ Composite Index had fallen by the close last Friday around 15% from its November 2021 all-time high. A significant correction but nothing like the 30%~50% down-leg that’d be ‘normal’ for an overheated market coming in for the hard-landing all multi-year hot markets eventually and inevitably experience.

I don’t want to labor the metaphor or the point but investors in still overvalued new-economy stocks relatively undisturbed by the falls of what may be regarded as non-comparable peers should, perhaps, take greater cognizance of the skies?

Nial Gooding

Saturday, February 19th 2022