Let’s get straight to it. The effects of COVID-19 on the world’s major economies will be significant and long lasting. That’s according to Alexander Chudik of the Federal Reserve Bank of Dallas (et. al.) writing in a CESifo (a Munich based organization) Working Paper.

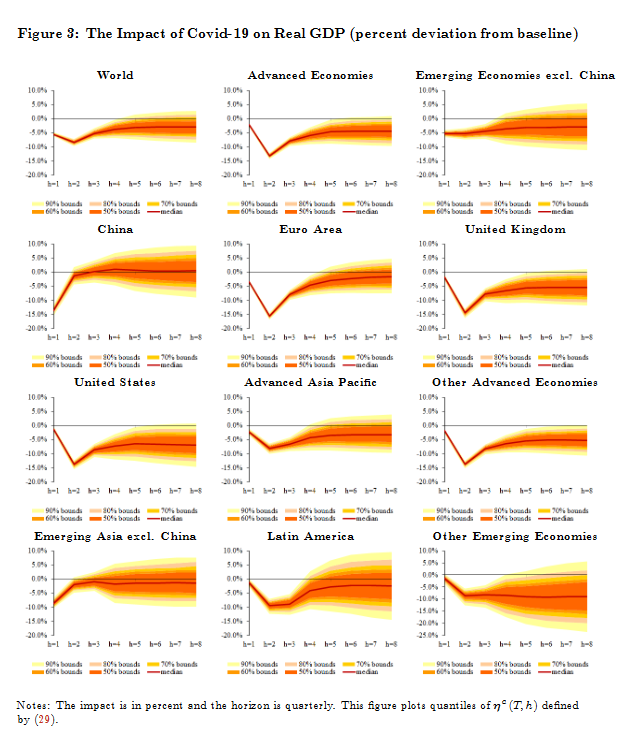

Below is the key figure from their work and the straight black horizontal line in all cases shows the neutral GDP growth if there had been no COVID-19 shock.

I’ll let that graphic do its own talking; but just in case it’s not immediately clear China is the stand out in terms of least-to-worry-about.

The methodology of the work is interesting (and, to be honest, I only kind-of get-it) but the value of the paper is it’s conclusions and here are what are I think are the key points:

- COVID-19 will result in a significant fall (c.3%) in world output and this effect will be long lasting.

- The effect will be heterogeneous (not the same for everyone) across countries and regions.

- China (see the graphic again, above) and other emerging Asian economies will fare better than most.

- The U.S., U.K. and other advanced economies will experience both deeper and longer lasting effects.

- Non-Asian emerging markets stand out for their (multiple) vulnerabilities.

- Long term interest rates will remain under downward pressure in advanced economies but this will not be the case in emerging markets.

Of course, these are only forecasts The actual outcomes may be much better, or of course, much worse.

The main point though seems intuitively incontrovertible i.e. a hoped for V-shaped recovery will not present itself, for many, anytime soon [If at all?].

You can access the paper in full via this link Lasting economic effects of COVID-19.

Happy Sunday.